TAX APPLICATION

For the TAX application the user required the migration of existing taxpayer information (name, tax identification number, location name) to the TAX application. A conversion file with taxpayer data was created and imported into the Taxpayer logical file in the TAX application. The source of the data was the Account Holder logical file.

The user required the ability to Add, Change and Delete the taxpayer information in the Taxpayer logical file.

The user required the ability to View the taxpayer information prior to changing or deleting information.

From the Names of Possible Functions listed identify the base functional components for the TAX application baseline. Select N/A if a Name of Possible Functions does not apply.

Identify the functions used:

Identify the data and/or transactional functions in the following scenario:

In an international company, the user requires the Human Resources (HR) application to provide the following capabilities:

All hourly employees must be paid In United States dollars

When adding or changing employee information (name, social security number, number of dependents, type code, supervisory level, standard hourly rate, collective bargaining unit number, and location name), on the employee screen, the HR application must access the Currency application (CA) to retrieve a conversion rate. After retrieving the conversion rate, the HR application converts the employee's local standard hourly rate to a U.S. hourly rate using the following calculation:

standard hourly rate / conversion rate = U.S dollar hourly rate

When deleting employee information, on the employee screen, the HR application must NOT access the CA application to retrieve a conversion rate.

The HR application must maintain employee information in the HR Employee logical file

From the Names of Possible Functions listed identify the base functional components for the HR application. Select N/A if a Name of Possible Function Type does not apply.

Identify the functions used.

The Procurement application requires the ability to maintain information on each new supplier. The information that must be maintained on the Supplier logical file includes:

Supplier id

Supplier name

Supplier mailing address

Supplier skill

As a result of creating a new supplier record, the supplier's annual costs should be automatically calculated and saved with the other supplier information.

Orders are maintained in the Order logical file by the Procurement application. The Accounts Payable logical file is updated for each order. Line items for each order are stored in the Order Detail subgroup of the order logical file.

Backorders and delivery errors are tracked by the Procurement application on the Transparency Track Record logical file. This file is compared to each supplier's values in the Service Level Agreement logical file which is maintained by the Contract application. The Procurement application produces a report for the Legal Office of suppliers that are performing outside of their Service Level Agreement.

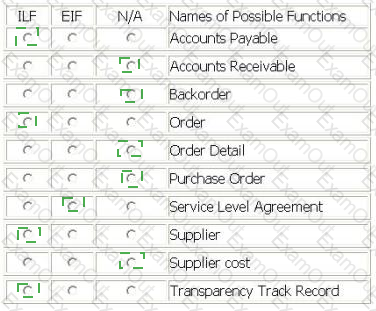

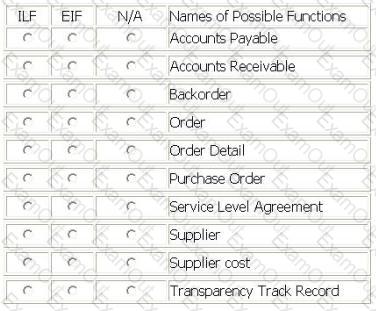

From the Names of Possible Functions listed identify the data functions for the Procurement application. Select N/A if a Name of Possible Function does not apply.

Identify the functions used.

An Assets Tracking application has a batch update process. Twice a month each of the branch offices sends a transaction file to the headquarters.

Records are flagged with an "A" for equipment that is Added to the inventory; "C" for equipment that has been Upgraded or refurbished; "D" for equipment that has been Disposed of and is to be removed from inventory.

A summary inventory update report will be created that totals number of inventory records added, changed and deleted broken out by equipment type. The report will be sorted by branch and will start on a new page for each change of branch.

A detail inventory report will be available to the branches with the detail of inventory records updated.

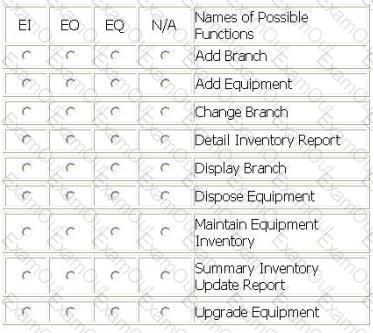

From the Names of Possible Functions listed identify the transactional functions for the Assets Tracking application. Select N/A if a Name of Possible Functions does not apply.

Identify the functions used.

Several functions are outlined within the following scenario for the Internet Application (IA):

From the company intranet the user selects the IA application.

The purchase item option allows the user to pay their internet shopping bill, after performing inquiry selection of items for purchase. The pay bill option updates the Customer, Inventory and Purchase History logical files.

If this is the user's first purchase, the Customer Information screen captures information about the customer and stores it on the Customer logical file. Once the customer information is saved and the customer chooses the next option, they are returned to the Pay Bill option.

If the user is an existing customer, they may view their customer information. The customer has the option of changing their information, but cannot delete it.

An itemized report totaling monthly customer purchases is created at the end of each month.

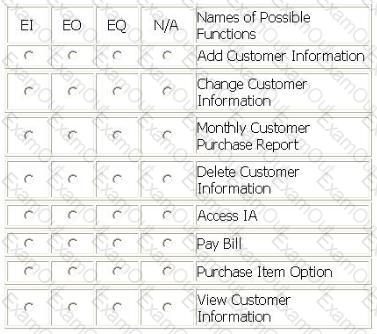

From the Names of Possible Functions listed identify the transactional functions for the IA application. Select N/A if a Name of Possible Function does not apply.

Identify the functions used:

The CCY application maintains the Currency Exchange file. The Currency Exchange file is copied into the Customer application on a daily basis to improve timely access to the data. The Customer application references the Currency Exchange file for all its transactions. How would the Currency Exchange file be counted in the Customer application?

The add, change, delete and retrieve job information functionalities are modified as part of an enhancement. A new summary report totaling job information is added. What transactions are counted for the enhancement project?

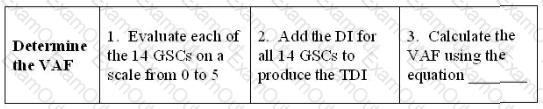

The procedure for determining VRF is:

What is the equation used in step 3?

Identify the potential EI from the following activities:

An organization has purchased a new Order Entry application. One of the requirements is to convert an existing file of customer information to the new application. In the Development project functional size how is the conversion counted?