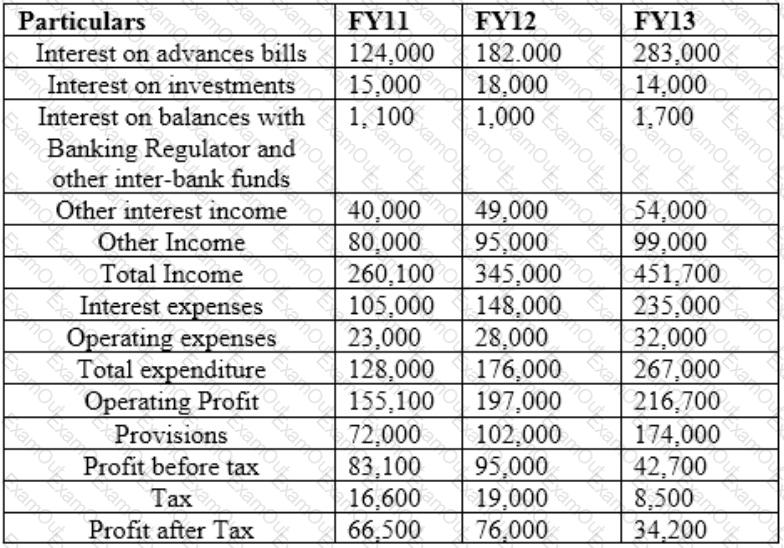

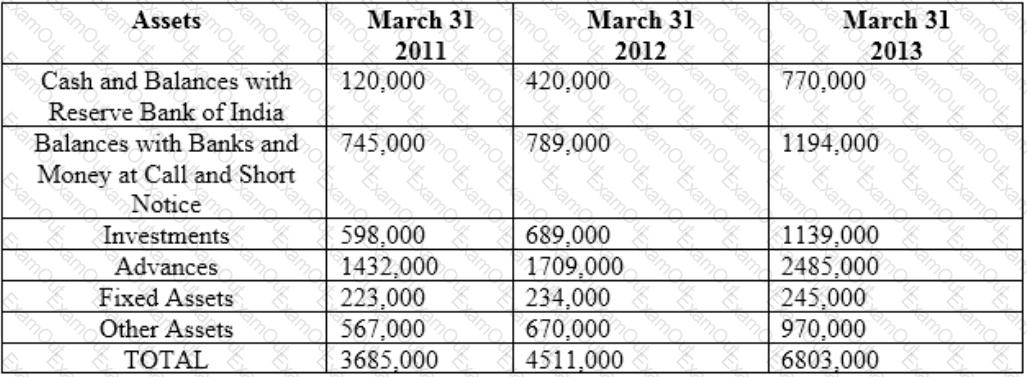

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across India. The bank has been in business since 1971 and has about 40% branches in rural areas and about 75% of all branches are in

Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks in India.

Although top management has appointment period of 5 years, generally they retire on ach sieving age of 60 years with an average tenure of only 2 years at the top job.

Profit and Loss Account

Balance Sheet

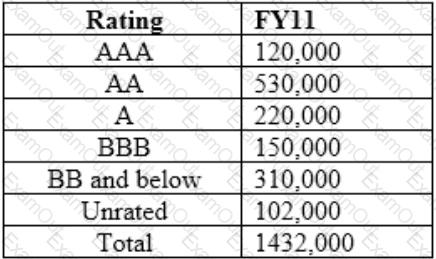

The rating wise break-up of assets for FY11 is as follows:

Computer risk weighted assets for Auckland Ltd for FY11:

In Steepening short term rates ______relative to long term rate

Which of the following is not an importance of the sovereign rating?

During FY13, Small Bazar, a leading retail company has sold three of its prime properties for a sum of USD 24 Million. The same had a carrying value of USD 30 Million.

Analyst had considered the same as operating income and considered it to be part of operating expenses.

However, she realized her mistake and recorded the loss as non-operating loss. Which of the following ratio will not change despite the correction?

A) EBITDA Margins

B) Interest Coverage

C) PAT Margins

D) Gross Profit Margin

Project 1: Company X has a sugar mill at Philadelphia and is replicating same at Toronto.

Project 2: Company Y has a sugar mill at Philadelphia and is increasing capacity from 100000 MT to 140000 MT per annum.

What type of projects are Project 1 and Project 2?

Provisioning Coverage Ratio (PCR) is essentially the ratio of provisioning to ______ and indicates the extent

of funds a bank has kept aside to cover loan losses.

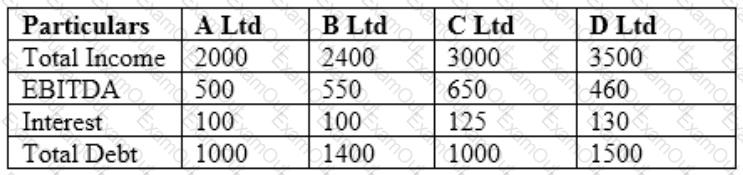

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Which of the four entities has best interest coverage ratios?

Stand by letter of credits are typically taken as credit enhancement for___________

The longer the term to maturity of bond:

Based on the Moody’s KMV model which of the following is not correct?