The performance of ABC Mutual Fund ranks 54 out of 100 funds in its peer group. What is its quartile ranking?

Iliana owns 1,000 participating preferred shares in the First Canadian Bank. Which of the following features are characteristic of her investment?

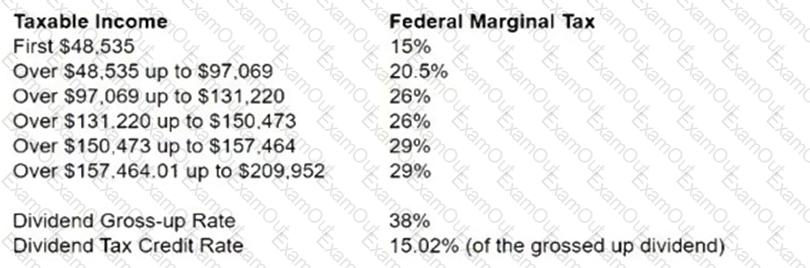

Last year Peter’s earned income from employment was $50,000.

Last year, after receiving a $2 per share in dividends from 500 shares in ABC Inc., a publicly-traded Canadian corporation, he sold his shares. The sale resulted in a capital gain of $15,000.

Based on the tax rates mentioned above, what is Peter’s net federal tax liability for the year? (Round to 2 decimal places).

Your client Charlie is thinking about making a large investment into the Sentinel Canadian Equity Fund on December 15. The ex-dividend date for the mutual fund is December 20. What advice would you give

Charlie to avoid the tax trap?

Jonathan is a Dealing Representative who has just finished an appointment with his new client, Shirley. Jonathan has concluded that Shirley has a low-risk profile but wants to establish additional savings of $500,000. During their discussion, Shirley emphasizes she wants investments that are also tax efficient. Jonathan learned that currently Shirley has no registered retirement savings plan (RRSP) and tax-free savings account (TFSA) contribution room due to using those opportunities by investmenting elsewhere.

What variable is a PRIMARY consideration for Jonathan when making an investment recommendation?

Taylor is chatting with other parents in the park when the conversation turns to registered education savings plans (RESPs). Taylor thinks that most of what they are saying is incorrect. Which of the following

statements about self-directed RESPs is TRUE?

Jasmine received an inheritance from her grandmother of $10,000. She wants to invest her money wisely. She has seen in the news that a particular energy company is doing very well and has good prospects. She has also seen how volatile its share price has been in the last year. She knows the risks of the resource sector and wants to invest but is not comfortable with so much volatility. Which of the following mutual fund benefits would address her concern?

Axis Wealth Management Inc. is a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA).

Indrek is a Branch Manager for the Guelph Branch and he is responsible for conducting suitability reviews in order to identify any unsuitable transactions or accounts. Which of the following

accounts/transactions would be unsuitable?

Which of the following could be a passively managed fund?

Jeff is a new client. He is 50 years old with modest savings in the low six figures, and wants to reinvest his portfolio to ensure that he can retire comfortably at age 65. In his meeting with Jeff, the advisor uncovered some of Jeff’s biases. Jeff displayed several strong emotional biases along with a few weak cognitive biases. What should the advisor do?