The value of the capital invested in producing and selling product F is $600,000. A return on investment of 14% is required from all products.

Budgeted production and sales of product F for next period are 25,000 units and the standard cost per unit is $33.

In order to achieve the required return on investment the selling price per unit of product F must be

Refer to the exhibit.

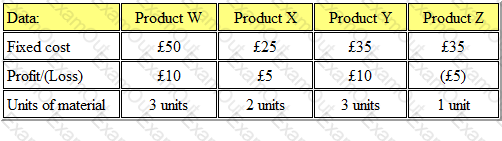

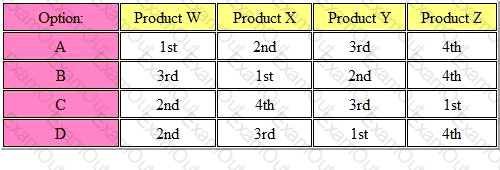

SS Ltd. manufactures four products which require the same type of material. The following fixed cost and profit/(loss) per unit is available:

In a period in which materials are in short supply, which of the following options is the rank order of production?

Refer to the exhibit.

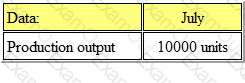

RX Ltd expects to have limited machine time for July, which will result in the following production levels:

It is anticipated that there will be 1,500 units of opening inventory and the company wishes to hold a minimum of 500 units of closing inventory at the end of July.

How many units will be available for sale during July?

Refer to the exhibit.

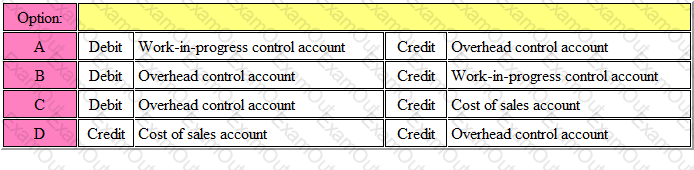

In an integrated cost and financial accounting system, the accounting entries for factory overhead absorbed would be:

In the context of short term decision making, what is a notional cost?

A company's output level increases but remains within the relevant range. Which ONE of the following statements is incorrect?

A company uses an integrated accounting system and absorbs production overhead using a predetermined rate of $6 per machine hour.

Last period a total of 25,500 machine hours were worked and the actual production overhead incurred was $158,000.

The accounting entries for the production overhead under- or over-absorbed for the period would be:

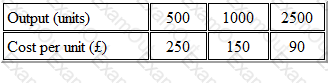

Refer to the exhibit.

Which type of cost do the following figures represent?

VL manufactures a single product. The management accountant has estimated that the margin of safety as a percentage of budgeted sales is 25%. The company's profit/volume ratio is 20%, variable costs are $8 per unit and budgeted sales for the year are 80,000 units.

The budgeted fixed costs for the year, to the nearest $000, are.

Which ONE of the following would be classified as an internal environmental cost?