Section A (1 Mark)

Which of the following is an effective strategy in times of falling interest rates?

Section B (2 Mark)

A property has 120 rooms and each room has a monthly rent of Rs.750. The occupancy rate throughout the year is 80% and maintenance expenses per year works out to be Rs.3,00,000. Capitalization rate is 12%. Calculate the value of the property.

Section A (1 Mark)

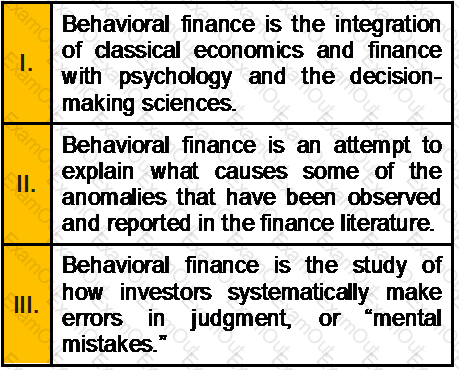

Which one of the following statements is false?

Section B (2 Mark)

Consider the one-factor APT. The variance of returns on the factor portfolio is 6%. The beta of a well-diversified portfolio on the factor is 1.1. The variance of returns on the well-diversified portfolio is approximately __________.

Section A (1 Mark)

Any property inherited by a female Hindu from her husband or from her father in law, in the absence of any son or daughter of the deceased shall go to…..

Section A (1 Mark)

After buying two stocks, one rises by 25% an d the other drops by 25%. You congratulate yourself on your brilliance for the first stock and blame bad luck on the second. You are demonstrating which investor bias?

Section A (1 Mark)

The Eligibility Criteria for Personal Loans for Self Employed Professionals & Businessman in India states that the minimum age of the applicant should be:

Section A (1 Mark)

The eligibility Criteria for Personal Loans Salaried Individuals for Maximum Age of Applicant at Loan Maturity in case of personal loan is:

Section B (2 Mark)

Suppose the price of a share of CAS stock is Rs500. An April call option on CAS stock has a premium of Rs5 and an exercise price of Rs500. Ignoring commissions, the holder of the call option will earn a profit if the price of the share

Section A (1 Mark)

REITs offer all of these, except:

Section A (1 Mark)

_____________seek to explain people's preferences in relation to consumption and saving over the course of their life.

Section A (1 Mark)

………………………arises by operation of law eg trust created under MWP Act

Section A (1 Mark)

Which of the following is true regarding credit card loans?

Section C (4 Mark)

Read the senario and answer to the question.

Harish incurred Rs. 10 Lakh on the construction of his house five years ago which has depreciated today to Rs. 7 Lakh. The cost of construction over the period has gone up by 70%.The depreciated value of household items is Rs. 2.5 Lakh and their present cost of replacement is Rs. 4 Lakh. Harish wants to buy a Householders’ insurance policy in such a way that the house is insured on reinstatement basis and household goods on the basis of written down value. How much total insurance coverage should he take from the insurance company?

Section B (2 Mark)

What are the two strategies that have the broadest mandate across financial, commodity, and futures markets?

Section A (1 Mark)

The two primary tools of a technical analyst are:

Section A (1 Mark)

Securities with betas less than 1 should have:

Section B (2 Mark)

Which of the following statements is/are correct?

Section A (1 Mark)

Rahul deposits Rs. 30,000/- per year, at the end of the year, into an account for 30 years. What amount would be accumulated in that account at the end of 30 years if ROI is 9 % per annum?

Section A (1 Mark)

An Agreement between the tenant and the landlord for the right to use the property for a specified period of time is known as ____________.

Section B (2 Mark)

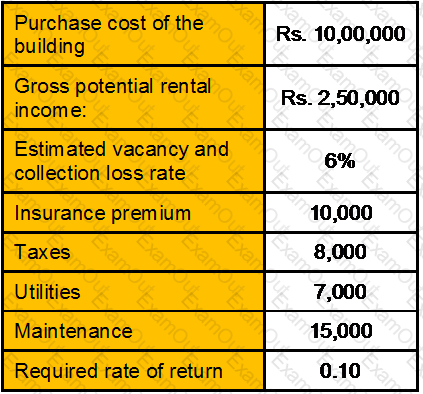

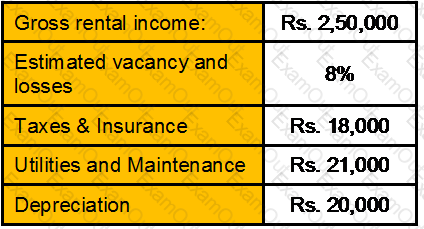

An investor is considering the purchase of a small office building and, as part of his analysis, form the following given data calculate the appraised value of the property using the Income Approach.

Section B (2 Mark)

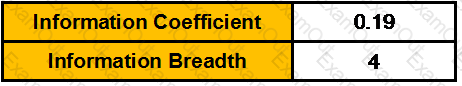

Calculate the Information Ratio from the following data:

Section B (2 Mark)

As a CWM you are considering the following bond for inclusion in the fixed income portfolio of your client:

What will be the duration of this bond? and What will be the effect of the changes on the duration of the bond if the coupon rate is 6% rather than 9%?

Section A (1 Mark)

An equity analyst working for a growth oriented mutual fund has a tendency to misvalue the stocks of popular companies that she has previously recommended and the fund already owns. Her behavior is most likely consistent with which of the following biases?

Section A (1 Mark)

An aggressive asset allocation would contain larger proportions of __________ than a conservative allocation.

Section A (1 Mark)

A(n)_______________ is a credit-rating agency that keeps records of borrowers' loan payment histories.

Section B (2 Mark)

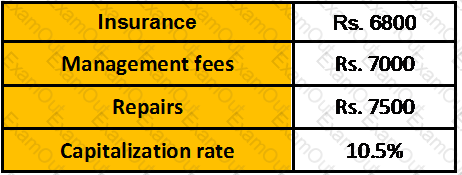

Mahesh wants to sell a property for Rs. 30 lakhs. He is earning rent from tenant Rs. 3,60,000. He is spending following amounts annually on that property.

Based on the above information what should be the value of the property would be:

Section A (1 Mark)

_____________allow investors to increase diversification in direct real estate holdings by investing in groups of real estate projects.

Section B (2 Mark)

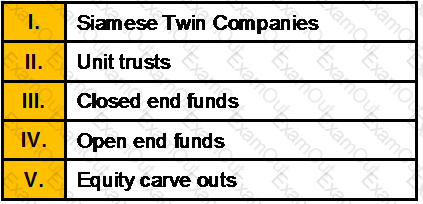

____________ are good examples of the limits to arbitrage because they show that the law of one price is violated.

Section B (2 Mark)

If after the partition of an HUF 2 members became partners in 3 firms on behalf of their respective HUFs and they also become partners in a fourth firm. The funds were obtained by means of loans from the other 3 firms. The share incomes of the members from the fourth firm were assessable as their individual income only.

Section B (2 Mark)

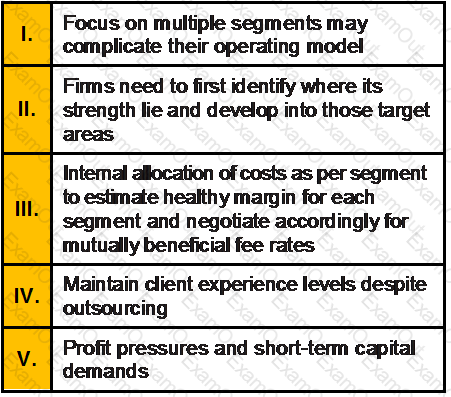

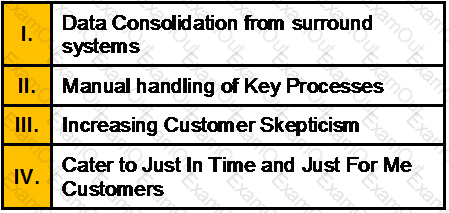

Which of the following is/are the Potential Challenges for wealth management players in India?

Section B (2 Mark)

Calculate the value at which an office building can be priced from the following information:

A similar building has 8% capitalization rate.

Section B (2 Mark)

How much interest is paid in total on a 3-year loan for Rs27 400? The interest rate is 8.6% compounded monthly and the payments are monthly?

Section C (4 Mark)

Asit an industrialist wants to buy a car presently costing Rs. 10,00,000/- after 5 years. The cost of the car is expected to increase by 10% p.a for the first 3 years and by 6% in the remaining years. Asit wants to start a SIP with monthly contributions in HDFC Top 200 Mutual Fund. You as a CWM expect that the fund would give an average CAGR of 12% in the next 5 years. Please advise Asit the monthly SIP amount starting at the beginning of every month for the next 5 years to fulfill his goal of buying the Car he desires.

Section B (2 Mark)

Rakhi purchased a piece of land on 25-4-1979 for Rs.80000. This land was sold by him on 23-12-2011 for Rs.1250000. The market value of the land as on 1-4-1981 was Rs.98000. Expenses on transfer were 1.5% of the sale price. Compute the capital gain for the assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711]

Section B (2 Mark)

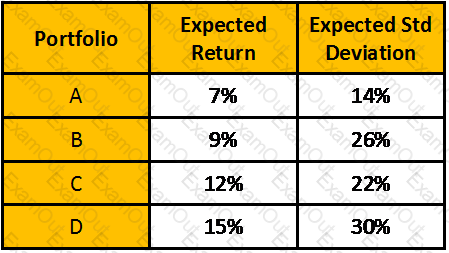

Which of the following portfolios falls below the Markowitz Efficient Frontier?

Section C (4 Mark)

Read the senario and answer to the question.

Portfolio A had a return of 12% in the previous year, while the market had an average return of 10%. The standard deviation of the portfolio was calculated to be 20%, while the standard deviation of the market was 15% over the same time period. If the correlation between the portfolio and the market is 0.8, what is the Beta of the portfolio A?

Section A (1 Mark)

Debt Equity Ratio is 3:1,the amount of total assets Rs.20 lac, current ratio is 1.5:1 and owned funds Rs.3 lac. What is the amount of current asset?

Section A (1 Mark)

The trust which is empty at creation during life and tranfers the property into the trust at death is called ____________

Section B (2 Mark)

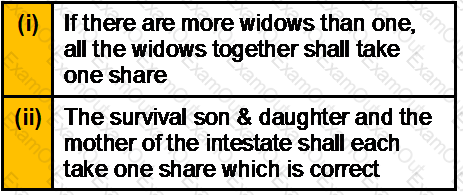

Which one of the following statements is/are correct?

Section A (1 Mark)

All of the following are assumptions made by technical analysts except:

Section C (4 Mark)

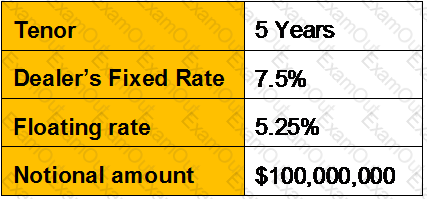

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?

Section B (2 Mark)

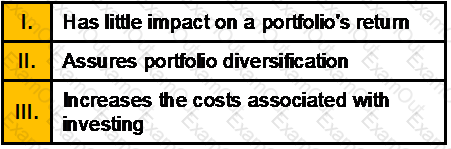

Asset allocation policy

Section A (1 Mark)

_____________ is the transfer of the balance of an existing home loan that you availed at a higher rate of interest (ROI) to either the same HFC or another HFC at the current ROI a lower rate of interest.

Section B (2 Mark)

Eric, who has lived in the Netherlands for the whole of his life, arrives in the UK on 1 June 2011 and remains in the UK until 31 December 2011, when he returns permanently to the Netherlands. His UK residence status for 2011-12 is:

Section A (1 Mark)

Which of the following is/are the challenges of Private Banking?

Section B (2 Mark)

If an investor determines that next year’s earnings estimate is Rs2.00 per share and the company subsequently falters, the investor may not readjust the Rs2.00 figure enough to reflect the change because he or she is “anchored” to the Rs2.00 figure. This is not limited to downside adjustments—the same phenomenon occurs when companies have upside surprises

Which of the following Biases have been exhibited by the investor?

Section A (1 Mark)

As per ARTICLE 12 in DTTA with US , the maximum tax rate on the gross amount of the royalties or fees for included services in the Article is:

Section A (1 Mark)

Which of the following can be the underlying for a commodity derivative contract?

Section A (1 Mark)

Convertible bond arbitrage is to event driven as _________ is to corporate restructuring.