SAR/STR NARRATIVE

A SAR/STR has been submitted on five transactions conducted on the correspondent banking relationship with ABC Bank.

Client Information:

Remitter information: DEF Oil Resource Ltd. is the oldest member of the DEF Group. It was founded in 1977 as a general trading business with a primary focus on exports from Africa and North America. The group has business activities that span the entire energy value chain. Their core field of endeavor is centered within the oil and gas industry and its associated sub-sectors.

Beneficiary Information:

As per the response received from ABC Bank, it was determined that the beneficiaries are related to DEF Oil Resource Ltd. These were created by DEF Oil Resource Ltd. to purchase property in a foreign country on behalf of their senior management as part of a bonus scheme. The purpose behind this payment was for the purchase of property in another country.

Payment Reference:

ABCXXXXX31PZFG2H

ABCXXXXXX51PQGEH

ABCXXXXXX214QWVG

ABCXXXXXX41PSXA2

ABCXXXXXX815QWS3

Concerns:

• We are unsure about the country of incorporation of the beneficiaries.

• We are concerned about the transactional activity since the payment made towards entities (conducted on behalf of individuals) appears to be possible tax evasion.

• There appears to be an attempt to conceal the identity of individuals (senior management), which again raises concerns about the source of funds.

• Referring to the response received from ABC Bank, we are unclear about the ultimate beneficiary of funds.

• The remitter is involved in a high-risk business, (i.e., oil and crude products trading), and the beneficiary is involved in real estate business which again poses a higher risk.

When drafting the SAR/STR narrative, the investigator notes several payment references. What additional information should the investigator include in the narrative?

An analyst reviews an alert for high volume Automated Clearing House (ACH) activity in an account. The analyst's initial research finds the account is for a commercial daycare account that receives high volumes of large government-funded ACH transactions to support the programs. The account activity consists of checks (cheques) made payable to individual names in varying dollar amounts. One check indicates rent to another business.

An Internet search finds that the daycare company owner has previous government-issued violations for safety and classroom size needs, such as not having enough chairs and tables per enrollee. These violations were issued to a different daycare name.

Simultaneous to this investigation, another analyst sends an email about negative news articles referencing local child/adult daycare companies misusing governmental grants. This prompts the financial institution (Fl) to search all businesses for names containing daycare' or 'care1. Text searches return a number of facilities as customers at the Fl and detects that three of these businesses have a similar transaction flow of high volume government ACH funding with little to no daycare expenses.

During the investigation, it was determined that some of the checks were issued to a mother-in-law of a PEP and deposited into her account with the Fl. This customer was not found on the Fl's PEP list How should the investigator proceed in this situation"? (Select Two.)

An unusual spike in activity has occurred for a customer who is a supplier of aviation parts to a military force. The customer's current line of business is consistent with the banks records, and no adverse media hits have occurred. Which is the best reason for an investigator to continue an investigation?

An investigator is reviewing an alert for unusual activity. System scanning detected a text string within a company customer's account transactions that indicates the account may have been used for a drug or drug paraphernalia purchase Based on the KYC profile, the investigator determines the customer's company name and business type are marketed as a gardening supplies company. The investigator reviews the account activity and notes an online purchase transaction that leads the investigator to a website that sells various strains of marijuana. Additional account review detects cash deposits into the account at the branch teller lines, so the investigator reaches out to the teller staff regarding the transactions. The teller staff member reports that the business customers have frequently deposited cash in lower amounts. The teller, without prompting, adds that one of the transactors would occasionally smell of a distinct scent of marijuana smoke.

Which are the best next steps for the investigator to take? (Select Three.)

Which payment method for purchasing luxury items is a red flag for potential money laundering?

An EU bank account received 1.8 million EUR from a Swiss bank. The EU bank determines the originator was indicted by U.S. law enforcement, arrested in Switzerland, and extradited for alleged insider trading. Which is the best reason the EU bank should file a SAR/STR?

What action does the USA PATRIOT Act allow the US government to take regarding financial institutions (FIs) that are based outside of the US?

Law enforcement (LE) suspects human trafficking to occur during a major spotting event. LE officers asked several financial institutions (FIs) to monitor financial transactions occurring before, during, and after the event.

An investigator identified a pattern linked to a business. The business* account received multiple even dollar deposits between midnight and 4:00 AM. They occurred each day for several days prior to the date of the sporting event. Also, large cash deposits, typically between 2,000 USD and 3.000 USD. made by a person to the business' account occurred in many branches in the days alter the sports event.

There was little information about the company. The company did not have any history of employee payroll expenses or paying taxes. Expenses from the business account included air travel and hotel expenses. Searches about the person making cash deposits showed little. An online social media platform webpage with the individual's name showed ads for dates" and "companionship."

Which fact should not be included in (he SAR/STR narrative?

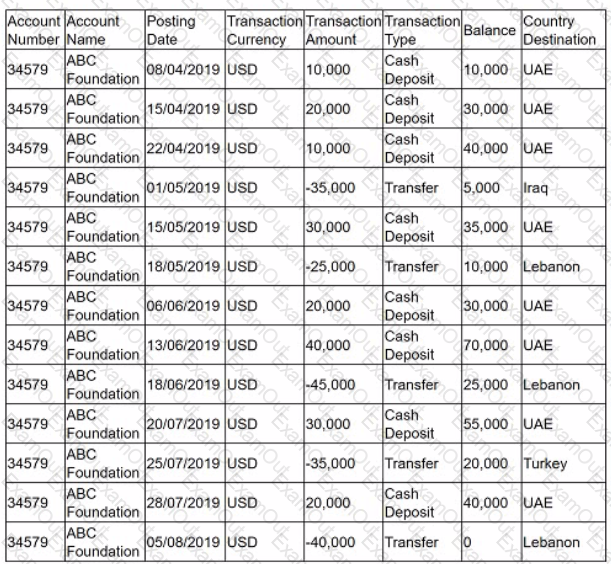

Each month the automated transaction monitoring system generates alerts based on predetermined scenarios. An alert was generated in relation to the account activity of ABC Foundation. Below is the transaction history for ABC Foundation (dates are in DD/MM/YYYY format).

The relationship manager for ABC Foundation contacts the client to request more information on the beneficiary of the transfer in Turkey. ABC Foundation advises that this is a not-for-profit charity group called 'Forever Free." Which is the best next step in the investigation?

In a SAR/STR narrative concerning Individual A. which statement indicates a product of analysis rather than a fact or judgement?