CDE, an entity registered for sales tax, purchases a piece of equipment for cash on 31 December 20X6 for $30,000 including sales tax. The sales tax rate is 20%. What is the journal entry required to record this transaction in the nominal ledger?

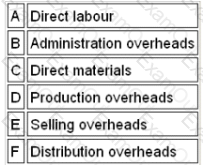

Place the labels in the corresponding position in the table below:

Refer to the exhibit.

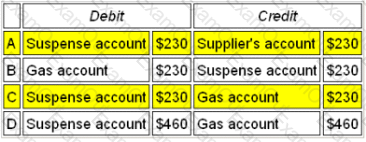

A suspense account shows a credit balance of $230 which has arisen because of the recording of a gas bill twice in the gas account.

In order to correct the error, which one of the following journal entries is required?

The correct journal entry is

Which of the following is not a book of prime entry?

An accountant is taking on financial accounting responsibilities for company PQ. Which TWO of the following are NOT true of financial accounting?

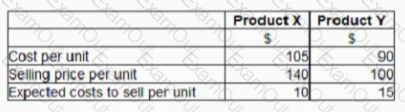

AB sells two products ,X and Y. The following information was available at AB’s year-end, 31 December 20X6:

At 31 December 20X6 AB held 800 units of Product X and 400 units of Product Y

What is the value that will be included in inventories in AB's statement of financial position as at 31 December 20X6?

Which ONE of the following deals with problems that arise with existing accounting standards?

Refer to the Exhibit.

Which of the following items should be included in the valuation of inventory in a manufacturing company?

Which THREE of the below are possible reasons for an entity's capital amount to change?

A public limited company declares a 10% final dividend.

The nominal value of the shares is 50p and the shares are currently trading, in the stock market, at a price of £2.

A shareholder who purchased 1000 shares at a price of £1.00 per share, will receive a dividend of:

Give your answer to 2 decimal places.

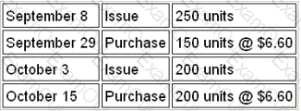

Refer to the Exhibit.

A company operates an AVCO system of inventory. Opening inventory at the beginning of the period was 400 units @ $6.50 per unit.

During the period, the following purchases and issues were recorded:

The amount charged to the company's income statement in the period is