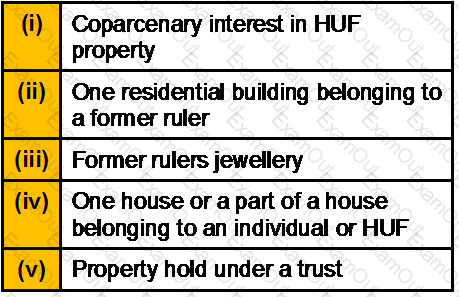

Which assets are totally except from wealth tax?

A portfolio consists of 3 securities.

What is the standard deviation of the portfolio?

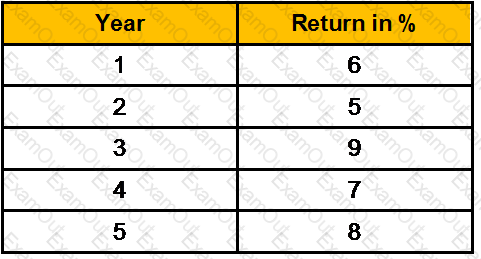

Calculate the variance (%2) from the data given below:

Mr. M is an employee of Z Ltd. His basic pay is Rs.24,000 p.a., Dearness Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free education for two children in a school owned and maintained by the employer – school tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. M and examine whether he is a specified or non-specified employee?

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

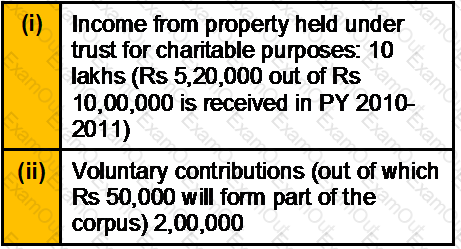

Shri Ganjarwala Charitable Trust (Regd.) submits the particulars of its income/outgoing for the previous year 2009-2010 as below:

The trust spends Rs 2,77,500 during the previous year 2009-2010 for charitable purposes. In respect of Rs 5,20,000, it has exercised its option to spend it within the permissible time-limit in the year of receipt or in the year, immediately following the year of receipt.

The trust spends Rs 2,00,000 during the previous year 2009-2010 and Rs 1,00,000 during the previous year 2010-2011.

Compute the tax payable on the income of the trust.

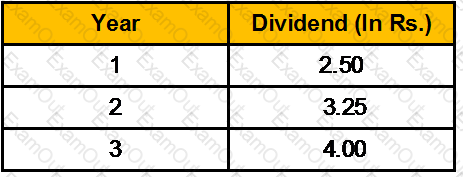

Management has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Vinod joined on 01/01/90 in ABC Ltd. and retired on 01/01/2007.Employee paid leave encashment of Rs. 4,00,000/-. His last drawn salary is Rs. 25000/-. His last 10 months average salary is 23500/-. He availed 150 days leave during the service. What will be his taxable leave salary amount?

R purchased a house property for Rs. 26,000 on 10-5-1962. He gets the first floor of the house constructed in 1967-68 by spending Rs. 40,000. He died on 12-9-1978. The property is transferred to Mrs. R by his will. Mrs. R spends Rs. 30,000 and Rs. 26,700 during 1979-80 and 1985-86 respectively for renewals/reconstruction of the property. Mrs. R sells the house property for Rs. 11,50,000 on 15-3-2007, brokerage paid by Mrs. R is Rs. 11,500. The fair market value of the house on 1-4-1981 was Rs. 1,60,000. Find out the amount of capital gain chargeable to tax for the assessment year 2007-08.

Mr. Nitin, a trading and a clearing member, took proprietary position in August 2007 expiry contract. He bought 10000 units of SAIL@ Rs.140 and sold 8000 units @ Rs.143.50. The end of the day settlement price for August 2007 expiry contact is Rs.141. If the initial margin per unit of SAIL for August 2007 is Rs.42 per unit, then the total initial margin payable by Nitin would be_______

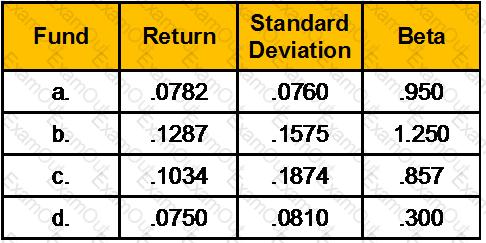

Given the following diversified mutual fund performance data, which fund has the best risk adjusted performance if the risk free rate of return is 5.7%

An individual has recently purchased a house worth Rs. 40 lakh for self-occupation by availing housing loan of Rs. 28 lakh at 9.25% p.a. rate of interest. The tenure of loan is 18 years. He has Rs. 12 lakh financial assets at present. He is expected to save annually Rs. 2 lakh which he invests on a quarterly basis beginning a quarter from now in an instrument which is expected to provide return of 9% p.a. What would be his net worth five years from now? The value of the house which is for consumption purposes is not considered in the net worth so arrived.

If a scheme has 45 cr units issued and has a Face Value of Rs. 10 and NAV is at 11.13, unit capital (Rs. Cr) would be equal to

Calculate the death claim amount if the assured dies in the 25th year of the policy. Money back policy with SA of Rs. 50000. Term is 25 years. Survival benefits of 10% each paid at the end of 5th , 10th, 15th, and 20th years. Accrued bonus of Rs. 500 per thousand of SA.Interim bonus of Rs. 75 per 1000 of SA.

What is the surrender value, if the sum assured is Rs. 100,000/-, DOC is 01/01/1997, endowment with profit 25 years, due date of last premium paid 01/01/2010. Premium to be paid semi-annually. Accrued bonus is 500 per thousand of SA. Surrender value factor is 19% ?

Mr. Sushil, is 35 years old and working as a physician in a private hospital. He will retire at the age of 60. He is saving Rs. 30,000/- p.a. at the end of every year for past 5 years and will continue to save the same up to his retirement @ 7% p.a. His annual expenditure is Rs. 3,00,000/-. Life expectancy of Mr. Sushil is 75 years. On retirement, rate of interest is expected to be 6%. Calculate on retirement how much he can spend per annum if he leaves Rs. 5,00,000/- as estate for next generation?

Rate of 15% pea compounded annually will be equal to ---------------- % per month.

Vinod is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2 months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6months and Rs. 800 for 2 months thereafter. Please calculate the Present Value of this cash stream if rate of interest is 9%

Mr. Rajesh Rawat deposits Rs. 15,000 per month at the end of the month for 6.50 years in an account that pays a ROI of 8.80% per annum compounded quarterly. What will be the amount in the account after 6.50 years.?

Yogesh Jain is a Chartered Accountant by profession and a very disciplined investor he has started investing from today in an account Rs. 1,00,000 every year (beginning of year) and plans to increase his contribution by 10% every year. If the ROI he gets is 15% per annum compounded half yearly calculate the corpus he would be able to accumulate in 25 years.?