__________ is a arrangement wherein lessee and lessor agree to a payment schedule where for a set period of time, there is no payment and penalty.

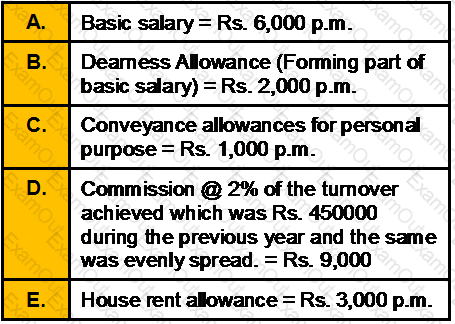

Sudesh Haldia is employed at Delhi as Store Manager in one of the Retail Companies. The particulars of his salary for the previous year 2006-07 are as under:

The actual rent paid by him is Rs. 2,000 p.m. for an accommodation at Noida till 31-12-2006.From 1-1-2007 the rent was increased to Rs. 4000 p.m. Compute the taxable HRA?

Tax slab for male / HUF(for AY 2007-08)

Rs. 0 to 100000 — No Income Tax

Rs. 1,00,001 to 1,50,000 — 10%

Rs. 150001 to 2,50,000 — 20%

Rs. 2,50,001 and above — 30%

Note: A surcharge of 10% on income tax amount is payable if total income is exceeding Rs. 10,00,000 and a 2% education cess is payable on the income tax amount and surcharge.

A salaried individual, aged 45 years, was awarded a car of market value Rs. 6,50,000 by his credit card company in a draw on 20th December 2012. There was no TDS by the company. He has total income from salary of Rs. 8,45,000 in the previous year 2012-13. He saved a total of Rs. 1,80,000 under different investment instruments eligible for exemption u/s 80C and Rs. 25,000 was paid by him on 5th January, 2013 towards his health insurance policy. Find his tax liability for AY2013-14.

Mr. Sumit has worked in a PSU for 14 years 7 months. His Terminal Wages are Rs. 45,000. He wants to know the Gratuity amount payable to him (assuming that he leaves the service today). It is_____________

Mr. Sumit is an employee of Genesis Ltd. His basic pay is Rs.24,000 p.a., Dearness Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free education for two children in a school owned and maintained by the employer – school tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. Sumit and examine whether he is a specified or non-specified employee?

As per Payment of Gratuity Act, Employees are entitled to ___________ terminal wages as gratuity for each year of completed service or part thereof in excess of 6 months. Seasonal employees are entitled to __________ terminal salary for each season of service.

In context of Hindu Adoptions and Maintenance Act,1956 if a person has more than one wife living at the time of adoption

Which of the following statement(s) about Halal Credit Cards is/are correct?

Deduction u/s 80-IC regarding special provisions for enterprices in special catogries states is allowed to the extent of:

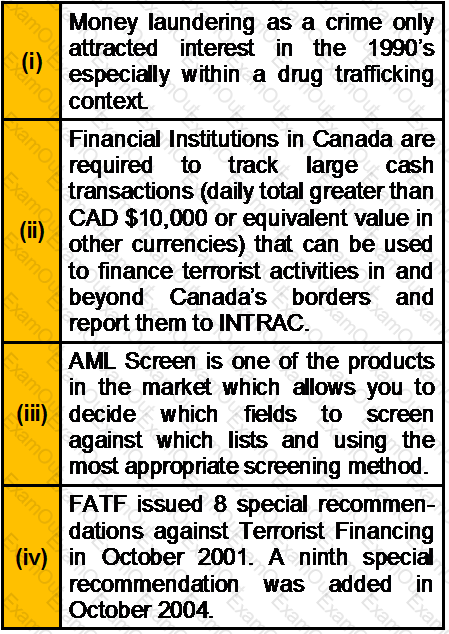

Which of the following statement(s) about Money Laundering is/are correct?