A company currently allows a discount of 20% to customers who pay at the time of purchase. If 30% of customers pay immediately, the extra sales needed in July to increase the cash receipts in that month by £6,000 are:

Refer to the exhibit.

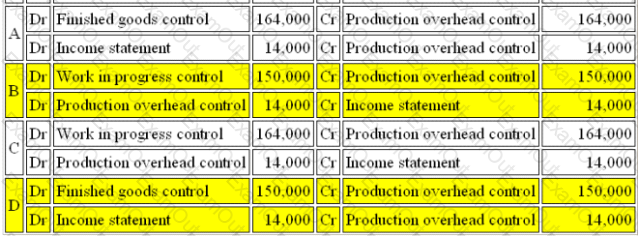

WS operates an integrated accounting system. Transactions relating to production overheads for the month of May were as follows:

Indirect Material costs were $15,000

Indirect Labour Costs were $45,000

Production overheads of $58,000 were incurred during the period.

Depreciation of factory machinery amounted to $32,000.

Overheads costs absorbed by production using a standard absorption rate was $164,000 for the period.

What are the correct entries to record the absorption of production overheads for the period?

The correct set of entries to record the absorption of production overheads for the period is:

An increase in the variable cost per unit, will cause the point at which the line plotted on a profit/volume (PV) graph intersects the horizontal axis to:

Eton Ltd. operates a manufacturing process that produces product A. Information for this process last month is as follows:

(a) Opening work in progress - 2,500 kg valued at £2,000 for direct material and £1,500 for labour and overheads.

(b) Materials input - 25,000 kg at £2.10 per kg.

(c) Labour - £10,000

(d) Overheads - £5,000

(e) Output during the month - 20,000 kg.

(f) There were 7,500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(g) Normal loss for the month was 3% of input and all losses have a scrap value of £1 per kg.

What was the average cost per kg of finished output during the month?

PQR Manufacturing Ltd. has £3,000,000 of fixed costs for the forthcoming period. The company produces a single product 'X', which has a selling price of £75 per unit and total cost of £50.

75% of the total cost represents variable costs.

What are the break-even units?

The principal budget factor can be defined as:

The production manager of your company has asked you to explain the methods of overhead analysis used, in particular the meaning of reciprocal servicing.

Reciprocal servicing is:

Refer to the Exhibit.

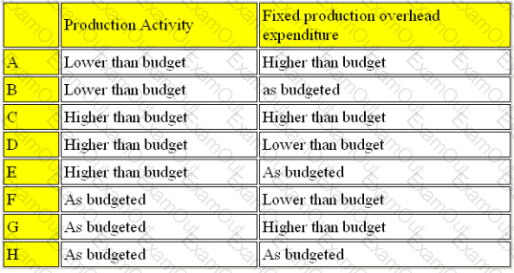

A company operates an absorption costing system. The management accounts show that fixed production overheads were over-absorbed in the period.

Which FOUR combinations could possibly have resulted in this situation?

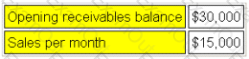

Refer to the Exhibit.

CM has produced the following budget information for next year:

The opening receivables balance represents 2 months sales. It is expected that the same level of sales will continue at an even rate throughout the year.

In an effort to improve receivables collection periods it is proposed to offer a discount of 5% for payment by cash. It is expected that 20% of customers will pay by cash. Of the remaining 80% credit sales, 40% will be settled within 1 month and 60% are expected to settle within 2 months.

What are the budgeted cash receipts from cash and credit sales in the year?

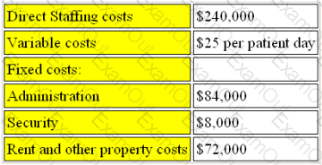

Refer to the exhibit.

X Enterprises runs a private nursing home for the elderly. The company are concerned that bed occupancy rates have been falling over the past 2 years with a consequential effect on profit. They have drawn up a budget for next year as follows:

The nursing home currently charges $90 per patient day.

The nursing home operates at 7,500 patient days per year. In an effort to increase occupancy rates the company are proposing to reduce the current price by 10% and increase spending on advertising by $10,000 each year. What effect will this have on the margin of safety?