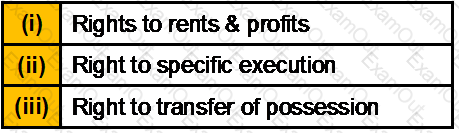

Which of the following are the rights of the beneficiaries?

For 2013, the maximum EITC is __________ for tax payers with one qualifying child.

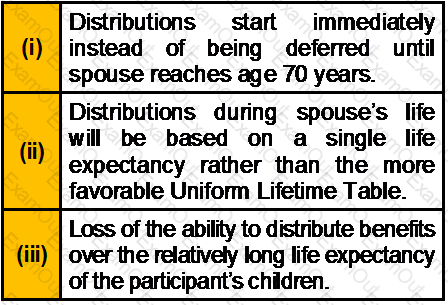

You are a Trust and Estate Planner. Mr. Keith is your client. He is 45 years old. He asks you that in case he wants to leave assets for the life benefit of his spouse, but ultimately have the funds pass to his children by a prior marriage he should create ______________________. He further asks you to explain disadvantages of such arrangement. You tell him that the disadvantages of the arrangement are ____________ of the given options.

Tax rate on corporate profits upto 300,000 SGD is ___________.

Under English law, an individual acquires at birth the domicile of the person on whom he or she is legally dependent, which the individual retains until reaching the age of _____________.

__________________ is used to show what Inheritance tax is due when someone has died and _________________ is used to show what Inheritance tax is due from lifetime events.

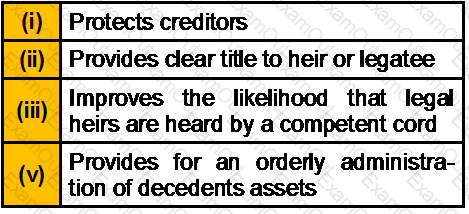

Which of the following option illustrates an advantage of the probate process?

In ________ the Income Tax Act was imposed, which was based on the Model Colonial Territories Income Tax Ordinance ________, which was devised for British colonies at that time.

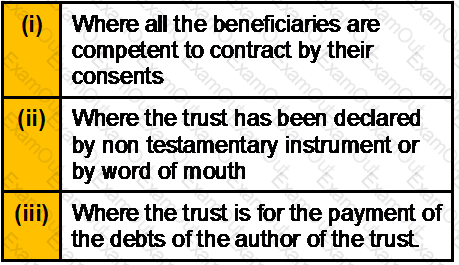

A trust not created by a will can be revoked only

In US, the amount of standard deduction is __________ for married individuals filing a separate return.