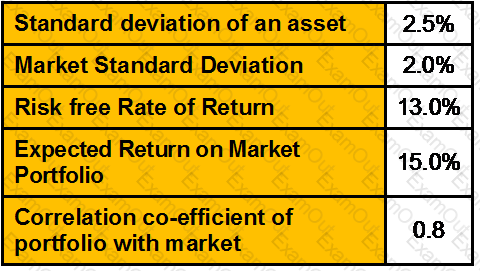

Case: Read the data given below & answer the following questions:

Market sensitive index will be:

Ram deposits Rs. 12,500 in an account that pays a ROI of 20% pea compounded annually on 5th. Of March 2010. Calculate the date on which the balance in his account would be Rs.35,338/-.

Mr. Amit Jain has bought a house today which cost him Rs. 50 lacs by taking a loan of 30lacs for 15 years at 11% per annum compounded monthly. He currently has 10 lacs of financial assets and plans to save Rs. 3.25 lacs every year at the beginning of the year for the next 5 years. All his investments are expected to grow at a ROI of 15%per annum compounded quarterly. What will be the net worth of Mr. Amit after 5 years if the value of the house after 5 years is expected to be 75 lacs.?

Mr. Kumar is a 40 year old NRI working abroad for past 5years. He invests Rs. 50, 000/- p.a. for past 5 years and wants to continue until his return to India. He plans to return to India after 10 years from now and enjoy his life back home. Inflation is expected to be 4% for next 30 years and his investment earns 6% interest. His expected life expectancy is 70 years. What would be his corpus at the time of return to India, and what amount he can with draw per month for his household expenses?

Azhar aged 30 is a disciplined investor. He has started depositing Rs. 25,000 every year in an account that pays a return of 9% every year. He plans to increase his contribution by Rs. 5000 every year till his age 50. Calculate the amount he would be having in his account at this age.?

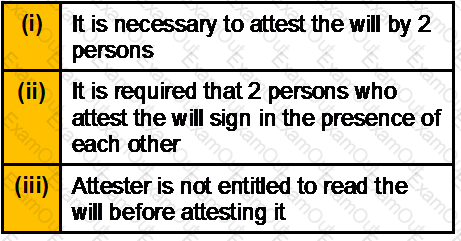

Which of the following statements is/are correct?

Which of the following transaction /transactions is/are an example of the Layering Stage of Money Laundering?

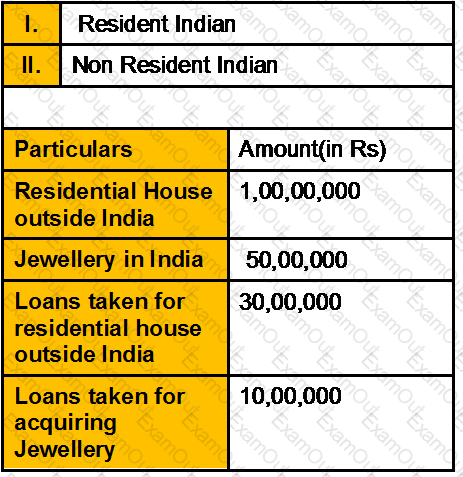

From the following information of assets assets and liabilities, the taxable wealth for:

Mahesh earns 1,20,000 pa. He has total debt of Rs. 2,00,000 and have two dependants. Interest rate is 7%, and assumes 80% of his pre-death salary is the estimated requirement to maintain his family after paying the loan. Calculate the life insurance cover needed under multiple approach method.

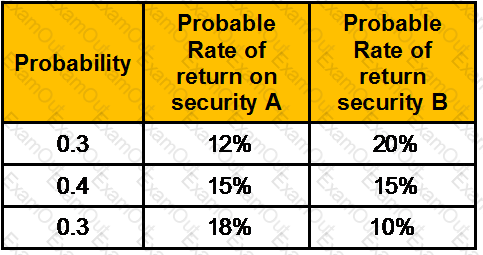

Given the following information what is the expected return on the portfolio of two securities where both are held in equal weights?

Mr. D'suza is a operations manager in a private company college in Hyderabad. During the previous year 2011-12, he gets the following emoluments:

He gets Rs. 17,500 as reimbursement from his employer in respect of medical expenditure incurred on treatment of his wife in a private clinic. Besides, he gets Rs.12, 300 as reimbursement from the employer in respect of books and journals purchased by him in discharging his official work.

He contributes 11% of his salary to statutory provident fund to which a matching contribution is made by the employer. During the year, he spends Rs.17, 000 for maintaining a car for going to the college. Determine his net income under the head salaries.

A portfolio manager is considering buying Rs. 1,00,000 worth of Treasury bills for Rs. 96,211 versus Rs. 100,000 worth of commercial paper for Rs. 95,897. Both securities will mature in nine months. How much additional return will the commercial paper generate over the Treasury bills?

A stock earns the following returns over a five year period:

What is the standard deviation of returns for the stock?

Mr. Sachdeva is working as a regional head in a Pharmaceutical Company in New Delhi. He has a annual income of Rs. 10,00,000. His current expenses are Rs. 5,00,000 and he will be retiring in next ten years . The inflation rate for the foreseeable future is expected to be 5%. He assumes that his post retirement expenses will be 70% of his last year expenses of his service and they will increase at inflation rate and paid at the beginning of each year.

On his retirement he plans to leave his current rented apartment and shift into a another apartment located in NCR . The current price of the bungalow is Rs. 24 lakh which is estimated to increase in line with inflation rate. A ten year government security paper fetches 10% interest rate, which will remain constant for the forthcoming period. He is in good health and expects to live for twenty years after retirement.

As a CWM you are required to calculate the amount Mr. Sachdeva needs to save at the end of ten years on an annual basis so that he can pay his post retirement expenses as well as to buy the apartment.

A zero coupon bond of Rs 10,000 has a term to maturity of seven years and a market yield of 9 percent at the time of issue. What is the issue price? What is the duration of the bond? What is the modified duration of the bond?

The correlation coefficient between returns on stock of M/s X Ltd and the market returns is 0.3. The variance of returns on M/s X Ltd. is 225(%)2 and that for the market returns is 100(%)2 . The risk-free rate of return is 5% and the market return is 15%. The last paid dividend is Rs. 2 and the current purchase price is Rs. 30. The growth rate for the company is 10%. The required rate of return on the security as per the Capital Asset Pricing Model is:

A property has 120 rooms and each room has a monthly rent of Rs.750. The occupancy rate throughout the year is 80% and maintenance expenses per year works out to be Rs.3,00,000. Capitalization rate is 12%. Calculate the value of the property?

Mr. John purchased a house in Mumbai in March 2010 for Rs.12,50,000. In April,2011 he entered into an agreement to sell the property to Mr. Akram for a consideration of Rs.19,75,000 and received earnest money of Rs. 50,000. As per the terms of the agreement, the balance payment was to be made within 30 days of the agreement. If the intending purchaser does not make the payment within 30 days, the earnest money would be forfeited. As Mr. Akram could not make the payment within the stipulated time the amount of Rs.50000 was forfeited by John. Subsequently John sold the house in June, 2011 for Rs.2130000. He paid 2% brokerage on sale of the house. Calculate the capital gains chargeable to tax for the assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711]

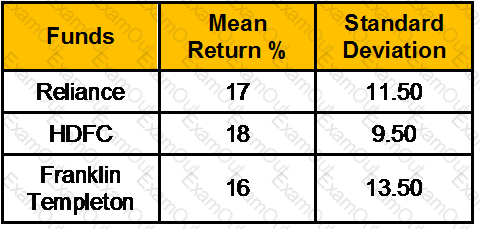

From the following data on mutual funds, Calculate the Sharpe Ratio.

Risk free return is 8%.

What is the portfolios standard deviation if you put 25% of your money into stock A which has a standard deviation of 15% and rest into stocks B which has a standard deviation of 10%. The correlation coefficient between the returns of the stocks is .75.?