What percentage of average annual gross income is to be held as capital for operational risk under the basic indicator approach specified under Basel II?

If P be the transition matrix for 1 year, how can we find the transition matrix for 4 months?

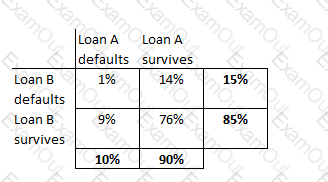

A portfolio has two loans, A and B, each worth $1m. The probability of default of loan A is 10% and that of loan B is 15%. Theprobability of both loans defaulting together is 1%. Calculate the expected loss on the portfolio.

When compared to a medium severity medium frequency risk, the operational risk capital requirement for a high severity very low frequency risk is likely to be:

The difference between true severity and the best approximation of the true severity is called:

Which of the following are valid approaches for extreme value analysis given a dataset:

I. The Block Maxima approach

II. Least squares approach

III. Maximum likelihood approach

IV. Peak-over-thresholds approach

Which of the following is not true about the ISDA master agreement (ISDA MA):

Which of the following is NOT an approach used to allocate economic capital to underlying business units:

The capital adequacy ratio applied to risk weighted assets for the calculation of capital requirements for credit risk per Basel II is:

For a group of assets known to be positively correlated, what is the impact on economic capital calculations if we assume the assets to be independent (or uncorrelated)?