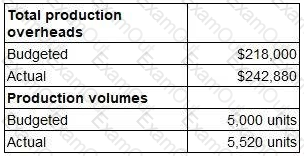

A company uses an integrated accounting system. The following data relate to the latest period.

At the end of the period, the entry in the production overhead control account in respect of under or over absorbed overheads will be:

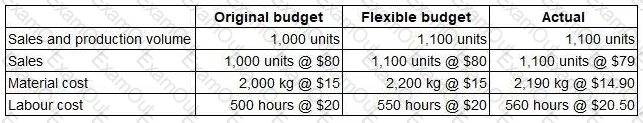

The following data relate to the latest period.

A statement is to be prepared that reconciles the difference between the flexible budget profit and the actual profit.

Which TWO of the following will appear on this statement? (Choose two.)

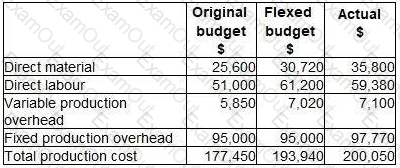

The following is an extract from a budgetary control report for the latest period:

The budget variance for prime cost is:

Which of the following statements relating to risk and uncertainty is correct?

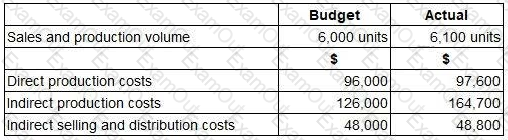

A company uses standard absorption costing. Budgeted and actual data for the latest period are as follows.

What was the production overhead absorption rate per unit?

A company’s policy is to hold closing inventory each month equal to 10% of the next month’s budgeted sales volume. The budgeted sales volumes of product Q for months 1 and 2 are 1,660 units and 2,300 units respectively.

The production budget for product Q for month 1 is:

The following data are available for a company that produces and sells a single product.

The company’s opening finished goods inventory was 2,500 units.

The fixed overhead absorption rate is $8.00 per unit.

The profit calculated using marginal costing is $16,000.

The profit calculated using absorption costing and valuing its inventory at standard cost is $22,400.

The company’s closing finished goods inventory is:

Which TWO of the following are characteristics of Management Accounts? (Choose two.)

A company’s management accountant wishes to calculate the present value of the cost of renting a delivery vehicle. There will be five annual rental payments of $5,000, the first of which is due immediately. The company’s discount rate is 12%.

Which TWO of the following are valid ways to calculate the present value of the rental payments? (Choose two.)

Which type of budget would be the most suitable for a cash budget?