A farmer who plans to sell his/her corn crop in three months would benefit MOST from which of the following?

Evaluating the liquidity needs of an organization is a function of:

Multinational corporations repatriate funds from foreign operations through which of the following?

Company J is looking to perform an A/R cash analysis based on the following sales information:

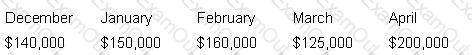

60% of sales are collected within two months after sale. After three months, $135,000 of January's sales were collected. What was the dollar amount of January's sales collected in April?

ABC Company offers trade terms of 2/10 NET 30. For several reasons, ABC has decided to eliminate the requirement for a letter of credit from one of its customers. If ABC puts the customer on open book credit, what is the MOST LIKELY outcome?

Company ABC has recently started to experience a significant reduction in funds availability. Which of the following is MOST LIKELY to reduce funds availability?

If the Federal Reserve wanted to stimulate a sluggish economy, it could do so by:

ABC company has a significant number of customers who are mainly consumers making monthly installment payments. Which one of the following types of lockbox would be the MOST appropriate for ABC to use?

Which of the following would MOST LIKELY cause a decrease in a company's deposited checks availability?

The Treasury Department of ABC Corporation has been working hard to prevent external fraud from impacting its operating bank accounts. Recently, they implemented protective services on their disbursement accounts. This morning, the treasury analyst realized that an expected sales tax payment to the state of Maryland had not occurred. The analyst knew that it had been successfully initiated yesterday. Which service used by the corporation may need to be adjusted to pay the state of Maryland?

Under a loan agreement, which of the following could be an event of default?

I. Nonpayment of interest when due

II. A material adverse change in the condition of the borrower

III. A debt-to-equity ratio above the limit specified

IV. Shortening the cure period by half

LST Company is a publicly traded company with $120 million in sales. Historically, LST does not extend credit to customers beyond net 45 terms. To help promote sale of a new product introduced into the market this year, LST offered financing terms to customers purchasing the new product. As a result, sales increased by 15% from the prior year and accounts receivable increased by 5%. At the end of their fiscal year LST had a $15 million sale to a new customer that was recorded as a note receivable. LST recognizes revenue when goods leave the facility. During the financial audit the auditors discovered that the customer did not receive the product until three days after the year-end. Under GAAP accounting, the auditors would MOST LIKELY render a(n):

A U.S. government agency issues securities transfers using Fedwire Book-Entry Securities System. The first transfer request of the day in the amount of $1 million is sent at 1:00 p.m. EST, the second one for $2 million at 3:30 p.m. EST, the third one for $3 million at 4:30 p.m. EST and the fourth one for $4 million at 5:00 p.m. EST, all on the same day. Which of the following represents the total value transferred at 5:00 p.m. EST that day?

Merchant XYZ has total credit card sales of $20,000 for one day with an average ticket of $200. The merchant’s interchange reimbursement fees are 2% and transactions fees are $0.05. This merchant receives net settlement. Which of the following is the value of the deposit for that day?

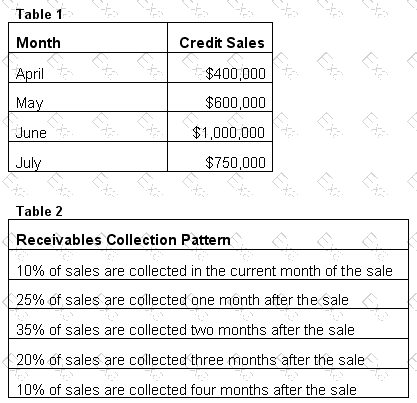

The company's monthly credit sales are in Table 1 and its receivables collection pattern is in Table 2. If this company wishes to achieve a second quarter (April-June) DSO of 60 days, what would its ending accounts receivable balance need to be?

Assume a 90-day quarter.

Company XYZ sends an ACH debit file valued at $300,000 with an average item value of $1,000. The file settlement date is March 10. The file contains no duplicate items and items are split equally between corporate and consumer items. One percent of consumer items and 2% of corporate items were returned. What would be the final net settlement value for Company XYZ?

A new retail chain has decided to offer 3 payment methods: cash, cards and checks. It was determined that card payments would be the biggest sales driver and projects have been scheduled accordingly. To be in line with this strategy, which of the following should be the priority?

Which of the following statements is (are) true about non-repetitive wires?

I. They may require additional security steps.

II. They are typically used for cash concentration.

III. They may be used for transactions where dates, parties, and/or amounts may be variable.

Which of the following is considered a financing decision?

The relationship between debt and equity in a company's capital structure is called: