Tax rate on foreign sourced income in Singapore is ____ to _______ subject to conditions.

There are _____________ types of Amortized Loans.

A client has a minor child she is concerned about what might happen if she was to die, while the child was still young and unable to sensibly handle a sizeable inheritance, one solution could be to draft her will so that the child receives the asset once reaching age 21 this is an example of

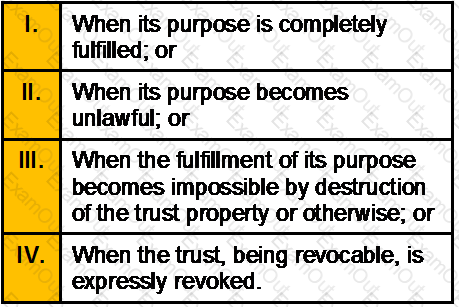

A trust is extinguished

With respect to the Income Tax Structure in Singapore, if the income of an individual is below______________ the tax rate is 0%.

Assuming that Mr. Nitin leaves everything to surviving spouse. Shortly, thereafter Mrs. Shikha dies same year leaving an estate of $5 million. Find the value of estate available for children. Assume only for this question that there is no estate tax exemption amount and the funeral expenses are not paid out of the estate amount.

A Deposit of a Will is ____________________

In US for year 2013, Dependent parent’s relief for each parent living with the tax payer in the same household is ___________ and the same is______________ for each parent if they are not living with the tax payer in the same household.

Which of the following structure of Unborn Trust is not valid?

A member is defined under ___________ of the Societies Registration Act and a Governing body is defined under_______________ of the Societies Registration Act.