Which of the following is not a source of long-term capital for a company?

Central banks fulfill all of the following functions except which?

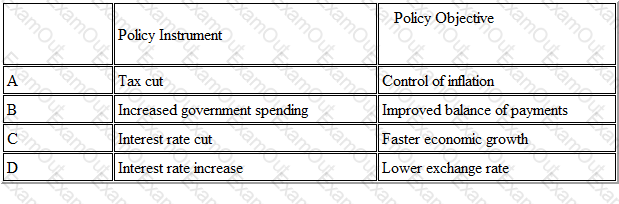

Which of the following pairings of policy instruments and policy objectives is correct?

In the foreign exchange market all of the following are sources of demand for a country's currency except one. Which ONE is the exception?

What international convention regulates banking?

£100 of new cash is issued, which is then deposited in a bank which is part of a banking system operating a cash ratio of 10%. The maximum possible increase in the money supply which can follow from this transaction, additional to the initial deposit, is

Which ONE of the following would be expected to reduce the net present value of a proposed investment project?

A rise in

All of the following were contributory causes of the banking crisis of 2008 (the 'credit crunch') except one. Which ONE is the exception?

Which of the following is not a reason for a firm to issue bonds rather than ordinary shares to raise additional finance?

Which of the following describes a 'spot rate' in foreign currency dealing?