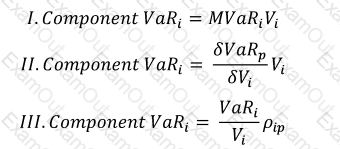

Which of the following formulae correctly describes Component VaR. (p refers to the portfolio, and i is the i-th constituent of the portfolio. MVaR means Marginal VaR, and other symbols have their usual meanings.)

Which of the following is not a risk faced by a bank from holding a portfolio of residential mortgages?

According to the Basel II standard, which of the following conditions must be satisfied before a bank can use 'mark-to-model' for securities in its trading book?

I. Marking-to-market is not possible

II. Market inputs for the model should be sourced in line with market prices

III. The model should have been created by the front office

IV. The model should be subject to periodic review to determine the accuracy of its performance

Pick underlying risk factors for a position in an equity index option:

I. Spot value for the index

II. Risk free interest rate

III. Volatility of the underlying

IV. Strike price for the option

The loss severity distribution for operational risk loss events is generally modeled by which of the following distributions:

I. the lognormal distribution

II. The gamma density function

III. Generalized hyperbolic distributions

IV. Lognormal mixtures

What is the risk horizon period used for credit risk as generally used for economic capital calculations and as required by regulation?

Which of the following are considered counterparty based credit enhancements?

I. Collateral

II. Credit default swaps

III. Close out netting arrangements

IV. Guarantees

The unexpected loss for a credit portfolio at a given VaR estimate is defined as:

The returns for a stock have a monthly volatilty of 5%. Calculate the volatility of the stock over a two month period, assuming returns between months have an autocorrelation of 0.3.

When estimating the risk of a portfolio of equities using the portfolio's beta, which of the following is NOT true: