Which of the following can be described as involving direct finance?

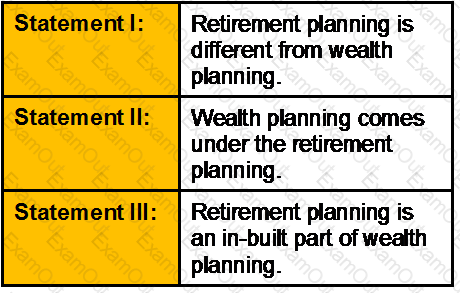

Which of the following statement is true?

If one earns 10% on investment but inflation is 2%, real rate of return is

Sudhir has invested Rs. 60,000, 30% of which is invested in Company A, which has an expected rate of return of 15%, and 70% of which is invested in Company B, with an expected return of 12%. What is the return on Sudhir’s portfolio?

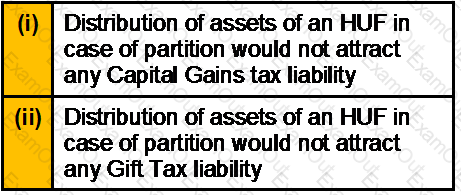

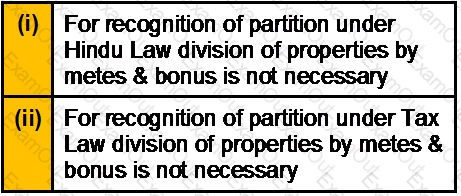

Which of the following statements is/are False

Mayank an investor buys one share of stock for Rs.500 at the beginning of the first year, and buys another share for Rs.550 at the end of the first year. The investor earns Re.10/- in dividends in the first year and Re.20/- in the second year. What is the time-weighted rate of return if the shares are sold at the end of the second year for Rs.650/- each?

A person is on the verge of retirement. He has sufficient funds to meet his daily regular expenses and even he has sufficient insurance coverage. He owns a house property. His family consists of him and his wife only. As a Chartered Wealth manager, which insurance policy would you suggest him?

A maximum of _____% of the trade done by a fund house can be routed through a single broker

Nishant aged 35 years is married and is working as a manager in M/s Zenith Ltd. His most likely retirement age is 60 years.His present salary is Rs. 3,00,000/- pa and self-maintenance expenses are 30,000/- per year. He pays Life insurance premium paid of 15,000/-and Income tax & professional tax amount to Rs. 20000/-. Rate of interest assumed for capitalization of future income is 8%.

Calculate Nishant’s HLV to recommend adequate insurance cover.

Total income for assessment year 2007-08 of an individual including long-term capital gain of Rs. 60,000 is Rs. 1,40,000. The tax on total income shall be:

During last five years, Mr. Saxena owned securities that gave the following annual rate of return:

Which is the preferable security as per Geometric mean annual rate of return?

Which of the following statement is/are correct?

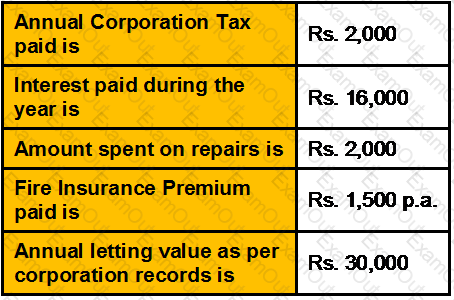

Mr. Pradip completed construction of a residential house on 1.4.2011.

Interest paid on loans borrowed for purpose of construction during the 2 years prior to completion was Rs. 40,000. The house was let-out on a monthly rent of Rs. 4,000.

Property was vacant for 3 months.

Compute the income under the head “Income from House Property” for the A.Y. 2012-13.

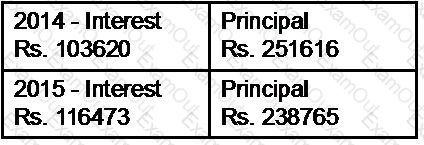

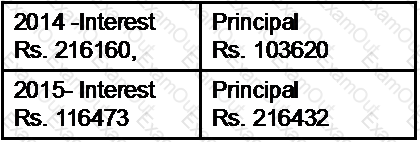

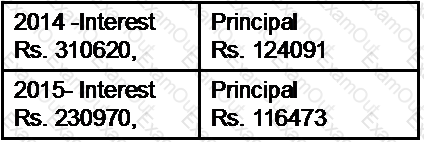

Dinesh took a housing loan of Rs. 25,00,000/- for 15 years in 2010 at a ROI of 11.75% per annum compounded monthly. Calculate the total interest and principle paid by him in the 2014 and 2016.

A)

B)

C)

D)

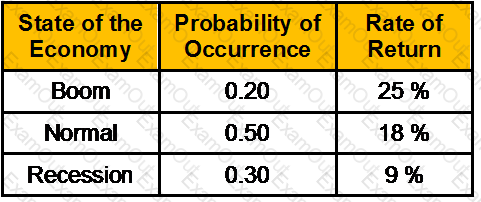

The probability distribution of the rate of return on a stock is given below:

What is the standard deviation of return?

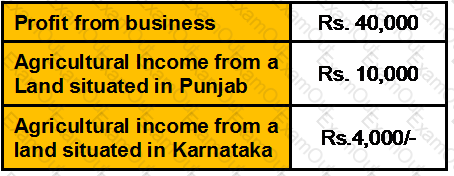

Compute Gross Total income and amount of loss allowed to be carried forward to next year:

Mr. Neeraj Gupta wants to withdraw Rs. 50,000 per quarter form an account after 3 years for 6 years. How much should he deposit in this account today if the ROI is 12% p.a. compounded quarterly.?

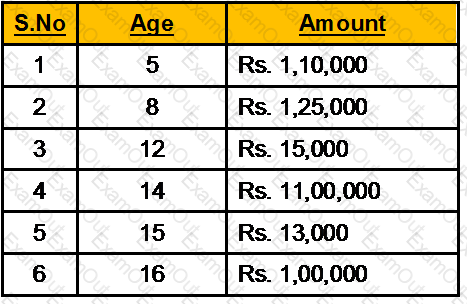

Mr. Shikar wants to invest his savings in an account that pays an interest rate of 9.25% p.a. compounded annually at different ages of his son whose current age is 4 years. Please calculate for him the Future Value of these investments when his son turns 18.

Mr. Ravi aged 28 years is a marketing professional who earns a salary of Rs. 50000 p.m. He is very concerned about his retirement expenses. For the same he has started saving Rs. 6000 p.m. regularly in a bank fixed deposit paying an interest of 9.5% p.a. since the age of 23.

At the age of 38, he is thinking of buying a house on his retirement which is 25 years away.

He has estimated that the price of the house at his retirement will be Rs. 4000000. Calculate the amount of retirement corpus accumulated by him and the extra savings he has to make at the age of 38 in order to purchase the house? (Inflation rate = 3% p.a.)

Mr. Patel expects the stock of A to sell for Rs. 70/- a year from now and to pay Rs. 4/- dividend. If the stock’s correlation with the Market is –0.3, and the standard deviation of A is 40% and standard deviation of the Market is 20% and the risk free rate of return is 5% and the market risk premium is 5% , what would be the price of stock A be now ?