Section B (2 Mark)

As Per Article 12 Double Taxation Avoidance Agreement with US, _____per cent of the gross amount of the royalties or fees for included services as defined in this Article, where the payer of the royalties or fees is the Government of that Contracting State, a political sub-division or a public sector company.

Section B (2 Mark)

What is the size of the final unequal payment of a loan that has 89.34 payments and the equal payment size is Rs215.64? The interest rate is 3% per compounding period.

Section A (1 Mark)

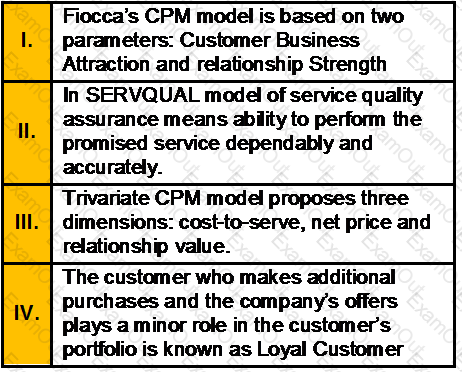

Which of the following statements is/are correct?

Section A (1 Mark)

_____________ is defined as the transfer of services to private enterprise in US.

Section C (4 Mark)

Read the senario and answer to the question.

Mrs. Deepika’s brother is impressed with Manav Fashion Ltd. an online clothing firm that focuses on the 18–22 age bracket. Their prices are much lower than their competitors, and the quality is high. Reading about the firm on its web site and in various financial newspapers, her brother has learned that the company plans to expand its clothing lines. The prevailing price of its share is 70 per share. Manav Fashion Ltd. has had recent annual earnings of Rs. 5 per share. Only three other companies have very similar business to Manav Fashion Ltd. and have stock that is traded and there PE ratios are as follows:

Her brother asked Mrs. Deepika to guide him in investing the Manav Fashion Ltd. Getting the query from her brother Mrs. Deepika asks your advice on this matter. As a Chartered Wealth Manager what will be your advice?

Section A (1 Mark)

The fact that a consumer feels a strong moral and ethical responsibility to repay a loan on time refers to the ______________________ of that individual.

Section A (1 Mark)

You have added more money to a losing stock twice, despite no good news about the stock. You are likely demonstrating which type of judgment error?

Section A (1 Mark)

For making a personal financial statement for a client, the optimum cash levels would be

Section A (1 Mark)

Which of the following is NOT one of the phases of the life-cycle theory of asset allocation?

Section C (4 Mark)

Monika has a investment portfolio of Rs. 100000, a floor of Rs. 75000, and a multiplier of 2. So the initial portfolio mix is 50000 in stocks and 50000 in bonds. If stock market falls by 20%, what should Monika do?

Section A (1 Mark)

___________is concerned with the rational solution to the problem at hand. It defines an idea that actual decisions should strive to approximate.

Section C (4 Mark)

Saurabh decided to invest Rs.1,00,000/- in a portfolio of equities and debt mutual funds. He invests Rs. 60,000/– in equities, and 40,000/– in debt mutual fund.

A year later, Saurabh’s portfolio worth reached to Rs. 1,35,000/– (90,000/– equity, 45,000/– debt mutual fund). During the year Rs. 2,500/– cash dividends was received on the equity and Rs. 1,000/– dividend was received on debt mutual fund. Find out Saurabh’s return on equity fund & debt mutual fund for the year?

Section A (1 Mark)

Operational customer relationship management supports which of the following function?

Section A (1 Mark)

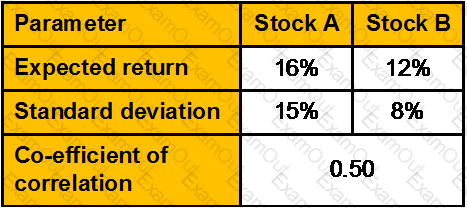

From the following data calculate the expected rate of return of a portfolio in which A and B has weights equally:

Section C (4 Mark)

Nifty is presently at 2694. Mr. XYZ expects Nifty to fall. He buys one Nifty ITM Put with a strike price Rs. 2800 at a premium of Rs. 132 and sells one Nifty OTM Put with strike price Rs. 2600 at a premium Rs. 52.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2359

• If Nifty closes at 3561

Section B (2 Mark)

Suppose you are working with two factor portfolios, Portfolio 1 and Portfolio 2. The portfolios have expected returns of 15% and 6%, respectively. Based on this information, what would be the expected return on well-diversified portfolio A, if A has a beta of 0.80 on the first factor and 0.50 on the second factor? The risk-free rate is 3%.

Section B (2 Mark)

An approved superannuation fund must have a minimum of _______ trustees

Section B (2 Mark)

A bank is about to make a Rs50 million project loan to develop a new oil field and is worried that the petroleum engineer's estimates of the yield on the field are incorrect. The bank wants to protect itself in case the developer cannot repay the loan. Which type of credit derivative contract would you most recommend for this situation?

Section A (1 Mark)

In “Teenage Years” life stage, one learns about ___________

Section A (1 Mark)

Which of the following is a special human trait that we need to sharpen and use very often in CRM?

Section A (1 Mark)

Following is not a head of income

Section A (1 Mark)

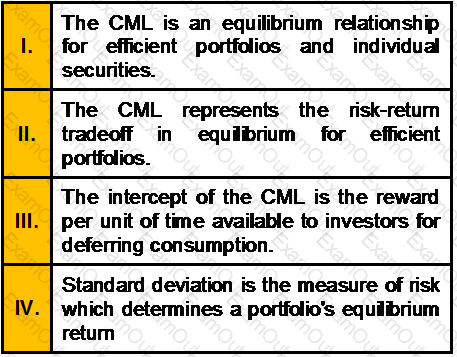

Select the INCORRECT statement regarding the CML

Section C (4 Mark)

Ms. Shweta wants to achieve the goal of higher education of her daughter after 15 years. She estimates that the funds required would be 30 lacs at then costs. She wants to invest monthly for this goal. You as a Wealth Manager suggest an asset allocation of 80% in Equity and 20% in Debt for 14 years and shifting the entire amount to liquid funds in the last year where the expected returns would be 6% p.a. If the returns in equity and debt funds are 14% and 8.50% respectively calculate the amount that needs to be invested in Equity and Debt Each Month.

Section A (1 Mark)

A dividend paid by a company which is a resident of India to a resident of the United Kingdom may also be taxed in India but the Indian tax so charged shall not exceed __________per cent of the gross amount of the dividend.

Section B (2 Mark)

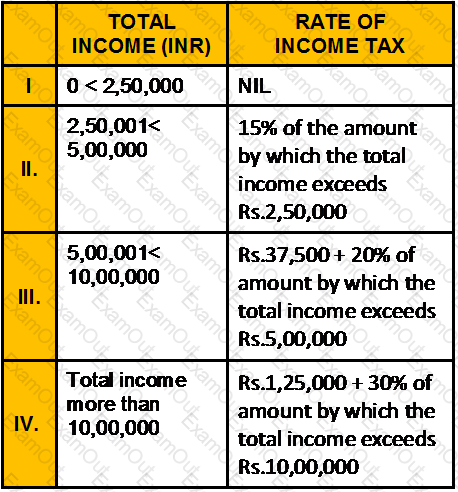

The income exemption threshold in respect of income year ending 30 June 2009 is as follows for an individual with two dependents in Mauritus is:

Section A (1 Mark)

The minimum annual income for availing Auto Loan is:

Section B (2 Mark)

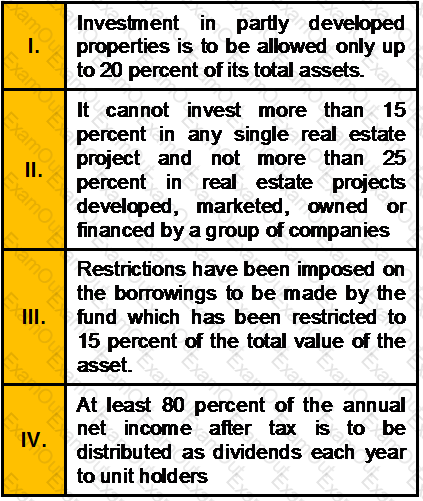

Which of the following is/are incorrect with respect to Draft guidelines of REITs in India?

Section B (2 Mark)

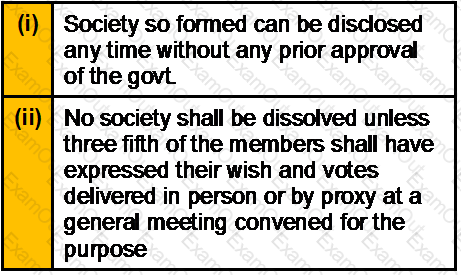

Which of the following statements is / are correct?

Section A (1 Mark)

Deduction u/s 80U in case of permanent physical disability (including blindness) allowed to:

Section C (4 Mark)

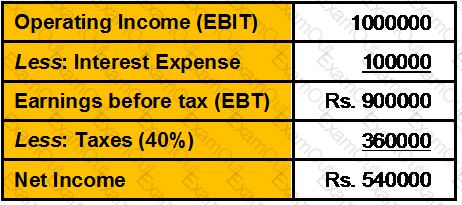

Phoenix Ltd has Rs 50,00,000 in total assets. The company’s assets are financed with Rs 10,00,000 of debt, and Rs 40,00,000 million of common equity. The company’s income statement is summarized below:

The company wants to increase its assets by Rs 10, 00,000, and it plans to finance this increase by issuing Rs 10, 00,000 in new debt. This action will double the company’s interest expense, but its operating income will remain at 20 percent of its total assets, and its average tax rate will remain at 40 percent. If the company takes this action, which of the following will occur:

Section A (1 Mark)

A retirement planner must have detailed information about the client’s current and future assets and liabilities. Which of the following is of least importance in developing a retirement plan?

Section C (4 Mark)

Mr. XYZ is bearish about Nifty and expects it to fall. He sells a Call option with a strike price of Rs. 2600 at a premium of Rs. 154, when the current Nifty is at 2694. If the Nifty stays at 2600 or below, the Call option will not be exercised by the buyer of the Call and Mr. XYZ can retain the entire premium of Rs.154.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2900

• If Nifty closes at 2400

Section B (2 Mark)

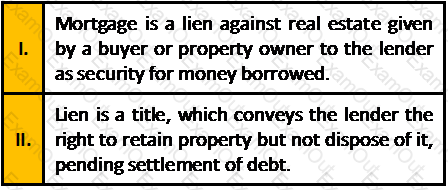

Which one of the above statements is/are correct?

Section C (4 Mark)

Navin Corporation, a manufacturer of do-it-yourself hardware and housewares, reported earnings per share of Rs2.10 in 1993, on which it paid dividends per share of Rs0.69. Earnings are expected to grow 15% a year from 1994 to 1998, during which period the dividend payout ratio is expected to remain unchanged. After 1998, the earnings growth rate is expected to drop to a stable 6%, and the payout ratio is expected to increase to 65% of earnings. The firm has a beta of 1.40 currently, and it is expected to have a beta of 1.10 after 1998. The Risk Free rate is 6.25%.

What is the value of the stock, using the two-stage dividend discount model?

Section B (2 Mark)

Lalit wants to sell a property for Rs.20 lakhs. He is earning rent from tenant Rs.2,15,000. He is spending following amounts annually on that property

The value of the property would be:

Section B (2 Mark)

Which of the following statements is/are correct with respect for Resident Senior Citizen i.e. who is of an age of 60 years and above, but below 80 years?

Section A (1 Mark)

Book building is used to help in better

Section C (4 Mark)

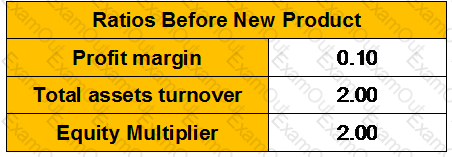

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

Section C (4 Mark)

Shikha has an investment portfolio of Rs.100000, a floor of Rs.75000, and a multiplier of 2. So the initial portfolio mix is 50000 in stocks and 50000 in bonds. If stock market goes up by 20%, what should Shikha do?

Section A (1 Mark)

Fundamental Analysis of security valuation includes …………

Section A (1 Mark)

The slope of the CML is the:

Section A (1 Mark)

The tendency, after an event has occured, to think that we knew what was going to happen beforehand. We overestimate the likeliness that we would have been able to predict the outcome of a past series of events. Which of the following is most likely consistent with this bias?

Section C (4 Mark)

Read the senario and answer to the question.

You advise Sajan to accumulate a retirement corpus at the age of 58 years to sustain 70% of pre-retirement household expenses till his lifetime, and thereafter 50% of pre-retirement expenses till Jennifer’s expected life (instead of Stephanie’s life). Such corpus shall generate an inflation linked monthly outflows, if invested in risk free instruments. He would accumulate at least Rs. 70 lakh for the corpus through his PPF A/C. by suitably investing in the scheme and extending the account till his retirement. For the balance amount of corpus, he wishes to start a monthly SIP immediately in his existing Balanced MF scheme. You calculate such amount to be _________.

Section A (1 Mark)

Which of the following is an assumption of the CMT?

Section A (1 Mark)

A(n) _____________ is an assurance that investors will be repaid in the event of the default of the underlying loans in a securitization. These can be internal or external to the securitization process and lower the risk of the securities.

Section B (2 Mark)

The basic rate of income tax on non-savings incomein UK for tax year in 2011-12 is:

Section A (1 Mark)

Conflict of interest should be discussed in ________

Section B (2 Mark)

You buy a share of ABC Ltd for Rs. 20. You expect it to pay dividends of Re.1, Rs.1.10 and Rs.1.21 in coming three years. Calculate the growth rate in dividend:

Section A (1 Mark)

The two major types of real estate are ____ and ___ .

Section B (2 Mark)

To pay for new equipment with a cash price of Rs7500, you need to borrow at 5.3% compounded monthly, then make monthly payments for 32 months. How much less would your payments be if you were able to save Rs2100 as a down payment before you purchase the new equipment?