Section B (2 Mark)

An employee benefit plan can generally help in accomplishing all of the following items except:

Section A (1 Mark)

In Working Capital Finance, what should be the minimum current ratio the borrower needs to ensure the compliance under the first method of lending.

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the Solvency ratio?

Section A (1 Mark)

Which of the following is an investment analysis approach to determine real estate values?

Section A (1 Mark)

A “Family Office” segment client has investible assets worth of

Section B (2 Mark)

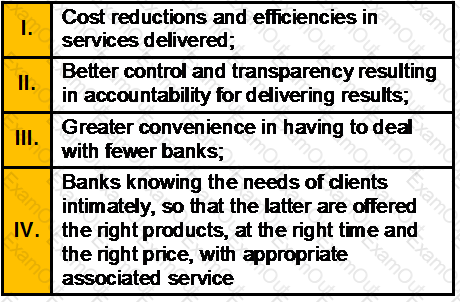

Which one of the above statements is/are not a important needs of clients in the context of relationship management?

Section C (4 Mark)

Mr. XYZ sells a Nifty Put option with a strike price of Rs. 4000 at a premium of Rs. 21.45 and buys a further OTM Nifty Put option with a strike price Rs. 3800 at a premium of Rs. 3.00 when the current Nifty is at 4191.10, with both options expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3287

• If Nifty closes at 4925

Section A (1 Mark)

In traditional approach to client servicing ,product offers were determined prior to analysis of client needs where as in Need Based approach a firm looks at book of business, and existing and targeted clients to assess its own core competencies and offerings

Section B (2 Mark)

Total income for assessment year 2007-08 of an individual including long-term capital gain of Rs. 60,000 is Rs. 1,40,000. The tax on total income shall be:

Section C (4 Mark)

Read the senario and answer to the question.

Sajan wants to cover for the expenses of his family without compromising their present lifestyle till the expected life time of Jennifer in case of his untimely death. He consumes 8% of monthly expenses exclusively on self. You advise him that the child plan covers a different goal. Assuming the cover proceeds are invested in a Balanced MF scheme, he should supplement his cover by taking a term insurance for _________ immediately to cover such future expenses. (Please ignore taxes and charges, if applicable, in regular withdrawals from Balanced MF scheme to meet proposed monthly expenses).

Section A (1 Mark)

The price that the writer of a put option receives for the underlying asset if the option is exercised is called the

Section B (2 Mark)

An employee joined in the year 2000 in a sugar mill. After working all the years as a seasonal employee up to the year 2011. He retires with the following monthly salary

How much gratuity is payable to him?

Section B (2 Mark)

Payback period is

Section A (1 Mark)

Mr. Vikas is now 50 years old. He has invested some amount in an annuity which will pay him from the END. of 5th year Rs. 35,000/- p.a. at the end of every year for 10 years. Rate of interest is 7% p.a. Calculate how much he has invested now?

Section C (4 Mark)

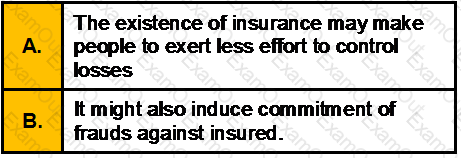

Which of the following statements is/are correct?

Section A (1 Mark)

Which one of the following statements is incorrect?

Section C (4 Mark)

Read the senario and answer to the question.

Sajan sold 350 shares of a company at Rs. 300 each on 1st March 2010. He purchased 50 shares on 1st May 1979 for Rs. 20 each. The fair market value was Rs. 40 each as on 1st April 1981. Again on 7 August 1998, he was allotted 50 bonus shares. The fair market value was Rs. 115 each as on 7th August 1998. He purchased additional 250 shares on 1st April 2009 for Rs. 150 each. Calculate the capital gains on shares sold.

(CII – 1981-82 : 100; 1998-99 : 351; 2008-2009 ; 582; 2009-10; 632)

Section A (1 Mark)

To try to develop a property’s competitive edge, an investor should consider which of the following?

Section A (1 Mark)

Mr. Sharma invested Rs. 2,00,000 in an investment that gives Rs 40,000/- for the first 4 years, and Rs. 60,000/- for next 3 years. If the discount rate is 12 %, calculate the Present Value of these cash flows?

Section A (1 Mark)

A swap that involves the exchange of one set of interest payments for another set of interest payments is called a(n)

Section B (2 Mark)

Lokesh purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-.As a CWM® calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

Section A (1 Mark)

A bank that wants to protect itself from higher credit costs due to a decrease in its credit rating might purchase _________________________.

Section B (2 Mark)

Which of the following factors affect the price of a stock option?

Section A (1 Mark)

In US which of the following is classified as passive income?

Section A (1 Mark)

A testamentary trust is affected after the

Section A (1 Mark)

NSSO stands for ____________

Section B (2 Mark)

If the currency of your country is depreciating, the result should be to ______ exports and to _______ imports.

Section B (2 Mark)

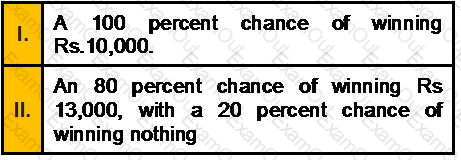

Which of the following two outcomes is an example of Status Quo Bias:

Section A (1 Mark)

The demand for insurance tends to be inelastic because of

Section A (1 Mark)

General Insurance business was established in India in

Section A (1 Mark)

The borrower's attitude toward his or her credit obligations is called:

Section A (1 Mark)

A cognitive heuristic in which decisions are made based on an initial 'anchor__________

Section A (1 Mark)

Pure premium and Loss Ratio methods are two methods to determine

Section B (2 Mark)

___________, the net profit margin realized by the enterprise from an international transaction entered into with an associated enterprise is computed in relation to cost incurred or sales affected or assets employed or to be employed in the enterprise or having regard to any relevant base.

Section B (2 Mark)

An employee who is not resident in the UK will be liable to UK income tax:

Section A (1 Mark)

The Net Operating Income (NOI) for a real estate investment is calculated as:

Section B (2 Mark)

As per article 11 Double Taxation Avoidance Agreement with UAE, Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State. However, such interest may be taxed in the Contracting State in which it arises and according to the laws of that State, but if the recipient is the beneficial owner of the interest, the tax so charged shall not exceed:

(a) _______ percent of the gross amount of the interest if such interest is paid on a loan granted by a bank carrying on a bona fide banking business or by a similar financial institution; and

(b) _______ percent of the gross amount of the interest in all other cases.

Section B (2 Mark)

A Resident is defined as not Ordinarily Resident provided such individual has been: a non- resident in 9 out of 10 Financial Years preceding the current year or his stay in India totals to _________days or less in ___________financial years preceding the current year.

Section B (2 Mark)

A bank plans to offer new subordinated notes in the open market next month but knows that its credit rating is being reviewed by a credit rating agency. The bank wants to avoid paying sharply higher credit costs. Which type of credit derivative contract would you most recommend for this situation?

Section B (2 Mark)

A bank recently loaned you Rs15,000 to buy a car. The loan is for five years (60 months) and is fully amortized. The nominal rate on the loan is 12 percent, and payments are made at the end of each month. What will be the remaining balance on the loan after you make the 30th payment?

Section A (1 Mark)

All the following real estate investors will acquire an income property except those who invest in

Section A (1 Mark)

A company making an IPO can avail which of the following option?

Section C (4 Mark)

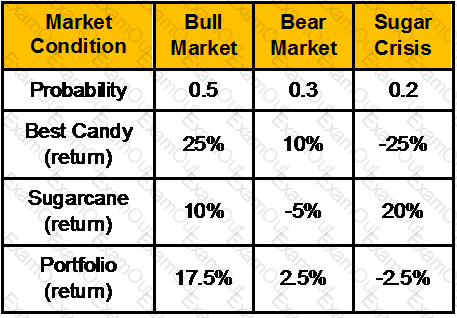

Two friends Neeraj and Kapil, both belonging to the 33.66% tax bracket, have invested Rs. 10 lakhs in a debt-based scheme. The scheme is a regular run of the mill, assembly line product — nothing extraordinary about it.

The scheme has earned a distributable profit of 12%.

Kapil’s financial condition is not good and due to the business losses his assets are to be auctioned.

Neeraj is working in MNC and getting an annual package of Rs. 18 lakhs. This includes Rs. 270000 as dearness allowance (2/3 forms the part of retirement benefit). He is also earning an agricultural income of Rs. 54000.His expenses are Rs. 80000 per month.

Neeraj has also taken a housing loan in joint name of his wife Anita and himself. Property is also in the joint name and their contribution is equal. Annual outflow towards housing loan in terms of repayment of principal and interest is Rs. 300000. Out of this Rs. 198800 is toward interest.

Neeraj has also invested an equal amount in a portfolio consisting of securities A and B. Standard deviation of A is 12.43%; Standard deviation of B is 16.54%; Correlation coefficient is 0.82

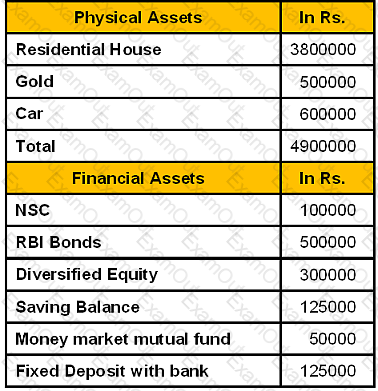

Assets held by Neeraj

Section C (4 Mark)

Read the senario and answer to the question.

Calculate his Life Insurance Coverage Ratio based on his net worth.

Section A (1 Mark)

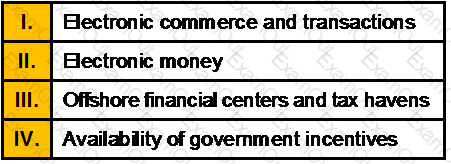

Fiscal termites are factors that threaten the integrity of tax systems, and most of which relate to the internationalization of tax. These are:

Section A (1 Mark)

Family Offices provide _____________

Section A (1 Mark)

Which of the following is/are correct?

Section B (2 Mark)

An Indian citizen leaving India during the previous year for employment purpose is said to be resident If:

Section C (4 Mark)

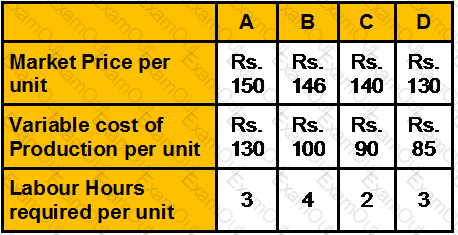

Division Z is a profit centre, which produces four products A, B, C and D, Each product is sold in the external market also. Date for the period is as follows:

Product D can be transferred to division Y but the maximum quantity that might be required for transfer is 2,500 units of D.

The maximum sales in the external market are:

Division Y can purchase the same product at a slightly cheaper price of Rs. 125 per unit instead of receiving transfer of product D from division Z.

What should be transfer price for each unit for 2500 units of D, if the total labour hours available in division Z is:

Section C (4 Mark)

Omax Inc. one of the largest developer of residential projects, reported earnings per share of Rs 8.0 in 2003, and paid dividends per share of Rs 4.8 in that year. The firm is expected to report earnings growth of 25% in 2004, after which the growth rate is expected to decline linearly over the following six years to 7% in 2009. The stock is expected to have a beta of 0.85 and current risk free rate is 6.25%.

Estimate the value of the firm using the H Model.