Section A (1 Mark)

When markets are in equilibrium, the CML will be upward sloping

Section A (1 Mark)

Monetary policy is determined by

Section B (2 Mark)

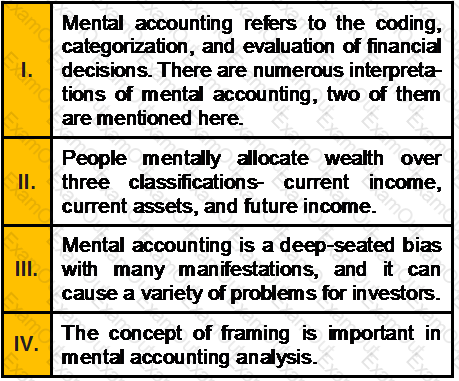

Which of the following statements is/are correct with respect to Mental Accounting?

Section A (1 Mark)

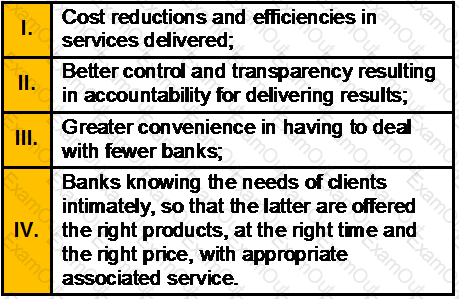

Which one of the above statements is/are not a important needs of clients in the context of relationship management:

Section B (2 Mark)

In _____________ first the cost incurred by the supplier of property is determined. An appropriate cost plus mark-up is then added to the cost so as to arrive at an appropriate profit in the light of the functions performed and market conditions.

Section A (1 Mark)

Generally speaking, high severity of losses will be accompanied by

Section A (1 Mark)

Debt ratio is

Section A (1 Mark)

In “CAMPARI” Model, R stands for:

Section A (1 Mark)

Mr. Murli is 55 years old at present. He has invested some amount in an annuity which will pay him begining of the 5th year Rs. 30,000/- p.a. at the beginning of every year for 10 years. Rate of interest is 7% p.a. Calculate how much amount he has invested now?

Section C (4 Mark)

Read the senario and answer to the question.

Nimita wants to know if she were to meet with an accident and get permanent disability in the third year of her Term Insurance policy, what amount of the premium due in the fourth year would be payable by her if the premium being paid towards the policy is Rs. 15,000 with sum assured of Rs. 50 lakh?

Section B (2 Mark)

Compute YTM of a bond with par value of Rs.1000/-, carrying a coupon rate of 8% and maturing after 10 years. The bond is currently selling for Rs.850/-.

Section B (2 Mark)

What is the correlation coefficient between the companies A and B, if their covariance is 23 and their standard deviation is 8 and 7 respectively?

Section A (1 Mark)

A(n) __________________ guards against the losses in the value of a credit asset. It would pay off if the asset declines significantly in value or if it completely turns bad.

Section B (2 Mark)

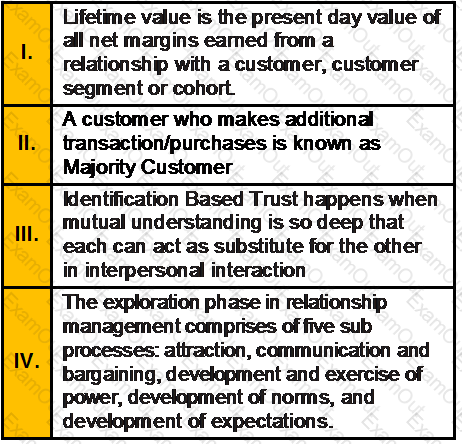

Which of the following statements is/are correct?

Section C (4 Mark)

Read the senario and answer to the question.

Nimita purchased 500 shares of ABC Ltd., a listed company at Rs. 45 per share on Sep. 15,2002. The company offered to buy back its shares on June 15, 2009 which Nimita accepted at a price of Rs. 75 per share on Jul 1, 2009. What is the tax liability in the hands of Nimita for this transaction for Assessment Year 2010-11? Cost inflation indices are 2002-03: 447 and 2009-10 632. (Ignore Education Cess)

Section B (2 Mark)

The current market price of a share of MOD stock is Rs15. If a put option on this stock has a strike price of Rs20, the put

Section B (2 Mark)

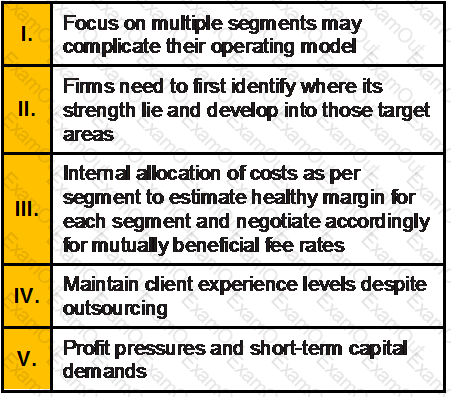

Which of the following is/are the Potential Challenges for wealth management players in India:

Section B (2 Mark)

Resident but not ordinary resident (RNOR) is ____________ on Indian Income and ___________ on Foreign Income.

Section A (1 Mark)

Ideally, clients would like to invest with the portfolio manager who has

Section B (2 Mark)

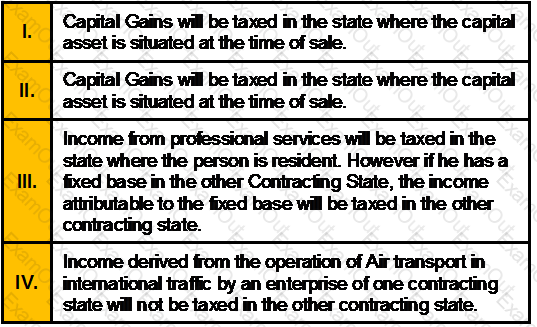

Which of the following statements with respect to DTAA is/are correct?

Section A (1 Mark)

A bank is considering making a loan to Jitesh Desai. Jitesh is a commissioned sales broker. Some months he earns as much as Rs 1,00,000 and in other months he earns virtually nothing. Which aspect of evaluating a consumer loan would this be concerned with?

Section B (2 Mark)

Rahul decides to deposit Rs. 5,000/- every month into an account yielding 12 % per annum compounded monthly for 20 years. What will be the accumulated value in this account after 20 years and how much amount can be withdrawn from this account every month for a further period of 20 years of ROI is 8 % per annum compounded monthly?

Section B (2 Mark)

Financial Year 2012-13 shall be considered as

Section A (1 Mark)

The____________________ in commercial real estate requires that the tenant pay a significant share of expenses of operation, as well as all taxes and insurance related to their rental unit.

Section A (1 Mark)

A bank is considering making a loan to Ram Kapoor. Ram has a gross salary per month of Rs40500 but has take-home pay of Rs27500 per month. What aspect of evaluating a consumer loan application is this fact most concerned with?

Section B (2 Mark)

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Bhatia owns a Maruti Wagonr with a monthly EMI of Rs. 6,312. The above loan will be completely repaid by August 2008. Mr. Bhatia planning to purchase a new car worth of Rs. 15 lakh. For this he has to take a full value loan of the car with 9% interest for 5 years. But his present car is in good condition and life of this car is approximately another 5 years repairs and maintenance cost are minimum. If he postpones his car purchasing plan now and deposit the same EMI outflow required for new car into an SIP with a minimum 15% yield for the next five years, then calculate the fund he can accumulate?

Section A (1 Mark)

As per presumptive income scheme under section 44AE, the presumed income shall be:

Section A (1 Mark)

Mansi deposits Rs. 50,000/- in a bank account which pays interest @ 10 % per annum. How much can be withdrawn at the beginning of each year for 5 years if first withdrawal is 6 years from now?

Section B (2 Mark)

Major phases of budgeting process are:

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Royalities are:

Section C (4 Mark)

Read the senario and answer to the question.

What will be the taxable amount of Gratuity on his retirement?

Section A (1 Mark)

A company, other than an Indian Company would be a resident in India for the previous year if during that year its control and management is situated:

Section A (1 Mark)

Unabsorbed depreciation can be carried forward for ____________.

Section B (2 Mark)

Broker dealer model is more prevalent in

Section A (1 Mark)

A general theoretical perspective in social psychology concerned with the issue of social perception. is known as_____________

Section A (1 Mark)

Expenditure incurred by an employer on medical treatment and stay abroad of the employee shall not be taxed in the case of ___________.

Section A (1 Mark)

What would be the tax liability if tea and snacks are provided in the office after office hours?

Section A (1 Mark)

Mr. X, partner of M/s XYZ, is assessable as

Section B (2 Mark)

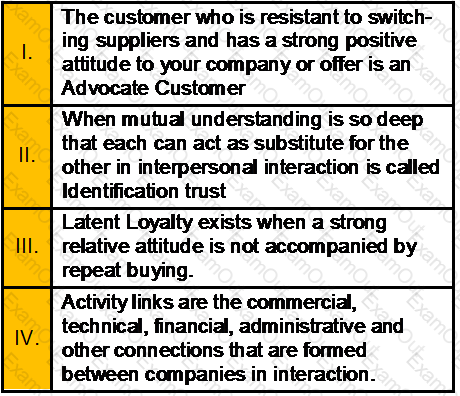

Which of the following statements is / are correct?

Section B (2 Mark)

Which of the following Biases are exhibited by Active Accumulator?

Section A (1 Mark)

Which of the following statements regarding inflation and investing are true?

Section A (1 Mark)

A type of lease where there is no payment schedule and penalty for a set period of lines.

Section A (1 Mark)

By agreeing to service any assets that are packaged together in the securitization process a bank can:

Section A (1 Mark)

A document which is used to hand over the legal powers to sign on legal documents pertaining to the property to someone other than the owner is called_____________

Section B (2 Mark)

Mr. Murti is working in a reputed company and earning Rs. 4,00,000/- p.a. and is now 50 years old. He has invested Rs. 1,50,000/- in an annuity which will pay him after 5 years a certain amount p.m. at the beginning of every month for 10 years. Rate of interest is 8% p.a. Calculate how much he will receive at the beginning of every month after 5 years?

Section B (2 Mark)

Mr.Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20000 by his employers out of which he spends Rs.18000 for shifting his family and personal effects. Which of the following is true?

Section C (4 Mark)

Mohan recommend that the stock of AZB Ltd. is a good purchase at Rs. 25. You do an analysis of the firm, determining that the Rs. 1.40 dividend and earnings should continue to grow indefinitely at 8% annually. The firm’s beta co-efficient is 1.34 and the yield on Treasury bills is 7.4%. If you expect the market to earn a return of 12 % should you follow Mohan’s suggestion?

Section C (4 Mark)

Pinnacle India Ltd, reported a net profit of Rs1.085 billion on sales of Rs7.425 billion in 1993. The sales/book value ratio in 1993 was approximately 1.2, and the dividend payout ratio was 20%. The book value per share was Rs19 in 1993. The firm is expected to maintain high growth for ten years, after which the growth is expected to drop to 6%, and the dividend payout ratio is expected to increase to 65%. The beta of the stock is 1.05. (The treasury bill rate is 7%.)

Estimate the price/sales ratio for the company.

Section B (2 Mark)

EDLI stands for