Which of the following is not a tool available to financial institutions for managing credit risk:

Which of the following was not a policy response introduced by Basel 2.5 in response to the global financial crisis:

Which of the beloware a way to classify risk governance structures:

A Reactive, Preventative and Active

B. Committee based, regulation based and board mandated

C. Top-down and Bottom-up

D. Active and Passive

Which of the following credit risk models considers debt as including a put option on the firm's assets toassess credit risk?

Which of the following are true:

I. The total of the component VaRs for all components of a portfolio equals the portfolio VaR.

II. The total of the incremental VaRs for each position in a portfolio equals the portfolio VaR.

III. Marginal VaR and incremental VaR are identical for a $1 change in the portfolio.

IV. The VaR for individual components of a portfolio is sub-additive, ie the portfolio VaR is less than (or in extreme cases equal to) the sum of the individual VaRs.

V. The component VaR for individual components of a portfolio is sub-additive, ie the portfolio VaR is less than the sum of the individual component VaRs.

Which of the following data sources are expected to influence operational risk capital under the AMA:

I. Internal Loss Data (ILD)

II. External Loss Data (ELD)

III. Scenario Data (SD)

IV. Business Environment and Internal Control Factors (BEICF)

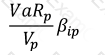

Which of the following formulae describes Marginal VaR for a portfolio p, where V_i is the value of the i-th asset in the portfolio? (All other notation and symbols have their usual meaning.)

A)

B)

C)

D)

All of the above

The principle underlying the contingent claims approach to measuring credit risk equates the cost of eliminating credit risk for a firm to be equal to:

A stock that follows the Weiner process has its future price determined by:

For a FX forward contract, what would be the worst time for a counterparty to default (in terms of the maximum likely credit exposure)