To access a property from an unconnected component, you use the

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

U+ Bank is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS.

Which type of outbound interaction do you configure to implement this requirement?

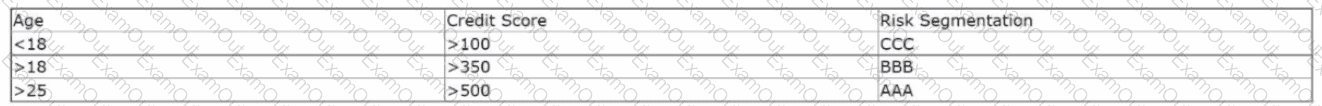

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning architect, how do you implement the business requirement?

U+ Bank observes that some customers receive the same credit card offer multiple times within a short period, which results in dissatisfaction. The bank wants to suppress a specific credit card offer if it has been shown three times within seven days.

What should you configure in the Contact Policy to prevent a specific credit card offer from being shown to a customer more than three times in seven days?

A financial services organization introduces a new policy that limits each customer to two promotional emails per month. To meet compliance requirements, the implementation team must configure this limit in the Next-Best-Action Designer.

Which configuration steps achieve the desired email frequency limit?

MyCo, a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFone 14 Pro offer is prioritized over other offers?

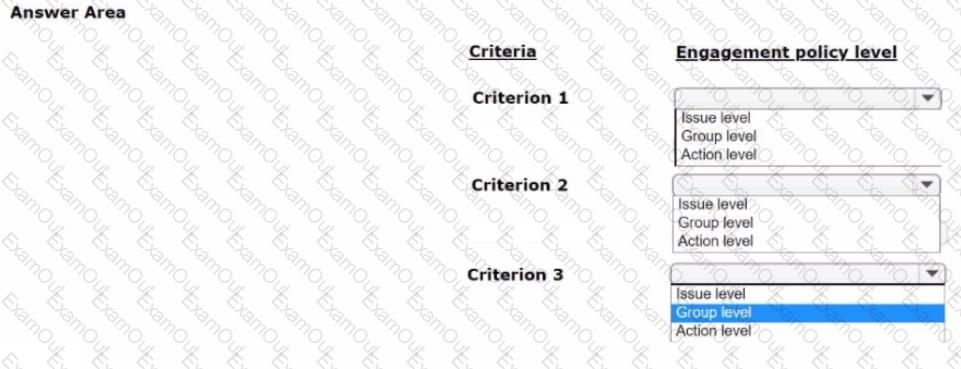

MyCo, a telecom company, developed a new data plan group to suit the needs of its customers. The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

U+ Bank has recently implemented Pega Customer Decision Hub™. As a first step, the bank went live with the contact center to improve customer engagement. Now, U+ Bank wants to extend its customer engagement through the web channel. As a decisioning architect, you have created the new set of actions, the corresponding treatments, and defined a new trigger in the Next-Best-Action Designer for the new web channel.

What else do you configure for the new treatments to be present in the next-best-action recommendations?

U+ Bank wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?