Which 2 observations correctly evaluate risks that could affect the affordability of this project?

Pittville University insist that the business scope of the Pittville project should be based on the

development of a new campus on the site of the Old Fire Station Headquarters.

Is this an appropriate application of the Five Case Model for this project?

Using the Scenario and the extract below from the Revenue Budget for the Pittville project, answer the following

questions. (Note. The figures entered are correct).

Which 2 observations correctly evaluate the Expenditure?

The Director of Pittville University has resigned during the procurement process. As a result, the Deputy Director is now acting as Director. The other schools have now withdrawn their objections to Pittville University running the new campus. It is thought that

the delivery approach could be revised so that Pittville University manages all 16-18-year-olds education and further cost reductions could be achieved. There is no option in the OBC that provides this delivery approach with the service solution of a new

campus.

Should the preferred option be reviewed in the FBC? (Select one)

It is estimated that 60% of the taxation costs on the development will NOT be reclaimable.

Should the unclaimable taxation costs be excluded from the Financial Appraisal?

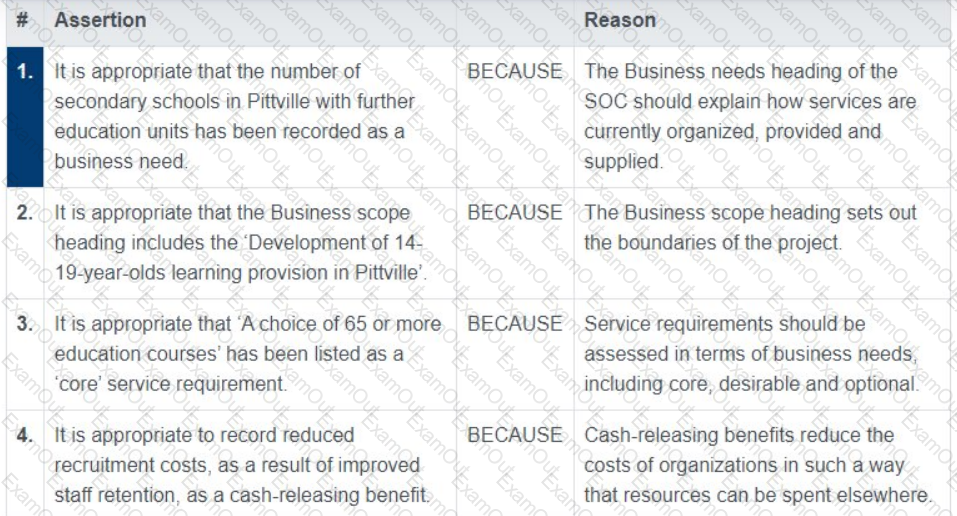

Using the Scenario, answer the following question about the Strategic Case section of the

Strategic Outline Case (SOC) for the Pittville project.

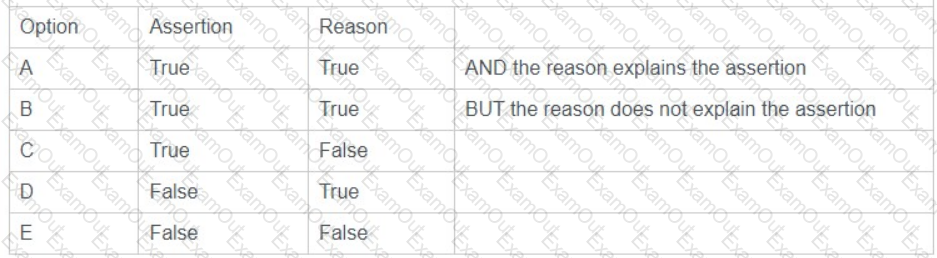

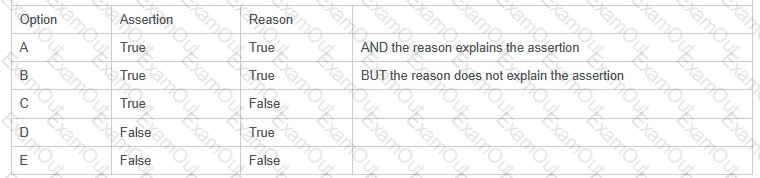

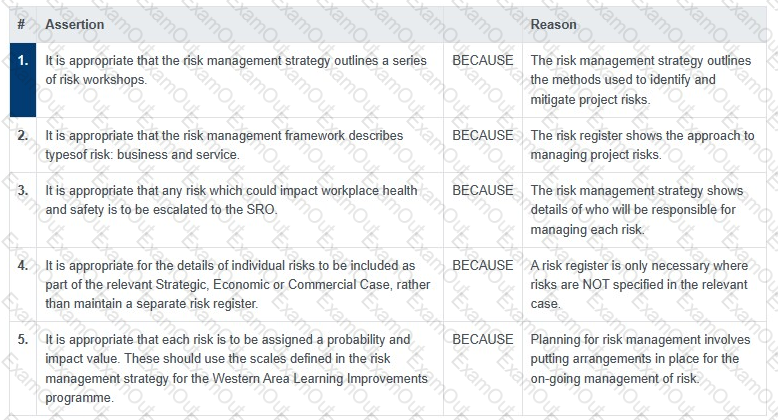

Lines 1 to 4 in the table below consist of an assertion statement and a reason statement. For each

line identify the appropriate option, from options A to E, that applies. Each option can be used once,

more than once or not at all.

An extract of an entry in the benefits register includes the following information:

1. Benefit type: Cash-releasing

2. Description: A net overall saving in the cost of cleaning

3. Target improvement: Reduce overall costs of cleaning contracts by 10% per annum

4. Responsible officer: Pittville University Procurement Manager.

Which 2 statements apply to these entries?

The Benefits Realization Framework section states:

1. It was identified in the OBC that existing schools and universities play a major role in the success or otherwise of the Pittville

project. A strategy for Learning Provider engagement is to be prepared.

2. A senior manager within the Local Education Authority is ultimately responsible for benefits realization.

Which 2 statements apply to these entries?

Service Solution 1: 'Do minimum - introduce learning network to

existing schools and universities only'.

Which 2 statements are correct about this entry in the Options

Framework?

Which detail should be explained in the Financial Case?

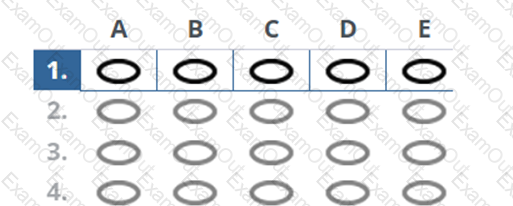

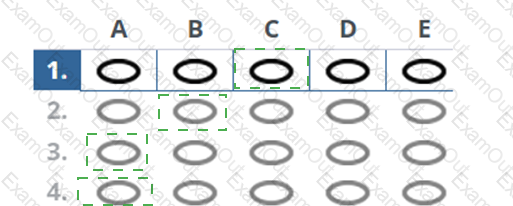

A white sheet with black text

Description automatically generated

A white sheet with black text

Description automatically generated A group of black ovals

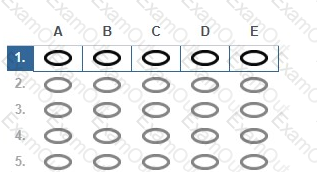

Description automatically generated

A group of black ovals

Description automatically generated