Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If $10,000 is scheduled to be paid out 5 years from now, what is the minimum amount we can invest today?

A schedule's late dates are calculated during the:

Listening to what is being said by all members of a group or audience and then summarizing or interpreting is called______________.

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following interest rates disregards the effects of compounding periods that occur more frequent than annually?

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor is 60%.

How does the project stand?

AACE International defines_____________as the primary activity that separates Value Methodology (VM) from other "improvement" practices and has the objective

to develop the most beneficial areas for continuing study.

Cost performance index (CPI) is defined by AACE International as: (assume no change in budgeted quantities)

If two alternatives with different useful lives are to be compared considering all costs, which of the following methods is most appropriate?

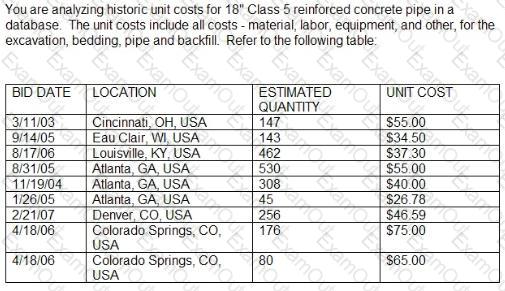

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen., using the drop down menu, to reference during your response/choice of responses.

Calculate the weighted average unit cost.

_____________is defined as the budget for the cost (work) account times the percent complete for that account.