An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If $100,000 is needed to purchase a piece of equipment 3 years from now, how much money needs to be invested today assuming a 10% rate of return (rounded to the nearest thousand)?

The four steps to writing are:

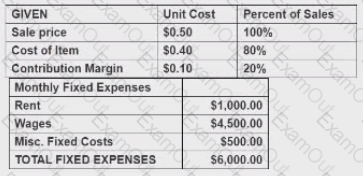

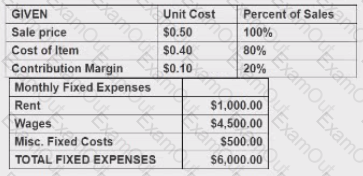

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

If XYZ considers S550 per month the minimum acceptable net income, the number of units that will have to be sold is:

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

If the fixed rent remains unchanged, and XYZ pays S0.01 per unit as additional rent, the monthly breakeven point in numbers of units becomes:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve. Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assume money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If $10,000 is invested now at 10% compounded annually, what will the investments be worth 10 years from now?

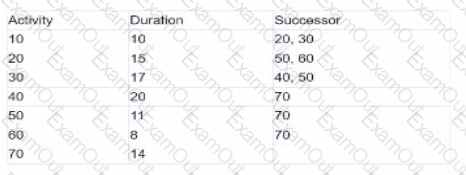

Develop a CPM method considering the below tasks and logical relationships. Use this information to answer the related questions.

What is the late finish date of activity 50?

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

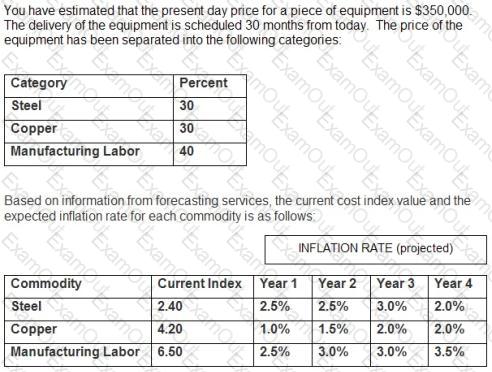

What is the cost of manufacturing labor for the piece of equipment today?

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is the cost performance index (CPI)?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The following question requires your selection of CCC/CCE Scenario 26 (2.5.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What class of estimate is used for the preliminary design phase of a project?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

According to Maslow's hierarchy of needs, which level should be satisfied first?