You are reconciling yourPayablesandReceivablesbalances against theGeneral Ledger. You are using thePayables to Ledger Reconciliation report.

You notice discrepancies between the balances in thesubledgers, subledger accounting, and general ledger.

Which three factors are responsible for these out-of-balance situations?

You want your sales representatives to be able to find points of interest, such as customers, while out on business. What should you enable to achieve this?

Which two statements are true about infotiles and infolets?

Manage Chart of Accounts Structure and Instance

Scenario

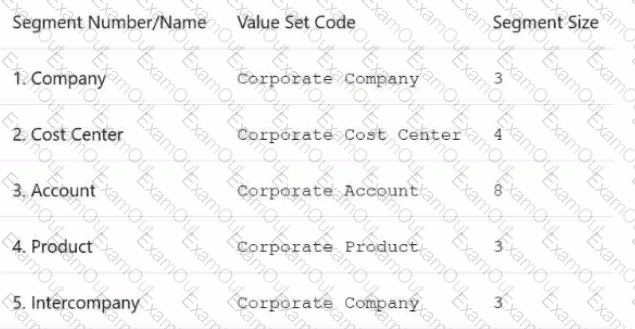

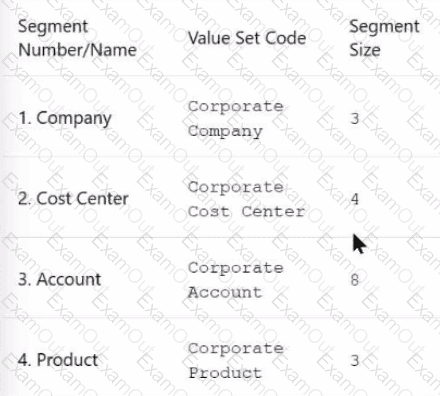

Your client is implementing Oracle Fusion Cloud Financials. The decision is to have a 5-segment Chart of Accounts: Company, Cost Center, Account, Product, and Intercompany. You are working in

the General Ledger team and will be responsible for creating the Chart of Accounts Structure and Instance for the Chart of Accounts.

Task 1

Create a Chart of Accounts Structure and Instance for the following Chart of Accounts:

Note:

· Prefix all your setups with 07, where 07 is your candidate ID

· There is one balancing segment.

· Choose the appropriate segment labels.

. For the purpose of this test there is no need to deploy the flexfield.

. Valid code combinations should be added to the Code Combination table automatically.

· Shorthand aliases will not be implemented.

. Accept the defaults for the instance segments.

Task 3

Manage Chart of Accounts Mappings

Scenario

Your client needs to consolidate their UK Ledger to the Canadian parent ledger. Each Chart of Accounts

has the following segments:

Company-LoB-Account-Cost Center-Product-Intercompany

Know that the Company, LoB, Product, and Intercompany segments share the same value sets.

Create a Chart of Accounts mappings to map UK Chart of Accounts to CA Chart of Accounts that meets the following specifications:

Cost Center Mapping

. Balance Sheet (0 and 000) should be mapped to

Balance Sheet

. All other cost centers should be mapped to 610

Account Mapping

. Asset accounts (in the 1000 range) should be

mapped to account 11101

. Liability accounts (in the 2000 range) should be

mapped to account 22100

. Equity accounts (in the 3000 range) should be

mapped to account 34000

. Revenue accounts (in the 4000 range) should be

mapped to account 42000

. Expense accounts (from 5000 onwards) should be

mapped to account 51100

Note:

· Do not use conditions based on parents.

. Treat any account after the 5000 range as an expense.

· Ensure all maps are numeric only.

· When creating your mapping rules for each segment

please allow for existing and future segment values

Challenge 2

Manage Shorthand Aliases

Scenario

Your client intends to utilize the Shorthand Alias feature and would like to see how the aliases will appear when entering transactions.

Task 2

Create a shorthand alias for the US Chart of Accounts to record Revenue Domestic for Supremo Fitness, Line of Business 2, and US Operations Cost Center.

Note:

. Prefix your alias name with 07, where 07 is

your exam ID.

. There is no Product or Intercompany

impact.