Refer to the exhibit

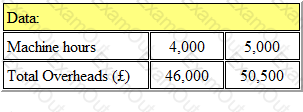

Zeff Ltd has forecast that the relationship between total overheads and machine hours will be as follows:

If the budget is to be based on 4,000 machine hours, the fixed overhead absorption rate will be:

Give your answer to 2 decimal places.

When compiling profit statement using a marginal costing system we must calculate the contribution. Once we have the contribution, we must deduct a specific amount to calculate the profit. Which of these values

should we NOT deduct? (Select ALL that apply.)

RJD Ltd is preparing the production cost budget for the forthcoming year and has found that there is a linear relationship between production volume and production costs.

They have found that a production volume of 1,600 units corresponds to production costs of £40000 and that a production volume of 3,200 units corresponds to production costs of £48,000.

What would be the production costs for a production volume of 4,000 units?

A flat letting company analyses its costs by individual property. Which of the following costs would be considered an indirect cost of the property?

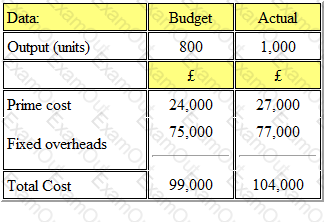

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1,000 units. The details of the costs are shown below:

The total budget variance was:

There are four global principles for management accounting which are intended to support organisations in setting a standard and improving their management accounting systems.

Which one of the following helps management determine whether a certain decision will potentially generate, preserve, or destroy value within the business?

Which of the following definitions best describes Zero based budgeting?