Which of the following measures can be used to reduce settlement risks:

Which of the following are valid approaches for extreme value analysis given a dataset:

I. The Block Maxima approach

II. Least squares approach

III. Maximum likelihood approach

IV. Peak-over-thresholds approach

Which loss event type is the failure to timely deliver collateral classified as under the Basel II framework?

Under the actuarial (or CreditRisk+) based modeling of defaults, what is the probability of 4 defaults in a retail portfolio where the number of expected defaults is 2?

An equity manager holds a portfolio valued at $10m which has a beta of 1.1. He believes the market may see a dip in the coming weeks and wishes to eliminate his market exposure temporarily. Market index futures are available and the current futures notional on these is $50,000 per contract. Which of the following represents the best strategy for the manager to hedge his risk according to his views?

Which of the following statements are true:

I. Liquidity risks during time of crisis may be exacerbated by large collateral calls continuing over a period of time.

II. Stress tests are always separately modeled from VaR computations which cannot deal with stress scenarios of the kind considered in stress tests.

III. A maximum loss scenario considers the maximum possible loss given a 'plausibility constraint' that is based upon the joint probability of such a loss happening

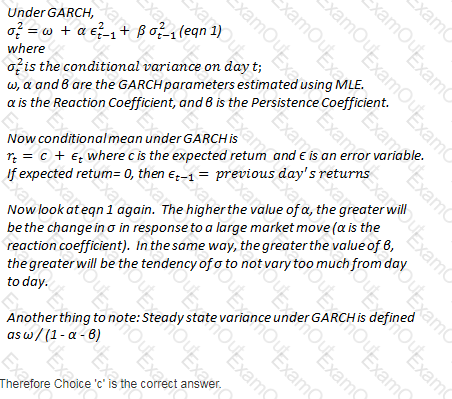

As the persistence parameter under GARCH is lowered, which of the following would be true:

Company A issues bonds with a face value of $100m, sold at $98. Bank B holds $10m in face of these bonds acquired at a price of $70. Company A then defaults, and the recovery rate is expected to be 30%. What is Bank B's loss?

Which of the following is not a permitted approach under Basel II for calculating operational risk capital

An investor holds a bond portfolio with three bonds with a modified duration of 5, 10 and 12 years respectively. The bonds are currently valued at $100, $120 and $150. If the daily volatility of interest rates is 2%, what is the 1-day VaR of the portfolio at a 95% confidence level?