Section A (1 Mark)

Bank Overdraft loan is an example of:

Section A (1 Mark)

The premium on all other riders put together should not exceed _____ of the premium on the base policy

Section B (2 Mark)

Mr. Jain is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2 months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6 months and Rs. 800 for 2 months thereafter. EACH CASH FLOW starts from the beginning of the month. Please calculate the Present Value of this cash stream if rate of interest is 9 % per annum compounded monthly?

Section A (1 Mark)

The length of the insurance industry’s business cycle is shortened because of

Section A (1 Mark)

In which year can the subscriber to a PPF account take the first loan from the opening of the account?

Section C (4 Mark)

Read the senario and answer to the question.

During identification of new business opportunities, one of Harish’s friends Shekhar has offered him a business proposal. In this proposal a partnership firm consisting of two partners, Harish and Shekhar, shall take the franchise of a company which is a reputed brand in the field of pathology lab in which their investment and profit sharing ratio shall be equal.

Franchise rights shall be valid for 5 years and the project requires an upfront investment of Rs. 25 lakh for required infrastructure. The franchisee agreement has an option that the company can take over the franchisee after 5 years by charging depreciation @15% p.a. on straight line basis.

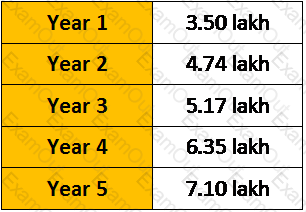

The projected profits from the firm are as follows:

Harish wants to know what IRR he will earn on his investment from this project ? (Please ignore taxes and assuming no additional investment is made during this five year period)

Section C (4 Mark)

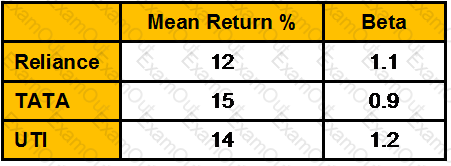

Consider the following information for three mutual funds:

Market Return 10%

Risk free return is 7%.

Calculate Jensen measure (%).

Section C (4 Mark)

As a CWM® you recommended Mr. Raj Malhotra to put his money in Asset A offering 15% annual return with a standard deviation of 10%, and balance funds in asset B offering a 9% annual return with a standard deviation of 8%. Assume the coefficient of correlation between the returns on assets A and B is 0.50. Calculate the expected return after 1 year and standard deviation of Mr. Raj Malhotra’s portfolio.

Section A (1 Mark)

All of the following are examples of excise taxes except:

Section C (4 Mark)

Mr. XYZ buys a Nifty Call with a Strike price Rs. 4100 at a premium of Rs. 170.45 and he sells a Nifty Call option with a strike price Rs. 4400 at a premium of Rs. 35.40.

What would be the Net Payoff of the Strategy?

• if Nifty closes at 4200

• if Nifty closes at 5447

Section B (2 Mark)

Mr. X gives Rs. 200000 to Mrs. X as gift. She invests in a proprietary concern and incurs a loss of Rs. 40000

Section A (1 Mark)

EMH frequently include, among others, assumptions such as:

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Dividends in UAE is charged at:

Section A (1 Mark)

Which ONE of the following in not the requirement for managing customer?

Section B (2 Mark)

Conventional theories presume that investors ____________ and behavioral finance presumes that they ____________.

Section A (1 Mark)

Amit has monthly net income of Rs10500. He has a house payment of Rs 4500 per month, a car loan with payments of Rs 2500 per month, a Visa card with payments of Rs 500 per month, and a credit card with a local department store with payments of Rs 1000 per month.

What is Amit's debt payments-to-income ratio?

Section A (1 Mark)

An investor will take as large a position as possible when an equilibrium price relationship is violated. This is an example of _________.

Section A (1 Mark)

Which one of the following has not caused the huge growth in hedge funds and private equity?

Section B (2 Mark)

Mahesh wants to sell a property for Rs. 30 lakhs. He is earning rent from tenant Rs. 3,60,000. He is spending following amounts annually on that property

Based on the above information what should be the value of the property would be:

Section B (2 Mark)

Both __________ depend on electronic information that has been collected about customers, in place of human knowledge, to build and manage relationships.

Section B (2 Mark)

Narayan expects to receive Rs 25000 in net receipts each year for five year and to sell the property for Rs 350,000 at the end of the five-year period, if Narayan expects a 15% return, what would be the value of the property?

Section A (1 Mark)

What amount needs to be invested today at 10 % per annum, so that it pays Rs. 1 lac per annum for 5 years, starting from 6th year to 10thyear. First payment starts at BEGIN of 6thyear.?

Section B (2 Mark)

If two customers choose exactly the same package of certain service, but customer A calls for help weekly and customer B calls only twice a year, which is most valuable customer?

Section B (2 Mark)

Mrs. Dikshit is a single, sixty-five year old with a modest lifestyle and no income beyond what her investment portfolio of Rs1,00,00,000 generates. Her primary investment goal is to not outlive her assets; she does not, under any circumstances, want to lose money because she recalls that her relatives lost money in the crash of 2000. Mrs. Dikshit exhibits these behavioral biases:

Section C (4 Mark)

Read the senario and answer to the question.

What is the monthly extra saving at beginning required to be done by Raman during his remaining working period to accumulate his required retirement corpus?

Section B (2 Mark)

How much total principal is repaid between the 1st and 17th payment interval of a 4.5-year loan for Rs 4567 at an interest rate of 7.44% compounded monthly. The payments are also monthly.

Section A (1 Mark)

The following is not a capital receipt

Section B (2 Mark)

To maximize this benefit a bank must:

Section A (1 Mark)

The quantum of deduction allowed u/s 80U is:

Section A (1 Mark)

If a certain stock has a beta greater than 1.0, it means that

Section A (1 Mark)

Which one of the following definitions of hedge fund strategies is not correct?

Section A (1 Mark)

Decision horizon is __________

Section A (1 Mark)

Mr. Raghav is now 40 years old. He has invested some amount in an annuity which will pay him after 10 years Rs. 30,000/- p.a. at the end of every year for 10 years. Rate of interest is 6% p.a. Calculate how much he has invested today?

Section B (2 Mark)

A bank has a long term relationship with a particular business customer. However, recently the bank has become concerned because of a potential deterioration in the customer's income. In addition, regulators have expressed concerns about the bank's capital position. The business customer has asked for a renewal of its Rs25 million dollar loan with the bank. Which credit derivative can help this situation?

Section A (1 Mark)

CRM is considered as a:

Section A (1 Mark)

___________ is a measure of the ratio between the net income produced by an assets (usually real estate) and its capital cost.

Section B (2 Mark)

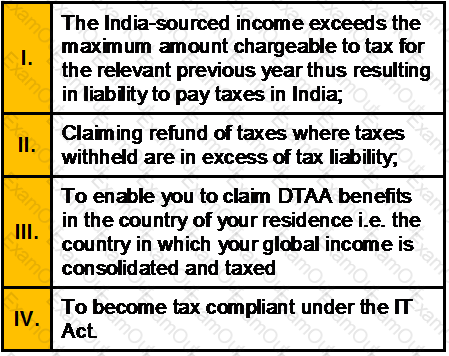

You may need to file your Returns in India under the following circumstances:

Section C (4 Mark)

Calculate expected rate of return on the following portfolio.

Weight of X and Y in the portfolio is 50% and 50% respectively.

Section A (1 Mark)

Risk factors in the APT must possess all of the following the characteristics except:

Section A (1 Mark)

A loan where the borrower pays interest each period, and repays some or all of the principal of the loan over time is called a(n) _________ loan.

Section C (4 Mark)

The following parameters are available for four mutual funds:

Calculate Treynor’s performance index for each of the funds on the assumption that r=6% where r stands for the risk – free interest rate.

Section B (2 Mark)

Markets would be inefficient if irrational investors __________ and actions of arbitragers were __________.

Section A (1 Mark)

The first step of portfolio management is:

Section A (1 Mark)

Which of the following measures is lowest for a currently callable bond?

Section B (2 Mark)

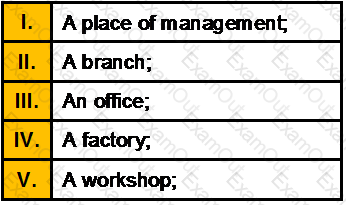

The term “permanent establishment” includes especially:

Section C (4 Mark)

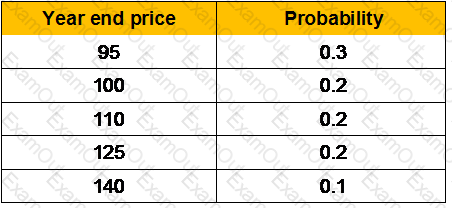

A share pays nil dividend and its current market price is Rs.100. The possible selling prices at the end of a year and the probabilities are:

What is the expected rate of return at the end of the year?

Section B (2 Mark)

Information processing errors consist of

Section A (1 Mark)

Hybrid plans are

Section A (1 Mark)

The risk that occurs when the index used for determination of interest earned on the CDO trust collateral is different from the index used to calculate the interest to be paid on the CDO trust is known as______________.

Section A (1 Mark)

Technical analysis reflects the idea that stock prices