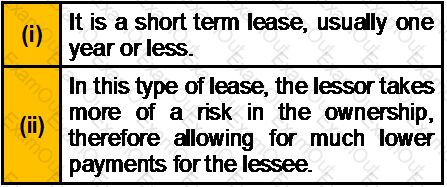

Which of the following statement(s) about Tax Lease is/are correct?

A person is deemed to be UK resident for fiscal purposes if in any tax year he/she lives in UK for more than ____________.

Goods and Services Tax (GST) was introduced in Singapore in ____________

In UK, for year 2013-2014, Blind Person’s allowance is ___________ and minimum amount of married couple’s allowance is __________.

The Hire Purchase System is regulated by the Hire Purchase Act ________

Foreign maid levy (applicable only to working mothers) is upto ____________ without domestic worker concession and ___________ with foreign domestic worker concession.

Foreign POA should be got stamped by the Collector after its receipt in India within prescribed time of _________. If a POA is in respect of an immovable property of value more than __________ it must be registered.

As per the tax structure in the UK, Inheritance Tax will be due at ____________ on the amount over the nil rate band.

Where a transfer of value is from a UK-domiciled spouse to a non-UK domiciled spouse, then the exempt transfer is limited to ________. For annual exemption, each individual can transfer an exempt amount of up to________ per year.

In US, GST exemption limit for 2013 is _______________ and the Estate and Gift tax for the same year is __________.