A company is keen to assess the innovation capacity of a supplier. Describe what is meant by 'innovation capacity' and explain what measures could be used. (25 marks)

The Answer Is:

See the answer in Explanation below:

Explanation:

Innovation capacity refers to a supplier’s ability to develop, implement, and sustain new ideas, processes, products, or services that add value to their offerings and enhance the buyer’s operations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, assessing a supplier’s innovation capacity is crucial for ensuring long-term value, maintaining competitive advantage, and achieving cost efficiencies or performance improvements through creative solutions. Below is a detailed step-by-step solution:

Definition of Innovation Capacity:

It is the supplier’s capability to generate innovative outcomes, such as improved products, efficient processes, or novel business models.

It encompasses creativity, technical expertise, resource availability, and a culture that supports innovation.

Why It Matters:

Innovation capacity ensures suppliers can adapt to changing market demands, technological advancements, or buyer needs.

It contributes to financial management by reducing costs (e.g., through process improvements) or enhancing quality, aligning with the L5M4 focus on value for money.

Measures to Assess Innovation Capacity:

Research and Development (R&D) Investment: Percentage of revenue spent on R&D (e.g., 5% of annual turnover).

Number of Patents or New Products: Count of patents filed or new products launched in a given period (e.g., 3 new patents annually).

Process Improvement Metrics: Reduction in production time or costs due to innovative methods (e.g., 15% faster delivery).

Collaboration Initiatives: Frequency and success of joint innovation projects with buyers (e.g., 2 successful co-developed solutions).

Employee Innovation Programs: Existence of schemes like suggestion boxes or innovation awards (e.g., 10 staff ideas implemented yearly).

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of supplier innovation as a driver of contractual success and financial efficiency. While the guide does not explicitly define "innovation capacity," it aligns the concept with supplier performance management and the ability to deliver "value beyond cost savings." Innovation capacity is framed as a strategic attribute that enhances competitiveness and ensures suppliers contribute to the buyer’s long-term goals.

Detailed Definition:

Innovation capacity involves both tangible outputs (e.g., new technology) and intangible strengths (e.g., a proactive mindset). The guide suggests that suppliers with high innovation capacity can "anticipate and respond to future needs," which iscritical in dynamic industries like technology or manufacturing.

It is linked to financial management because innovative suppliers can reduce total cost of ownership (e.g., through energy-efficient products) or improve return on investment (ROI) by offering cutting-edge solutions.

Why Assess Innovation Capacity:

Chapter 2 of the study guide highlights that supplier performance extends beyond meeting basic KPIs to delivering "strategic benefits." Innovation capacity ensures suppliers remain relevant and adaptable, reducing risks like obsolescence.

For example, a supplier innovating in sustainable packaging could lower costs and meet regulatory requirements, aligning with the L5M4 focus on financial and operational sustainability.

Measures Explained:

R&D Investment:

The guide notes that "investment in future capabilities" is a sign of a forward-thinking supplier. Measuring R&D spend (e.g., as a percentage of revenue) indicates commitment to innovation. A supplier spending 5% of its turnover on R&D might develop advanced materials, benefiting the buyer’s product line.

Patents and New Products:

Tangible outputs like patents demonstrate a supplier’s ability to innovate. The guide suggests tracking "evidence of innovation" to assess capability. For instance, a supplier launching 2 new products yearly shows practical application of creativity.

Process Improvements:

Innovation in processes (e.g., lean manufacturing) can reduce costs or lead times. The guide links this to "efficiency gains," a key financial management goal. A 10% reduction in production costs due to a new technique is a measurable outcome.

Collaboration Initiatives:

The study guide encourages "partnership approaches" in contracts. Joint innovation projects (e.g., co-developing a software tool) reflect a supplier’s willingness to align with buyer goals. Success could be measured by project completion or ROI.

Employee Innovation Programs:

A culture of innovation is vital, as per the guide’s emphasis on supplier capability. Programs encouraging staff ideas (e.g., 20 suggestions implemented annually) indicate a grassroots-level commitment to creativity.

Practical Application:

To assess these measures, a company might use a supplier evaluation scorecard, assigning weights to each metric (e.g., 30% for R&D, 20% for patents). The guide advises integrating such assessments into contract reviews to ensure ongoing innovation.

For instance, a supplier with a high defect rate but strong R&D investment might be retained if their innovation promises future quality improvements. This aligns with L5M4’s focus on balancing short-term performance with long-term potential.

Broader Implications:

Innovation capacity can be a contractual requirement, with KPIs like "number of innovative proposals submitted" (e.g., 4 per year) formalizing expectations.

The guide also warns against over-reliance on past performance, advocating for forward-looking measures like those above to predict future value.

Financially, innovative suppliers might command higher initial costs but deliver greater savings or market advantages over time, a key L5M4 principle.

John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

The Answer Is:

See the answer in Explanation below:

Explanation:

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessingthe financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

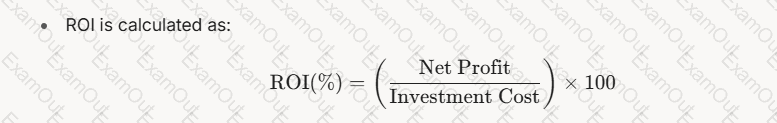

Definition:

A math equation with numbers and a square

AI-generated content may be incorrect.

A math equation with numbers and a square

AI-generated content may be incorrect.

Net Profit = Total Returns – Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing £100k that generates £120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4’s emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

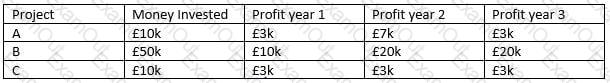

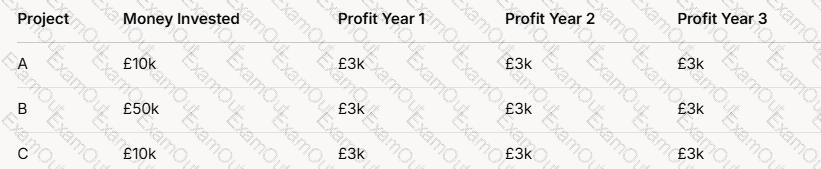

Using the data provided for the three projects, let’s calculate the ROI for each to determine the best option for John. The table is as follows:

A screenshot of a phone

AI-generated content may be incorrect.

A screenshot of a phone

AI-generated content may be incorrect.

Step 1: Calculate Total Profit for Each Project:

Project A: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project B: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project C: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Step 2: Calculate Net Profit (Total Profit – Investment):

Project A: £9k – £10k = -£1k (a loss)

Project B: £9k – £50k = -£41k (a loss)

Project C: £9k – £10k = -£1k (a loss)

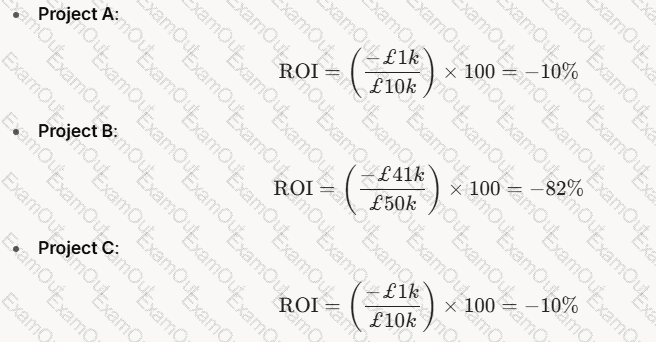

Step 3: Calculate ROI for Each Project:

A group of math equations

AI-generated content may be incorrect.

A group of math equations

AI-generated content may be incorrect.

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROIAll projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (£10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose eitherProject A or Project Cover Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let’s recommendProject A.

Recommendation: John should chooseProject A(or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as "a measure of the gain or loss generated on an investment relative to the amount invested," typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing "value for money," a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a "clear financial snapshot" of investment performance. In John’s case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI’s role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI’s "ease of calculation" makes it accessible for quick assessments, ideal for John’s scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI’s alignment with "maximizing returns," ensuring investments like John’s projects deliver financial value.

Comparability:

ROI’s percentage format allows "cross-project comparisons," per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI "does not consider the timing of cash flows," a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss "strategic benefits" like quality or innovation, which might apply to John’s projects.

Potential for Misleading Results:

The guide cautions that ROI can be "distorted" if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide’s focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to "rank investment options" but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide’s emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.