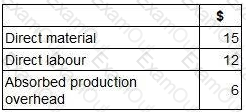

A new product requires an investment of $200,000 in machinery and working capital. The total sales volume over the product’s life will be 5,000 units. The forecast costs per unit throughout the product’s life are as follows:

The product is required to earn a return on investment of 35%.

What unit selling price needs to be achieved?

A company which manufactures and sells one product has fixed costs of $80,000 per period. The selling price per unit of $25 generates a contribution/sales ratio of 40%.

How many units would need to be sold in a period to earn a profit of $10,000?

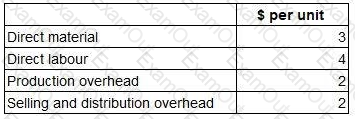

A company produces a single product for which the following cost data are available.

Analysis by the management accountant has shown that 100% of direct material cost and 50% of direct labour cost are variable costs. 50% of production overhead and 100% of selling and distribution overhead are variable costs.

What is the marginal cost per unit?

Which of the following is a relevant cost?

In a company that manufactures many different products on the same production line, which TWO of the following would NOT be classified as indirect production costs? (Choose two.)

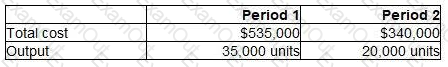

The records of a manufacturing company show the following relationship between total cost and output.

The budgeted output for Period 3 is 27,000 units. Assume that previous cost behaviour patterns will continue.

What is the total budgeted cost for Period 3?

Give your answer in the nearest whole number.

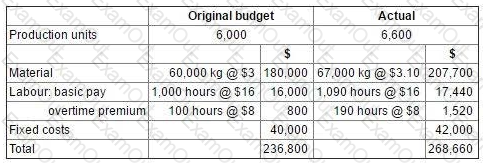

The budget and actual cost statements for the production department for the latest period were as follows.

Notes.

The 10% increase in production was required to meet unexpected additional sales demand.

The production manager is responsible for negotiating the price of materials with suppliers.

The normal working time is 900 hours per period. Any overtime worked above these 900 hours is paid at a premium of 50%.

In preparing the flexible budget for the latest period, which TWO of the following statements are correct? (Choose two.)

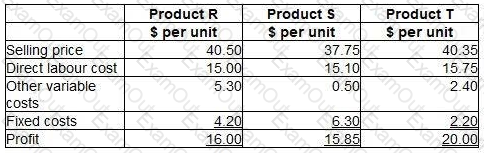

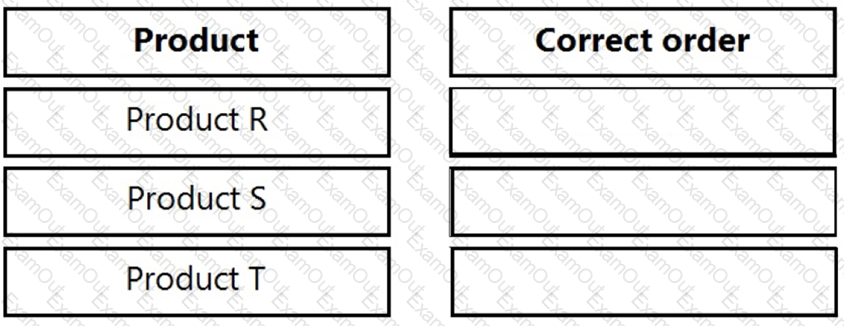

A company manufactures three products using the same direct labour which will be in short supply next month. No inventories are held. Data for the three products are as follows:

The fixed costs are all committed costs and cannot now be altered for the next month.

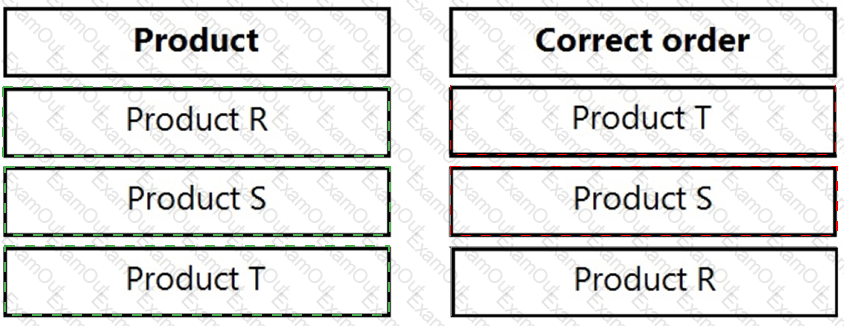

Place the labels against the correct product to indicate the order of priority for manufacture that will maximise the profit for the next month.

Which of the following is a valid definition of a cash budget?

A company has three production departments X, Y and Z, and one service department.

The service department’s overhead has been apportioned to the production departments in the ratio 3:2:5. As a result of this apportionment, $2,070 was given to Department Y.

What is the amount of service department overhead that would have been apportioned to Department Z? Give your answer to the nearest dollar.