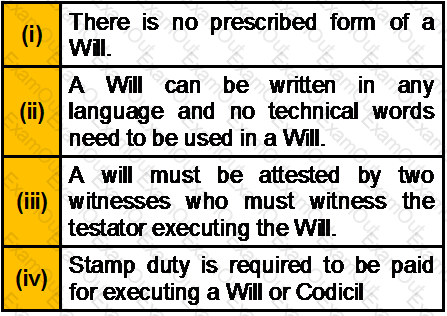

Which of the following statement(s) about Will is/are correct?

Pushkar completed the construction of a house property on 14.8.2008 with borrowed capital of Rs.8,00,000 @ 12%. The loan was taken on 1.4.2006 and is still outstanding. The house was used for his own residence during the entire FY 2012-13. Deduction U/S 24(B) for interest on borrowed capital for PY shall be

Which of the following statement(s) about Hindu Adoption and Maintenance Act, 1956 is/are correct?

In ____________ the parties have the right to withdraw from the contract as long as the parties do not leave the place of contract. In___________ the buyer could cancel the sale if the seller has sold the goods at price higher than the market price.

In_________ type of arrangement, the mortgagor binds himself to repay the mortgage money on a certain date.

There are ______________ sources of Muslim Law. As per Muslim Law, a marriage that is unlawful from it’s beginning is called ____________.

The interest payable for a housing loan outside India is not allowed as a deduction U/S 24 (1) while computing the income from house property. The given statement is

Mr. Sahil has two daughter and is in receipt of education allowance of Rs 200 per month for each of them. What would be the taxable allowance in the hands of Mr. Sahil for the full FY.

Any income chargeable under the head “Salaries” is exempt from tax under Section 10(6)(viii), if it is received by any non resident individual as remuneration for services rendered in connection with his employment in a foreign ship where his total stay in India does not exceed a period days in that previous year.

Mr Ram aged 53 years has put in 21 years of service in a PSU opts for a voluntary retirement under the company scheme. He has 5 years and 3 months of service left and his last drawn salary is Rs 18,000. He received Rs 10,00,000 as compensation. What would be the taxable part of this receipt?