An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

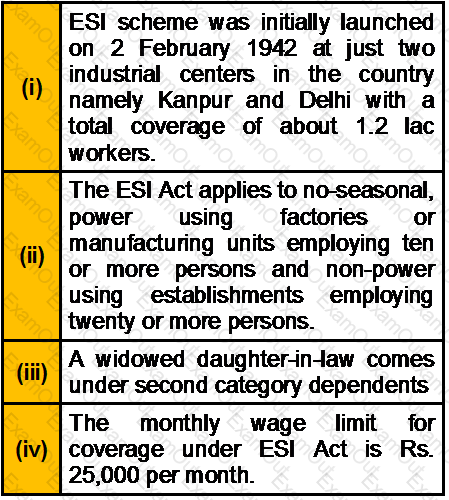

Which of the following statement(s) about Employee State Insurance Act is/are correct?

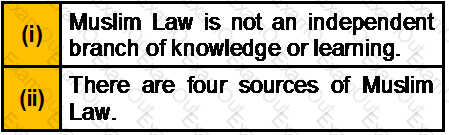

Which of the following statement(s) about Muslim Law is/are correct?

Money laundering Process has ____________ stages. The Financial Action Task Force on Money Laundering was formed in __________ by the G7 countries.

Which of the following is allowed as deduction from net annual value of a property?

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

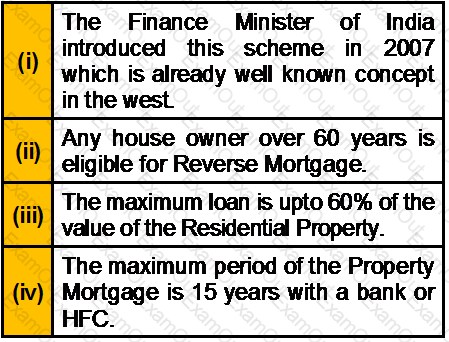

Which of the following statement(s) about Reverse Mortgage Scheme is/are correct?

Which of the following statement(s) about ‘Doctrine of Subrogation’ is/are correct?

In case of Loss of Thumb, what is the Percentage of Compensation given (as per Workmen’s Compensation Act)?

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.