You are a trainee management accountant working for a prestigious manufacturing firm. One day you go to a business meeting a business meeting and the managing director is there. They stand up and say that the

company is losing too much money through wastage and losses and so they have decided to implement a total quality management system. They go on to say this system will:

1:Allow the company to improve on a consistent and continual basis

2:Allow the company to identify and allocate quality accountability to certain departments

3:Help the company detect error and fraud

Are ALL of these statements correct?

A company uses limiting factor analysis to identify its optimal production plan. All of the company's products are manufactured in house and cannot be bought in.

What objective is assumed with limited factor analysis?

RST is preparing a quotation, on a relevant cost basis, for a special order.

Which TWO of the following are relevant costs that should be included in the quotation?

A manufacturing company sells 5 different products.

The company holds no inventories and has a high level of fixed cost.

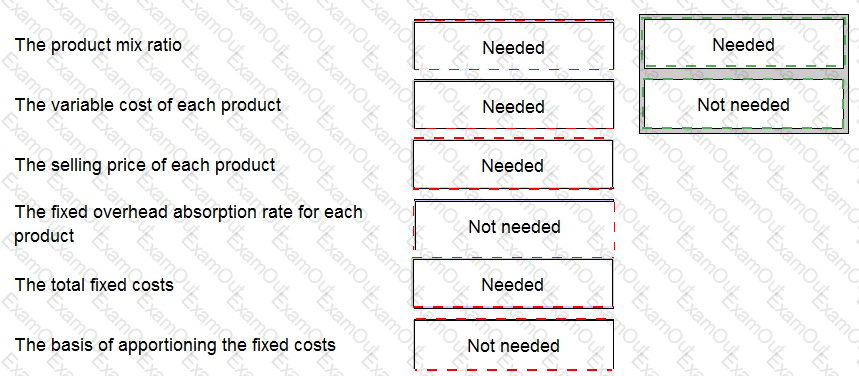

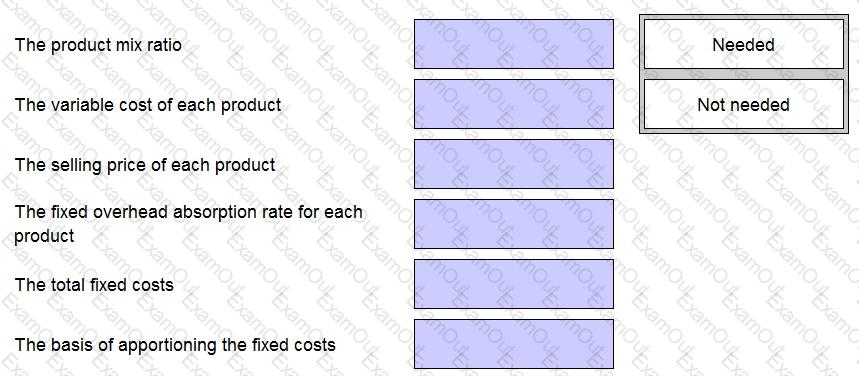

Place against the statements below the comment "needed" or "not needed" to select ALL of the information required to calcuate the total number of units to break-even.

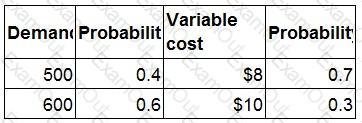

A company is launching a new product with a selling price of $20.

Demand and variable cost are both uncertain and possible demand levels and variable costs are given below:

Outcomes for demand and variable cost are independent.

What is the expected contribution from the product?

Give your answer as a whole number.

A company produces and sells more than one product.

All products are manufactured using the same facilities and incur common fixed costs.

Which of the following is used to calculate the break-even sales revenue for the business?

8fb9be1c-b0d5-4acb-8cfb-f4b4426e641B. The primary objective of Company A is to maximise profit. It is now deciding on the optimum production mix for the next period and has one limited production resource.

The production mix decision should be based on:

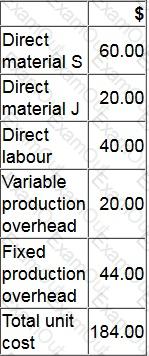

The cost card for one unit of Product G is as follows:

The opening and closing inventories of Product G for month 5 are budgeted to be 10 units and 60 units respectively.

Profit for month 5 using absorption costing is budgeted to be $15,000.

What is the budgeted profit for month 5 using throughput costing?