Which of the following is not a parameter to be determined by the risk manager that affects the level of economic credit capital:

If X represents a matrix with ratings transition probabilities for one year, the transition probabilities for 3 years are given by the matrix:

Which of the following are valid methods for selecting an appropriate model from the model space for severity estimation:

I. Cross-validation method

II. Bootstrap method

III. Complexity penalty method

IV. Maximum likelihood estimation method

The key difference between 'top down models' and 'bottom up models' foroperational risk assessment is:

Which of the following techniques is used to generate multivariate normal random numbers that are correlated?

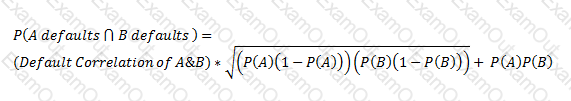

If A and B be two debt securities, which of the following is true?

Which of the following event types is hacking damage classified under Basel II operational risk classifications?

Which of the following belong in a credit risk report?

Which of the following decisions need to be made as part of laying down a system for calculating VaR:

I. The confidence level and horizon

II. Whether portfolio valuation is based upon a delta-gamma approximation or a full revaluation

III. Whether the VaR is to be disclosed in the quarterly financial statements

IV. Whether a 10 day VaR will be calculated based on 10-day return periods, or for 1-day and scaled to 10 days

Which of the following statements are true:

I. Capital adequacy implies the ability of a firm to remain a going concern

II. Regulatory capital and economic capital are identical as they target the same objectives

III. The role of economic capital is to provide a buffer against expected losses

IV. Conservative estimates of economic capital are based upon a confidence level of 100%