On which exchange is a company’s stock traded on the over-the-counter market?

The stock of a manufacturing company is priced so that its expected rate of return is below its required rate, as calculated by the Capital Asset Pricing Model (CAPM). Which of the following will occur in an efficient capital market?

Which of the following is a ratio that is often used by commercial banks to measure a company’s leverage and does not include the effect of assets that are difficult to value or are NOT easily converted to cash?

Which of the following is a characteristic of giro systems used in countries in Europe?

One of the advantages of raising capital through public offerings is that:

The Governmental Accounting Standards Board (GASB) is the authoritative standard-setting body for which of the following?

Which of the following would be MOST suitable for a risk-averse electronics manufacturer that uses copper in many of its components?

Kahuna Boards Co. has just experienced a very profitable year and wants to share the success with its shareholders. In order to pay dividends, a sequence of events must occur. Which of the following chronological sequence of events is correct?

1. Stock is sold without the upcoming dividend attached.

2. Dividend is paid.

3. Board of directors announces the dividend.

4. Holders of record are specified.

When a project has an initial cash outflow with cash inflows in subsequent years, what decision model is most applicable to use to evaluate the adequacy of the project?

During the 1970s, many companies instituted dividend reinvestment plans (DRIPS). There are many benefits of this plan. What is the one negative aspect?

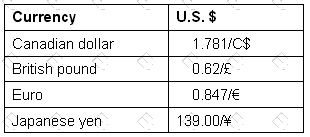

On the basis of the following exchange rates,

which of the following currency amounts has the greatest value in U.S. dollars?

Which of the following is MOST LIKELY to have a significant impact on the financial condition of an organization?

With respect to the Sarbanes-Oxley Act, a company may avoid additional reporting requirements by:

One reason for using a sale and lease-back arrangement in lease financing is to:

A distribution business has used several bank loans to finance its expansion plans. After a fire destroyed the company’s facility and inventory, it went out of business due to the loss of revenue during the month it was closed. What type of insurance coverage should the company have had to prevent its demise?

The Federal Reserve can increase the money supply by:

Company XYZ has determined that its weighted average cost of capital is 12.5%. The capital structure of the company is made up of 75% equity and 25% debt. The before-tax cost of debt is 10%. Given a tax rate of 34%, what is XYZ's cost of common stock?

A company has a line of credit and a bond trustee agreement with a bank. To prevent a decline in the company’s bond rating from having a negative impact on the company’s line of credit, the bank should have which of the following in place?

Which of the following is subject to transaction exposure?

Which of the following is NOT a drawback to using ROI as a performance measure?