Which of the following capital budgeting methods ignores the time value of money?

Company ABC is a restaurant chain that has enjoyed a surge in customers’ dining with not much of a profitability increase in the last couple of years. Following a bad restaurant review, customer traffic deteriorated with not much change in profitability. Which of the following BEST describes the cost structure of the company?

Racklyn Paint Company, a new paint and construction company, has vendor payables of $2 million due periodically over the next 3 months; payroll payable to its crews of $500K each month; a mortgage of $4.4 million with a fixed rate of 6.0%; and an equipment loan of $5 million with a bank at a 30-day LIBOR plus 150 bp payment of $100K due monthly. Racklyn receives their first contract valued at $12 million with half of the contract value due at the time of contract and final payment upon completion. Racklyn expects the job to last 6 months. Which option would be the BEST use of Racklyn Paint Company’s cash?

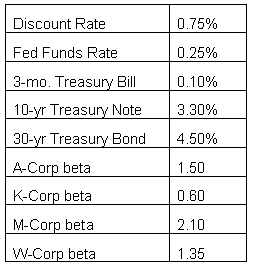

The historic rate of return in the U.S. stock market is 8%. An investment portfolio has a mix of equity investments consisting of 40% A-Corp stock, 30% K-Corp stock, 10% M-Corp stock and 20% W-Corp stock. The investment portfolio manager tends to buy and hold the equity investment position for 3 years on average. To calculate the required rate of return for this investment portfolio,

what rate from the table would be used as the risk-free rate?

Senior management at ABC Company plans to make a large capital expenditure to bolster its infrastructure exactly one year from now. Their primary concern is to preserve the current capital position until the expected cash outlay. The majority of the cash at ABC Company is held in treasury notes, but management would like to also invest some of the money into corporate bonds and money market funds. Which investment objective BEST suits the needs of ABC Company?

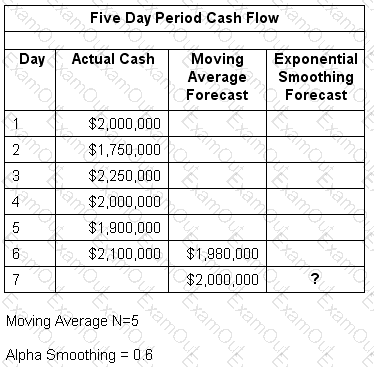

QRT Corporation uses exponential smoothing in its cash flow forecasting model. Five days are used to calculate the moving average forecast.

If the value of the smoothing constant is .60, what is the exponential smoothing forecast for day 7?

A U.S. company decides to enter a new geographic market facing some dominant competitors, but projects sales growth of 40% in its first year due to its superior product line. The company decides to only offer electronic payment methods for settlement of its receivables. A year later, the company’s sales volume only increases by 10%, but their average days’ sales outstanding of 32 days is the best in the industry. What should the company have considered in its collection policy objectives?

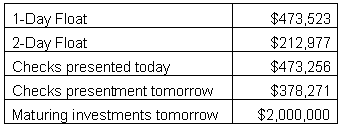

XYZ Corporation’s current ledger balance of the controlled disbursement account is $1,286,500. Based on the information in the table,

what will the corporation's available balance be at the end of today?

RAL Industries is a manufacturing company that currently has locations in the United States and Latin America and has just completed an acquisition of a company located in Europe. As a result of the acquisition, they have a large number of financial service providers. In an effort to reduce the number of providers and services used globally, RAL has decided to develop a formal selection process to consolidate its many global banking services. In order to reduce the amount of time the selection process takes, determine which services providers can offer, and the number of providers involved in the process, what should RAL Industries issue?

While revising the investment policy, the CFO performs a sensitivity analysis for the company’s cash flow from investments, and identifies that increasing the maximum dollar value for bond purchases will improve returns by 10% on average, all other variables being equal. What issue will the CFO now need to address in the investment policy?

A consumer is presented with payment options from a merchant when making a purchase. The consumer does not wish to share any information that could be later used in identity theft or fraud, while the merchant requires guaranteed payments within 24 hours with no NSFs or declined payments. Which of the following options would suit both the consumer and the merchant?

ABC Company offers a discount of 2/10, net 30 to its customers. ABC factored its accounts receivables with an outside vendor, under a “with recourse” arrangement. What impact might this have on the company?

The Treasury Manager is forecasting sales based on historical data. It was observed that sales decreased sharply in December last year, normally a high sales volume period. Further investigation indicated that a severe winter storm was experienced across the Southeastern United States. How should this event be classified in the forecast when considering the sales trends?

The Cash Manager of ABC Logistics, Inc. sets a daily cash position by noon. All departments have been given an 11 a.m. cut-off for presenting wire requests and 2 p.m. for ACH requests. A wire request came in at 3:30 p.m. to make an insurance premium payment, in order to receive a discount. What liquidity reserve requirement is impacted?

A company’s Chief Financial Officer assigns a team reporting to the Treasurer to restructure the company’s complex debt instruments and equipment leasing arrangements. The team executes the required settlement transactions using wire payments to facilitate the new debt structure, and in the process violates the lending requirements of the company’s bank. What should the Treasurer have done to prevent the violation?

A company has multiple wholly-owned subsidiaries that issue their own checks which are signed by head office staff. The company decides to move to electronic payments using their bank’s internet-based payment systems to reduce costs. Payments are now initiated by the subsidiaries. What element of the payment policy should be considered if the company still wants to maintain head office control over payments?

An analyst for a landscaping company wants to adjust her cash-flow forecast to account for the seasonality of outflows. How can this be accomplished?

Company A regularly modifies its capital structure by repurchasing stock. Which one of the following is a true statement?

A company with constant earnings and excess cash is considering a significant stock repurchase plan. Which of the following is MOST LIKELY to occur?

A foreign company could raise capital in the United States using an: