Loss assets should be written off. If loss assets are permitted to remain in the books for any reason,

______percent of the outstanding should be provided for.

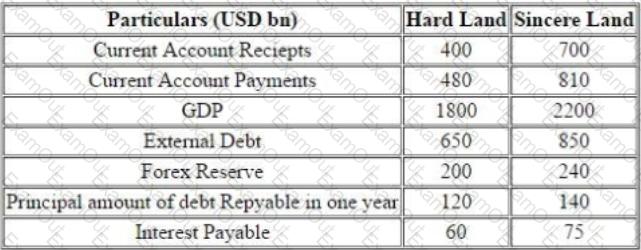

Two economies HardLand and SincereLand have provided following information with respect to their economies in USD Billion:

Based on the above information which entity is better in terms of current account deficit %?

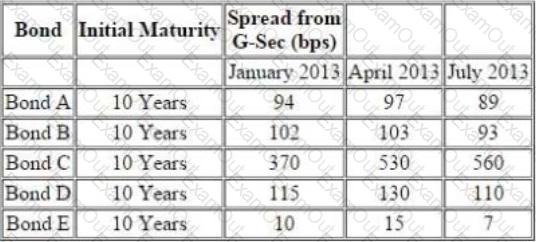

The following information pertains to bonds:

Further following information is available about a particular bond ‘Bond F’

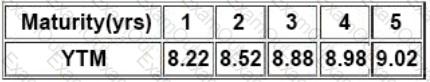

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Compute interpolated spread for Bond F based on the information provided in the vignette:

Which of the following factor is considered while undertaking management evaluation?

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements:

Analyst A: A portfolio’s standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up.

Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.