A company has a high value for its current ratio. What does this suggest in terms of liquidity and risk?

An auto manufacturing plant in Michigan has high scheduled demand for its product. If the company does not have a long-term contract for raw materials, what type of exposure could it face?

Capital budgeting decisions are most commonly evaluated in terms of:

An accounts receivable manager has been asked to accelerate cash into her company by offering trade discount terms to its customers. Her company's cost of capital is 11%. If she offers terms of 2/10, net 30 on a $50,000 invoice, what is the present value to the company if the customer accepts the discount and pays early?

A company has transferred all treasury functions to a new office overseas. When preparing the disaster recovery plan, the treasury manager seeks to identify the mission critical functions and then determine what risks the plan should address. Which of the following risks should be the focus of the Disaster Recovery Plan?

Which of the following credit terms would be MOST appropriate for a seasonal product that a manufacturer wants to sell to a retailer during the product's off-season?

In an international banking system, what role is commonly carried out by a large group of clearing banks?

ABC Company is a net borrower with a weighted average cost of capital of 11.5%. What kind of bank fee arrangement is it likely to prefer?

All of the following staff would be involved in the evaluation of an outsourced accounts payable solution EXCEPT:

Which cost benefit analysis technique uses the methodology to find where the present value of each project’s cash inflows equals the present value of each project’s outflows?

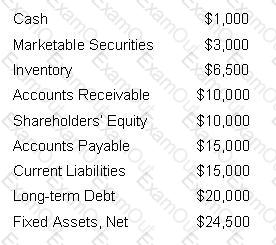

Refer to the following information about a company at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%.

What is the company's long-term debt to total capitalization ratio?

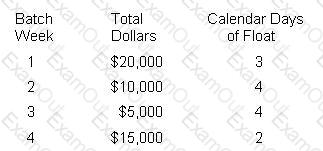

The lockbox receipt records for one 30-day month are provided below. The opportunity costs are 10%.

What is the annual cost of float rounded to the nearest dollar?

A manufacturing company experienced a system failure that lasted more than 24 hours. The company did not have any contingency plans in place and as a result the cash manager was unable to process the following payments:

P-card issuer: $25,000

Payroll: $125,000

Bond interest payment: $200,000

Vendor payments: $260,000

Utilities: $50,000

The cash manager does not have a way to confirm the receivable amounts deposited at the bank. The suppliers are threatening to stop shipments due to the delay in payment and the loss of supplier shipments would threaten the company’s just-in-time production. What concern should the company have?

A company can dispute any check alterations within how many days after the bank statement has been sent?

When a company must determine the optimal mix of long-term borrowings versus common equity, it is making which of the following types of corporate financial decisions?

A measure of the incremental impact of a company's investments on market capitalization is known as:

Check MICR line information includes which of the following?

I. Bank of deposit identification number

II. Payee bank identification number

III. Federal Reserve bank code

IV. Payor's account number

Companies implement EDI in order to realize which of the following benefits?

I. Decreased error rates

II. Decreased order lead time

III. Improved productivity

IV. Improved cash forecasting

The PRIMARY difference between money market instruments and capital market instruments is that capital market instruments are securities that are:

All of the following are basic considerations for balance compensation by a company EXCEPT: