A treasurer is evaluating a project that will cost $1,000 but will return cash flows of $225, $225, $300, $750, and $750 in years 1 through 5, respectively. The company’s interest rate on its debt is 10% and its marginal cost of capital is 15%. What is the Net Present Value (NPV) of this project?

Which of the following should NOT be a consideration when setting an optimal dividend policy?

A digital signature cannot be forged if:

The mix of long-term debt and equity refers to a company’s:

For newly issued debt, a company’s effective cost of debt is a function of yield to maturity and:

A trader of ABC Bank executed and audited his own trades. Assigning these two functions to the same person introduced which one of the following risks to the bank?

On a company’s financial statements, an increase in accounts receivable is reflected as a(n):

Controlled disbursement notification times can be improved by which of the following?

A company has $75 million in adjustable-rate debt, $25 million in fixed-rate debt, and $50 million in accounts receivable. If the company is concerned that interest rates will rise, which of the following would be the BEST interest rate derivative?

The before-tax cost of long-term debt is 10% and the cost of equity is 12%.

The marginal tax rate is 35%. The company's weighted average cost of capital is:

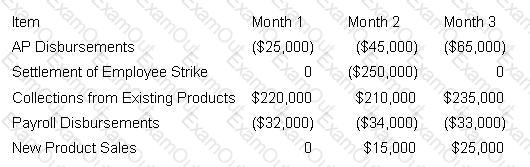

Company A anticipates the following cash inflows and outflows for the next three months:

If the company's treasurer is preparing a cash-flow projection for Month 2, and he is focusing purely on items that can be projected with a fair degree of certainty, what will the net projection be?

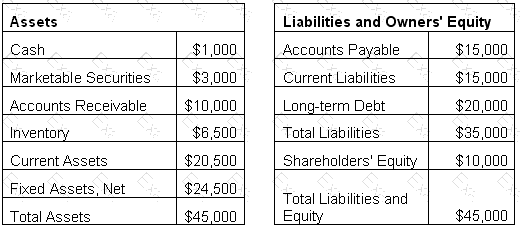

BF Company, a manufacturer of food products, reported financial information shown in the Exhibit for the end of the year. BF Company is subject to covenants in its commercial paper program. It is in compliance with which of the following?

Which of the following statements are true about the use of different discount rates for different types of projects?

I. Low-risk, short-term projects may be evaluated by using a short-term opportunity cost.

II. High-risk projects may be evaluated by using a discount rate that is greater than the company's normal opportunity cost.

III. A short-term investment (or borrowing) rate may be used as the company's short-term discount rate.

IV. The use of a lower discount rate for riskier projects forces riskier projects to earn higher rates of return.

A bank employee programs an internal payment system to transfer half a cent of each transaction to her personal bank account. What type of risk does this behavior illustrate?

A company issues $5 million of commercial paper at a discount for 60 days. The interest cost is $85,000. The backup line fee for this transaction is $2,000, and the dealer fee is $1,000. What is the annual interest rate?

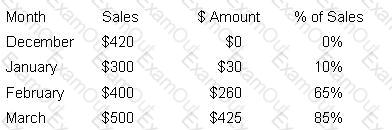

ACCOUNTS RECEIVABLE AT THE END OF MARCH

On the basis of the accounts receivable balance pattern above and April sales of $600, the cash flow forecast for April is:

In terms of targeting a company’s capital structure, when is it beneficial to assume a high level of financial risk?

In a publicly traded company, internal auditors typically report directly to the:

Which of the following types of risk is considered an internal operational risk?

A firm that thinks interest rates are going to rise is likely to: