Refer to the exhibit.

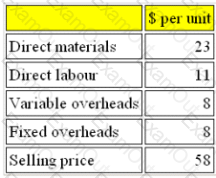

SL manufactures a single product, the cost and selling price of which are given below:

Fixed overheads per unit are based on a budgeted production volume of 25,000 units.

Budgeted sales are assumed to be 25,000 units.

If all costs increase by 5% but selling price remains the same, by how much must sales change from the budgeted volume to achieve the same budgeted profit?

Refer to the exhibit.

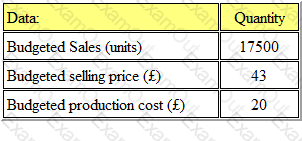

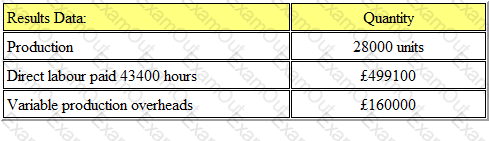

Xey Ltd. has the following budgeted information for product T4 in July:

The actual results for July were as follows:

What is the total sales margin variance?

Refer to the exhibit.

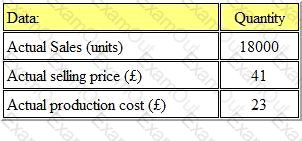

The wages analysis for the welding department of a manufacturing company is given below:

What is the direct labor cost for the welding department?

Refer to the exhibit.

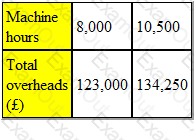

The following data relates to two activity levels of a department. Overhead absorption is on the basis of machine hours.

The variable overhead rate per hour is £4.50. The amount of fixed overhead, to the nearest £000, is:

Refer to the exhibit.

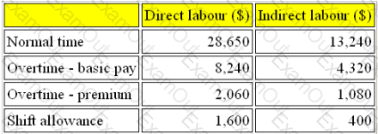

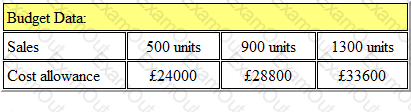

Budget information for 'Crome Ltd' is as follows:

The budgeted cost allowance for the sale of 1000 units would be:

Within a relevant range of output, the variable cost per unit of output will:

C Ltd produces a chemical in a single process. Information for this process last month is as follows:

(a) Opening work in progress - 10000 kg valued at £10000 for direct material and £7500 for conversion costs.

(b) Materials input - 25000 kg at £1.10 per kg.

(c) Conversion costs - £17000

(d) Output during the month - 23000 kg.

(e) There were 7500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(f) Normal loss for the month was 10% of input and all losses have a scrap value of 80p per kg.

What was the value of normal loss during the month?

Refer to the Exhibit.

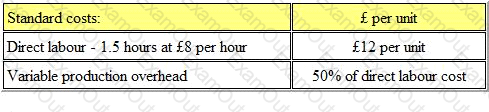

AM Ltd. makes and sells a single product for which the standard cost information is as follows:

Budgeted production for the period is 30000 units.

The actual results for the period were as follows:

What is the variable overhead expenditure variance?

Which of the following industries would not use process costing?

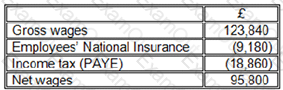

Refer to the exhibit.

DS is manufacturing company that uses an integrated accounting system. The following payroll data is available for the month of August:

The Employers' National Insurance for the period was $13,790. An analysis of the wages is as follows:

Which of the following factors affect the budgeted cash flow:

(a) Funds from the issue of share capital

(b) Bank Interest on a long term loan

(c) Depreciation on fixed assets

(d) Bad debt write off