MyCo, a telecom company, has a new requirement to track customer responses over a period of 20 days. What do you need to create to start tracking customer responses for the given period of time?

Reference module: Analyzing customer distribution using Pega Value Finder.

Myco, a telco, is working on implementing a project in which post-paid offers are presented to qualified customers. In the build stage of the ideation, the business wants to look for new opportunities to improve marketing. As a Decisioning Consultant, which simulation do you run to meet the requirement?

A bank wants to leverage Pega Customer Decision Hub’s Next-Best-Action capability to promote new offers to each customer on their website. What information does Pega Customer Decision Hub send back to the website in response to the real-time container request?

U+ Bank is currently running outbound communications for home loan offers and credit cards. They have added five new actions to the Credit Cards group. They would like to enable these actions in the email channel. What are the two minimum configurations that must be made? (Choose Two)

U+ Bank, a retail bank, wants to include offer related images in the emails that they send to their qualified customers. As a decisioning consultant, what best practice must you follow to include images in the emails?

Reference module: Sending offer emails

What is best practice for designing an action flow?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

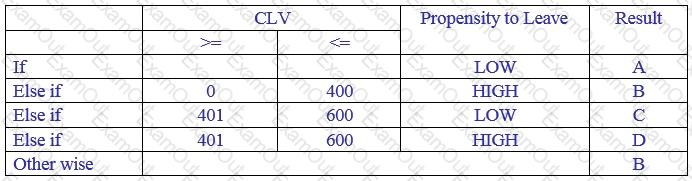

U+ bank uses a decision table to return a label for a customer. Examine the above decision table and select which label is returned for a customer with a CLV score of 550 and a LOW propensity to leave

In a decision strategy, you can use aggregation components to_______________.

Reference module: Adding more tracking time periods for contact policies

A bank is currently displaying a group of mortgage offers to its customers on their website. The bank wants to suppress the mortgage group for 15 days if a customer ignores three offers from the mortgage group. How do you define the suppression rule for this requirement?