Which of the following portfolios would require rebalancing for delta hedging at a greater frequency in order to maintain delta neutrality?

A company has a long term loan from a bank at a fixed rate of interest. It expects interest rates to go down. Which of the following instruments can the company use to convert its fixed rate liability to a floating rate liability?

A fund manager holds the following bond positions in a client portfolio:

a. A long position worth $100m in a bond with a modified duration of 7.5

b. A short position worth $65m in a bond with a modified duration of 12

c. A long position worth $120m in a bond with a modified duration of 6

What is the impact of a 10 basis point increase in interest rates across the yield curve?

In terms of notional values traded, which of the following represents the largest share of total traded futures and options globally?

Which of the following statements is not true about covered calls on stocks

Suppose the S&P is trading at a level of 1000. Using continuously compounded rates, calculate the futures price for a contract expiring in three months, assuming expected dividends to be 2% and the interest rate for futures funding to be 5% (both rates expressed as continuously compounded rates)

The transformation line has a y-intercept equal to

A portfolio manager desires a position of $10m in physical gold, but chooses to get the exposure using gold futures to conserve cash. The volatility of gold is 6% a month, while that of gold futures is 7% a month. The covariance of gold and gold futures is 0.00378 a month. How many gold contracts should he hold if each contract is worth $100k in gold?

Which of the following statements is true:

I. On-the-run bonds are priced higher than off-the-run bonds from the same issuer even if they have the same duration.

II. The difference in pricing of on-the-run and off-the-run bonds reflects the differences in their liquidity

III. Strips carry a coupon generally equal to that of similar on-the-run bonds

IV. A low bid-ask spread indicates lower liquidity

Which of the following describes the efficient frontier most accurately?

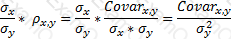

103.11.e1 is the standard deviation of the asset to be hedged, and

103.11.e1 is the standard deviation of the asset to be hedged, and  103.11.e2 is the standard deviation the asset being used to hedge against price movements in x, then the minimum variance hedge ratio is given by the expression

103.11.e2 is the standard deviation the asset being used to hedge against price movements in x, then the minimum variance hedge ratio is given by the expression  103.11.e3. In this question, correlation = 0.00378/(6%*7%) = 0.9. The minimum variance hedge ratio is given by (6%/7%)*0.9 = 0.77

103.11.e3. In this question, correlation = 0.00378/(6%*7%) = 0.9. The minimum variance hedge ratio is given by (6%/7%)*0.9 = 0.77 103.11.a3

103.11.a3