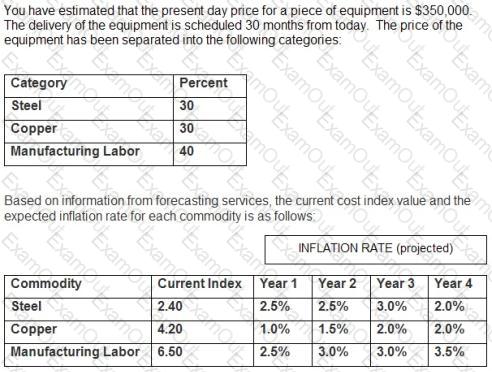

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

At the end of Year 4, the commodity which experienced the greatest projected percentage price index increase over today is:

A task has an early start of day 4. late start of day 14. early finish of day 10. and a late finish of day 20. What is the task's float?

An owner advertised his villa for sale. An investor worked out an estimate on the basis mat the villa could be rented out for $1000 per month. Maintenance charges and other taxes are estimated to be $1,500 per year. The tenant has to pay all utility charges. The investor thinks that he can sell this villa for S100.000 alter 6 years. Assuming that the minimum acceptable rate of return is 12%. answer the following question.

The villa could be recommended for purchase at all of the below-mentioned prices except:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Assuming the average life span of a lithium battery is two years and is normally distributed with a standard deviation of two months, what is the probability the battery will last between 20 months and 26 months?

SCENARIO: A can manufacturing company requested you to provide data for their decision making The unit prices of the can varies but an average selling price of $0.55 cents and average cost of S45 cents is estimated.

The monthly fixed costs are:

Rant-$1,500

Wages - $4.000

Miscellaneous fixed expenses - $500

If the rent increases by 100% and the unit sales/other costs remain unchanged, the new break even amount is?

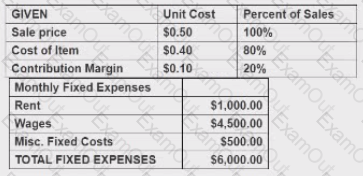

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

How many units are required per month to break even?