Section B (2 Mark)

IFB Stock currently sells for Rs38. A one-year call option with strike price of Rs45 sells for Rs9, and the risk free interest rate is 4%. What is the price of a one-year put with strike price of Rs45?

Section A (1 Mark)

In a short call, profit is

Section A (1 Mark)

Why have consumers/customers been so hyper-aware and so nervous?

Section A (1 Mark)

A bank is considering making a loan to Neil Garg. Neil has bounced three cheques in the last year and already has Rs 1,00,000 on a credit card and an automobile loan with a large balance. What aspect of evaluating a consumer loan application is this fact concerned with?

Section B (2 Mark)

The _________ is a plot of __________.

Section C (4 Mark)

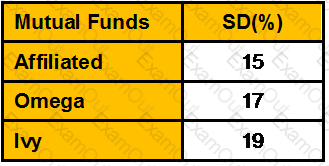

The expected return for the market is 12 percent, with a standard deviation of 20 percent. The expected risk-free rate is 8 percent. Information is available for three mutual funds, all assumed to be efficient, as follows:

Calculate the expected return on each of these portfolios respectively.

Section B (2 Mark)

There are three stocks, A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year; economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below:

If you invested in an equally weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate.

Section C (4 Mark)

Nifty is at 3200. Mr. XYZ expects large volatility in the Nifty irrespective of which direction the movement is, upwards or downwards. Mr. XYZ buys 2 ATM Nifty Call Options with a strike price of Rs. 3200 at a premium of Rs. 97.90 each, sells 1 ITM Nifty Call Option with a strike price of Rs. 3100 at a premium of Rs. 141.55 and sells 1 OTM Nifty Call Option with a strike price of Rs. 3300 at a premium of Rs. 64.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2929

• If Nifty closes at 4325

Section A (1 Mark)

Which of the following is NOT a major consideration in the asset allocation process?

Section B (2 Mark)

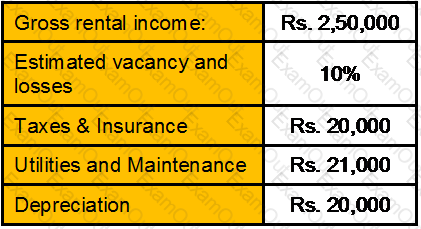

Calculate the value at which an office building can be priced from the following information:

A similar building has 8% capitalization rates.

Section A (1 Mark)

An example of ________ is that a person may reject an investment when it is posed in terms of risk surrounding potential gains but may accept the same investment if it is posed in terms of risk surrounding potential losses.

Section C (4 Mark)

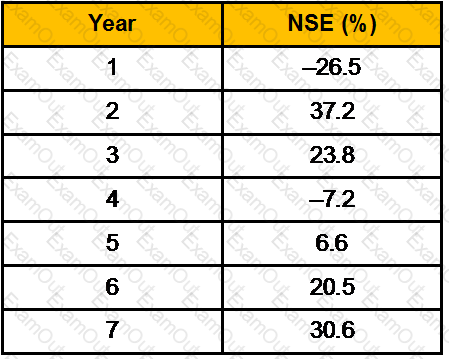

You are given the following set of data:

Historical Rate of Return

Determine the arithmetic average rates of return and standard deviation of returns of the NSE over the period given.

Section A (1 Mark)

A good wealth management plan must include an analysis of all of the following EXCEPT

Section A (1 Mark)

Conclusions about technical analysis suggest that:

Section B (2 Mark)

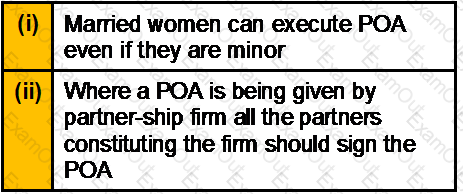

Which of the following statement is/are correct?

Section B (2 Mark)

_____________ begins with the price at which a product that has been purchased from an Associated Enterprise AE is resold to an independent enterprise

Section A (1 Mark)

Which of the following statements about the difference between the SML and the CML is/are TRUE?

Section A (1 Mark)

“Accumulation” is the age between ________

Section A (1 Mark)

Stock broker’s human capital is _________ to stock market as compared to a school teacher

Section B (2 Mark)

Ram born in 1950 has a life expectancy at birth of 65 years. Sita his wife born in 1955 has a life expectancy at birth of 70 years. Assuming that the life expectancies have not changed. Ram is planning to buy an annuity to be paid to him or his wife till anyone of them is alive. Assuming Ram will retire on attaining age 58 i.e. in 2008, what should be the time period of the annuity?

Section A (1 Mark)

How many types of power of attorney are there?

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the Net Worth of Mr. Adhikari as on 31/03/2009.

Section A (1 Mark)

The way to reduce tax liability by taking full advantage provided by the Act is

Section C (4 Mark)

Pacific Asia reported net income of Rs770 million in 1993, after interest expenses of Rs320 million. (The corporate tax rate was 36%.) It reported depreciation of Rs960 million in that year, and capital spending was Rs1.2 billion. The firm also had Rs4 billion in debt outstanding on the books, rated AA (carrying a yield to maturity of 8%), trading at par (up from Rs3.8 billion at the end of 1992). The beta of the stock is 1.05, and there were 200 million shares outstanding (trading at Rs60 per share), with a book value of Rs5 billion. Pacific Asia paid 40% of its earnings as dividends and working capital requirements are negligible. (The Risk Free rate is 7%.)

Estimate the free cash flow to the firm in 1993.

Section A (1 Mark)

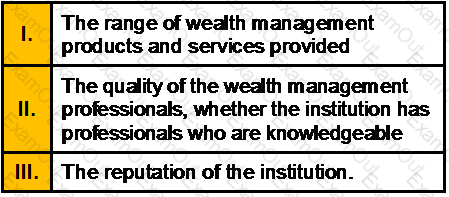

While choosing wealth management firms the criteria a client would consider include is/are:

Section B (2 Mark)

The risk-free return is 9 percent and the expected return on a market portfolio is 12 percent. If the required return on a stock is 14 percent, what is its beta?

Section A (1 Mark)

Supporting customers through the process of selecting, purchasing, and maintaining a product or service is known as:

Section B (2 Mark)

Mr. A purchased certain shares of a company during the financial year 1987-88 for a sum of Rs.1,50,000/-. A sold the shares during the financial year 2011-12 for Rs.8,10,000/- when the market is at all time high. Calculate the amount of capital gains. [CII-12-13: 852,11-12: 785,10-11:711]

Section B (2 Mark)

How much total interest is paid between the 5th and 11th payments inclusive on a loan that has monthly payments for 2 years and an original principal of Rs47 500? The loan rate is 6.6% compounded quarterly.

Section A (1 Mark)

Mr. X’s minor daughter earned Rs. 50000 from his special talent. This income will be clubbed with

Section C (4 Mark)

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio’s required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D. What would be the portfolio’s required rate of return following this change?

Section A (1 Mark)

A _________ portfolio is a well-diversified portfolio constructed to have a beta of 1 on one of the factors and a beta of 0 on any other factor.

Section C (4 Mark)

Read the senario and answer to the question.

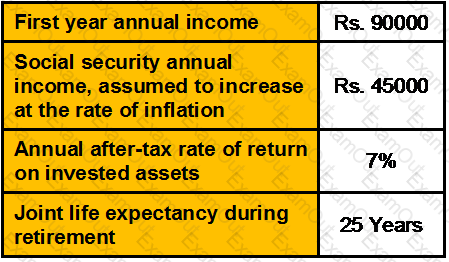

One commonly used method of calculating the total retirement fund necessary on the first day of retirement is to use the present value of an annuity due. The Pandeys’ anticipate that their annual retirement income will need to increase each year at the rate of inflation. Based on the following assumption, calculate the total amount needed to be in place when Shanker and Parvati retire (Round to the nearest Rs. 1000)

Section B (2 Mark)

The Dow theory illustrates that the three forces that simultaneously affect stock prices are ____________.

Section C (4 Mark)

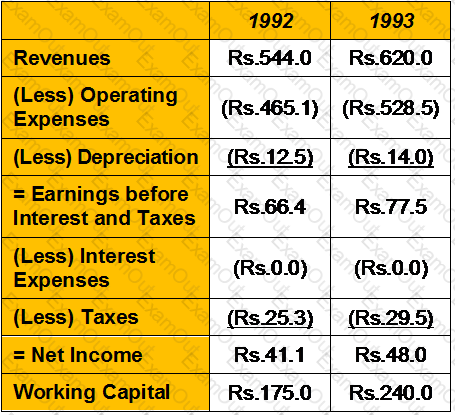

Dab Ltd manufactures, markets, and services automated teller machines. The following are selected numbers from the financial statements for 1992 and 1993 (in millions):

The firm had capital expenditures of Rs15 million in 1992 and Rs18 million in 1993. The working capital in 1991 was Rs180 million.

Estimate the cash flows to equity in 1992 and 1993. (in Rs Millions)

Section A (1 Mark)

In a life insurance contract, offer refers to

Section B (2 Mark)

Which of the following investment options would most likely be part of the portfolio of a Moderate investor?

Section B (2 Mark)

The two aspects of Regret bias are_____________ and _____________.

Section A (1 Mark)

The information in your credit report is primarily used by the credit bureau to compute your

Section B (2 Mark)

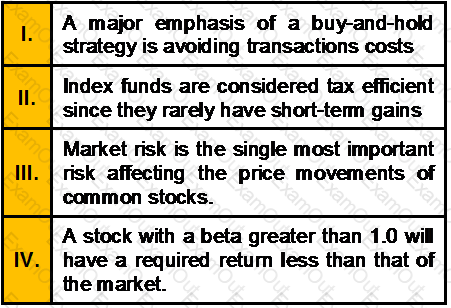

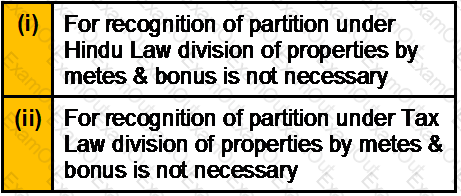

Which of the following Statements are correct?

Section A (1 Mark)

________ bias means that investors are too slow in updating their beliefs in response to evidence.

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable income is:

• $ 81250 in SGD and he is a Singapore citizen

• £ 67158p.a (only employment)and he is a UK citizen

Section B (2 Mark)

Which of the following statement is/are correct?

Section C (4 Mark)

Read the senario and answer to the question.

Compute Expanded Liquidity Ratio before his retirement as (beginning of October 2007) and find out for how many months of expenses, his liquid assets are sufficient enough to cover?

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Companies are:

Section B (2 Mark)

The Motor Vehicle Insurance Policy has inbuilt cover for death/disability of driver/owner caused by accident during the use of the insured motor vehicle up to Rs. __________ in case of car/commercial vehicle and Rs. _________ in case of two wheelers.

Section A (1 Mark)

Wages for the purpose of gratuity payment as per the Act means

Section A (1 Mark)

An American call option can be exercised

Section B (2 Mark)

The expected market return is 16 percent. The risk-free rate of return is 7 percent, and BC Co. has a beta of 1.1. Their required rate of return is

Section A (1 Mark)

The minimum income criteria for Personal Loans in case of Salaried employees is: