Which FOUR of the following should be categorised as a DEBIT (DR) when filling out a T-account?

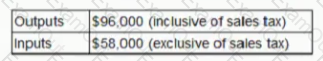

ABC has the following summary of transactions for the quarter ended 30 June 20X9 ABC is registered for sales tax at 20%.

At the beginning of the quarter ABC owed $2,300 to the local tax authority.

What is the balance owing to the local tax authority at 30 June 20X97 Give your answer to the nearest dollar.

STU has an accounting period end of 31 December 20X8 During the year STU paid $4,800 for business insurance to cover the year to 30 June 20X9 The amount paid for business insurance for 30 June 20X8 was $4,500.

What is the insurance expense to be recognized in the statement of profit or loss of STU for the year ended 31 December 20X8? Give your answer to the nearest $

Refer to the Exhibit.

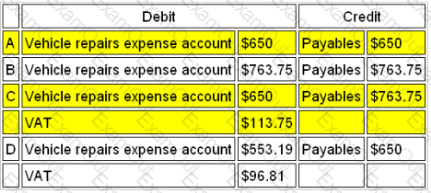

A company which is not VAT-registered received an invoice for vehicle repairs of $650 excluding VAT. The rate of VAT on the invoice was 17.5%.

Which of the following ledger entries to record the invoice are correct?

The correct ledger entries are.

After calculating your company's profit for the year, you discover that:

(a) A non-current asset costing £2,000 has been included in the purchases account; the asset has not been included in the closing inventory figure; nor has it been depreciated by the normal 25% per annum

(b) Closing inventory of raw materials, costing £500, have been treated as closing inventory of stationery.

These two errors have had the effect of.

IAS 2 Inventories does not permit the use of the last in. first out (LIFO) method of valuing inventory In a time of rising prices, which of the following is a reason for this?

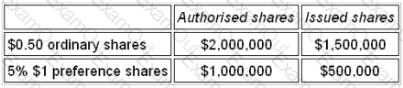

Refer to the exhibit.

The following information is available for a company:

The company has declared an ordinary dividend of $0.05 per share.

What is the total dividend payment to be made by the company?

Non-current assets can be divided between intangible and tangible assets.

Which THREE of the following are intangible assets?

One of the main responsibilities of internal auditors is to check the operational systems within their organization to establish whether the system's internal controls are sufficient and in full operation.

Which THREE of the following are examples of internal controls?

Which ONE of the following does the Statement of Cash Flows show: