Traditionally the primary source of operating risk in the area of external theft or malfeasance has been related to:

Since the inception of ABC Company's pension plan, 1,500 employees qualified and were paid pensions of $500 million after retirement, of which 700 employees were those who earned $110,000 or more and received $200 million in pension benefits. When the company filed for bankruptcy in 2010, the IRS claimed back taxes from the company stating that the pension plan was not qualified under ERISA. On what basis was the IRS MOST LIKELY making its claim?

What type of tax does a multinational auto manufacturer commonly pay in foreign countries at each stage of a vehicle’s production?

What is the MOST appropriate definition of working capital?

When will a depositor receive ledger and collected credit for a western check deposited at 2:00 P.M. Wednesday?

Ledger Credit - Collected Credit

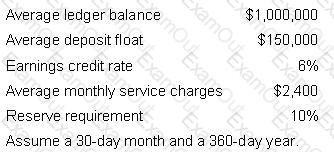

In this situation, the net earnings credit amount for the month would show:

A short-term bank line with $20 million of unused capacity and an investment in an overnight money market fund are both forms of which liquidity requirement?

A cash manager is responsible for a small subsidiary that has significant funds but only writes one check per month. Which of the following types of accounts would the cash manager use for this subsidiary?

Contingency plans often focus on the business supply chain, ensuring that customer service is maintained. The financial supply chain, which is equally critical to the plan, should address:

XYZ Company has decided to transition the responsibility for its hedging activities from the local offices to the head office; however, the local offices will continue to choose their own depository banks. Under the new structure, XYZ’s treasury operations will be:

If the spot foreign exchange rate and the forward foreign exchange rate are the same between two countries, which of the following is implied?

To acquire an asset without putting debt on the balance sheet, a company should consider which of the following arrangements?

A disclaimer opinion is required on a set of financial statements when:

A major toy retailer operates 65 stores throughout the Midwest. Which of the following collection methods is MOST LIKELY to be used by this company?

A U.S. company is selling product for US$10,000 to a Canadian company with payment in Canadian dollars. The exchange rate has been booked at C$1.45/US $1 for payment upon delivery in 15 days. The Canadian dollar is forecasted to weaken within this period. This is an example of A.

A firm’s air conditioning unit breaks down unexpectedly and must be replaced immediately. What type of liquidity requirement is this an example of?

A wholesale lockbox system does which of the following?

Which of the following services allows a single account to be used by a company with multiple units?

At the time of the initial debt contract, the only way debt holders can protect their interests effectively is to establish certain provisions or covenants designed to:

Which of the following is true about disbursement ZBAs?